在美国,我们面临将房产作为遗产,留给子女,家人的情况,最常见的三种解决方式是:

- 写遗嘱

- 立信托

- 依据法定授权(如夫妻共有财产,一方去世后,另一方自动继承)

(>>>推荐阅读:专栏|在美国,人去世后,她的财产到底是怎么传递下去?)

留房产给子女,家人的其他方式选择

对于家庭财务结构简单,特别是单身长者来说,通常会提出一个疑问,那就是,“我想把房产留给子女,有没有一种简单有效的办法?”

在现实中,通过遗嘱给子女或家人留房产,面临繁琐的遗嘱法庭认证过程;通过信托给子女或家人留房产,虽然可以规避遗嘱认证过程,但涉及到成本费用和委托人的情况。

那对于全美范围的普通家庭来说,有没有程序上的其他选择,可以不用信托,也不经过遗嘱认证,直接将房产留给子女,家人,或其他受益人呢?

答案是肯定的:在大多数州和地区,政府立法提供了Tod Deed(又名 Beneficiary Deed)文件,帮助居民在过世时,完成房产的指定转移。

(>>>相关阅读:设立生前信托是为了什么?1分钟了解生前信托的费用及功能 )

TOD Deed是什么?

TOD Deed,英文称为Transfer on Death Deed ,是对房产指定身后继承人的一份标准化契约文件,它是遗嘱的一个替代品。

和遗嘱,信托的功能一样,TOD Deed允许房主指定一人,或多人,或机构,在房主死亡后,继承这份房产。

和遗嘱不一样的是,这种方式不需要遗产法庭的介入,也不用进行遗嘱认证(Probate)。

TOD Deed为家庭提供了一种低成本的房产传承方案。以加州为例,引入此法律方案的议员 Mike Gatto (D-Glendale) 认为:

Just like a person can designate a bank account to go to a loved one upon death, by allowing individuals to transfer property cleanly through a TOD deed, we can avoid the expensive probate process and give families greater peace of mind.

“(译)就像一个人可以指定死后把一个银行账户留给亲人,通过允许个人通过 TOD 契约地转移财产,我们可以避免昂贵的遗嘱认证过程,让家人更加安心。” ——加州议员 Mike Gatto

如何使用TOD Deed把房产留给子女或家人?

填写和使用TOD Deed表格,把房子留给子女或家人,是TOD Deed的使用方式。

使用TOD Deed把房产留给子女和家人,和我们之前介绍的使用POD文件把银行现金存款留给子女和家人的流程类似。

通过POD把现金存款留给子女和家人,需要我们填写一份特点文件,写明存款受益人,并把文件递交给银行,就完成了现金财富的转移和继承。

通过TOD Deed把房产留给子女或家人,则是填写一份特点文件,写明房产受益人,去房产所在地的县,递交和登记这份文件。

(>>>推荐阅读:专栏|指定现金存款留给子女或家人的POD受益人银行账户是什么?)

TOD Deed 文件怎么获得?

