在前一篇“保障型指数保险是什么?哪些人适合买保障型指数保险?”专栏文章发布后,有读者留言,第一次知道了指数保险里面还细分了这么多不同的分类,也提出了新的问题:对于Whole Life保险,即我们常说的储蓄险,储蓄分红保险,是不是也分了很多不同的分类呢?我们会不会买错了WholeLife的保险产品呢?

带着这些疑问,美国人寿保险指南网©️对话了美国人寿保险财务顾问 Heather Xiong CFP®️。在本文中,Heather Xiong CFP®️以问答的方式,分享了她的从业经验和观点。本文经TheLifeTank.com编辑整理发布,供投保家庭参考。

(下文统一使用“Whole Life”替代“储蓄保险”,“储蓄分红保险”,“分红保险”等术语)

(下文统一使用“Whole Life”替代“储蓄保险”,“储蓄分红保险”,“分红保险”等术语)

问1:Whole Life(储蓄保险),也分为理财型和保障型吗?

答:是。

问2:这两种Whole Life(储蓄保险)之间有什么不同?

答:我举个例子吧,在今天,一名40岁不吸烟的健康男性,想要买$100万的WholeLife终身保险,要花多少钱?

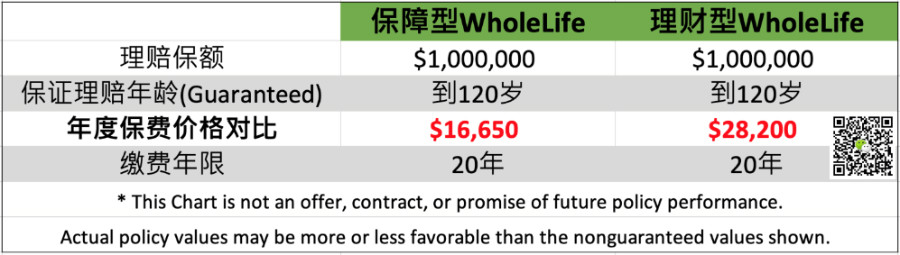

(如上图所示)如果是买传统意义上的保障型WholeLife,一年的保费金额约在1万7千美金上下;

如果是按照投资理财的目标,来购买理财型WholeLife,一年的起始保费在3万美元左右;进一步来说,作为投资来买的话,保费理论上是上不封顶的。

我们对比一下,虽然保额理赔金,都是$100万美元,但购买目的不同,每年保费却大不相同。这张保障型Whole Life保单,累积支付了$34万美元的保费;另一张Whole Life保单,则累积支付$60万的保费;两者保费的对比相差近30万,这就是明显的区别说明。

>>>【Transamerica Lifetime® Whole Life】全美人寿保险 Lifetime® 储蓄保险评价| 投保指南_用户评价_消费者手册

问3:那人们为什么要买理财型储蓄保险?

答:保险理财,是个人及家庭理财的一种方式和选择。

我们一般把理财型储蓄保险,称为储蓄分红保险,或者分红保险。这种类型的保单,提供了“储蓄”和“分红”的能力,并且已经销售了近百年,拥有良好的公众教育基础和市场份额。

设计合理的储蓄分红保险,是一种稳健的储蓄理财方式,它提供了诸如补充退休收入,财富传承给下一代的潜力。

问4:保障型储蓄保险是什么?

答:保障型储蓄保险不提供分红,是为了纯粹的保险理赔,它是一个简单易懂的保险产品类型。

从美国保险市场的整体数据里面可以看到,超过一半的WholeLife投保人,都是考虑到遗产的处理,身后的丧葬等与个人生命末期相关的家庭财务问题而进行的投保。

保障型储蓄保险的理赔金,是解决上诉问题的一个常见选择。通过对比也能看到,它的保费相对理财型储蓄保险更有优势。

问5:那这两种储蓄保险哪个更好?

答:这个问题并没有标准答案。

我一直在说,在美国,甚至全球的跨境保险市场,消费者或投资者面临的最大障碍,是进入正确渠道后,面临实在太多太多选择的问题;介于纯粹理财型和纯粹保障型之间,还有各种各样混合两者功能的储蓄保险方案;

投保人需要避免的是,在各种吵杂的声音影响下,被“贪婪”和”恐惧“所引导支配,做出了不利于自身的选择。

这样的家庭,不但没有达到保护资产,转移风险的目标,反而给家庭增加了一层不合理的债务杠杆。

因此,大概学习一些基本的美国金融类保险知识,了解自己的家庭实际情况,会更利于和专业人员之间的沟通和长期关系。您付出了您的时间,也会得到对应的知识回报。整个投保体验,也会更加