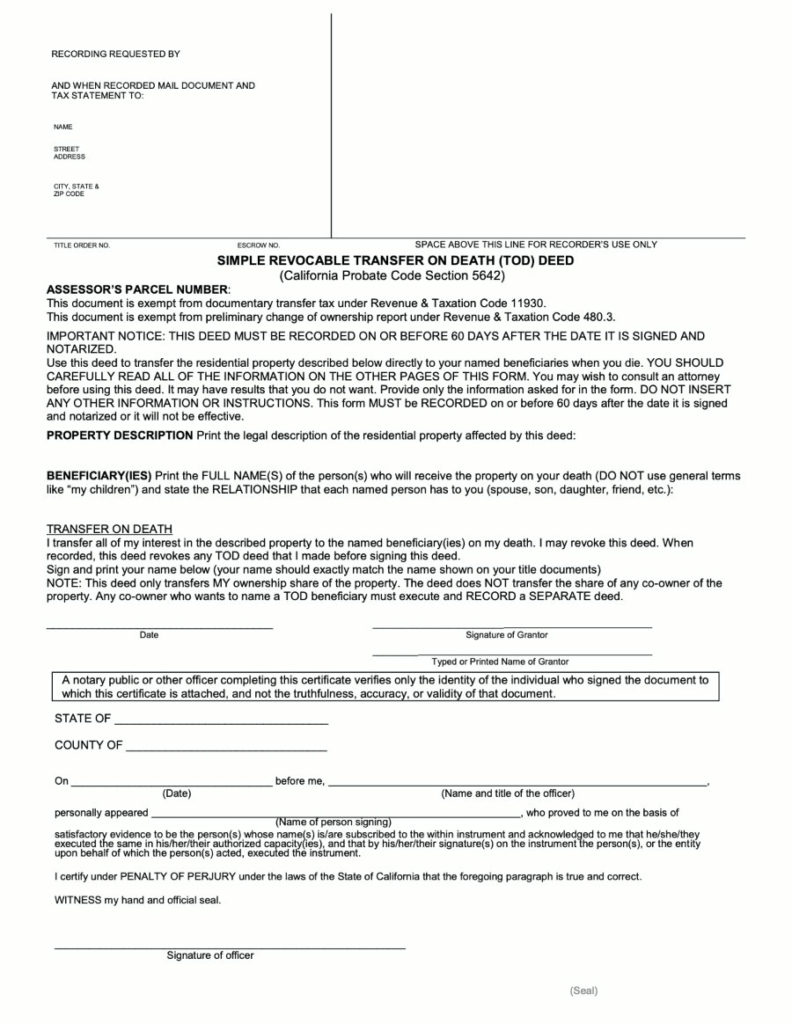

这份简单的表格文件通常只有1页(如下图范例)。我们可以联系当地县政府的登记员,或登陆当地政府网站上免费获得。

使用TOD Deed留房产给子女家人的常见问题

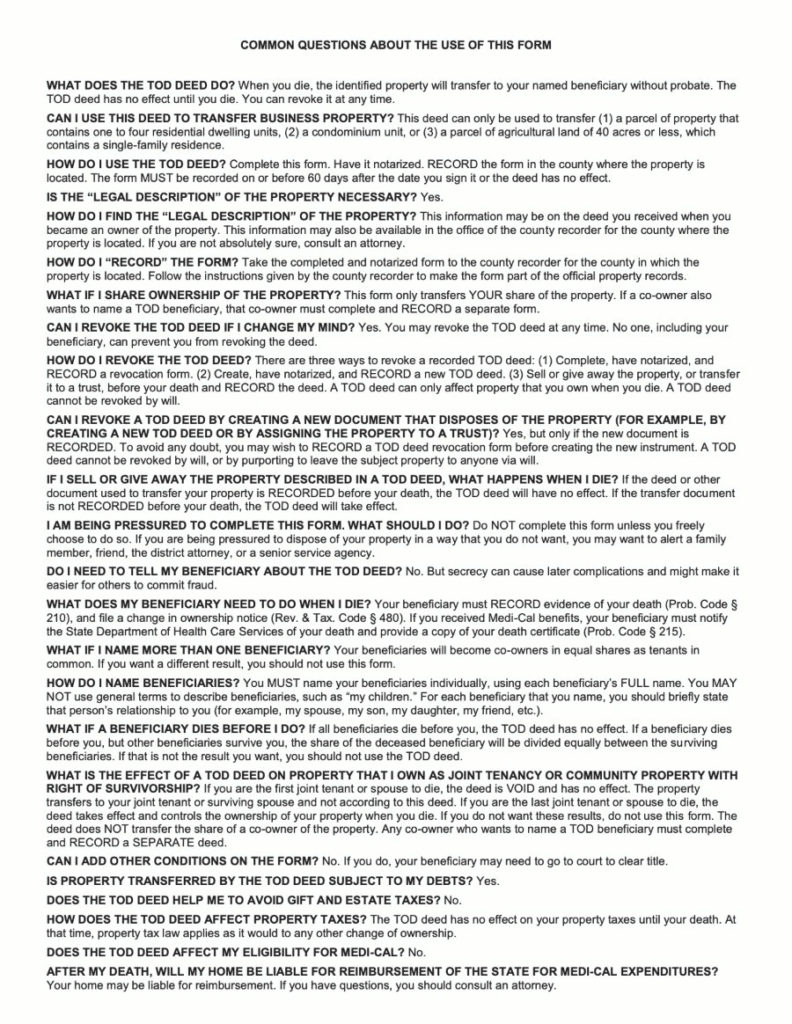

州政府和一些地区政府,通常会制做详细的使用问答指南(如下图范例,由亚利桑那州政府网站提供),解决当地居民关于将房产留给子女或家人的法律程序问题。

留房产给子女或家人的4个步骤

在使用这种方式之前,您需要了解当地关于TOD Deed最新的法律动态,了解注意事项。

使用这种方式留房产给子女及家人后,通常只需要4个步骤即可完成:

- 填写正确的身份和房产信息

- 填写您指定的房产继承受益人

- 在文件上签名,见证,并进行文件公证

- 将文件递交给当地县政府登记员登记

留房产给子女或家人专栏小结

除了遗嘱,信托外,TheLifeTank专栏介绍了一种逐渐进入大众视野的,把房产留给子女或家人的方式——TOD Deed。

这种留房产给家人的方式,相对于其他方式来说,更加经济实惠。同时,TOD Deed也赋予了房主和受益人在处理房产上的灵活性——房主可以在生前,随时更新这份文件,取消或重新指定房产受益人。而在房主去世后,房屋将自动传给 TOD Deed中指定的人,免除了遗嘱认证过程。(全文完)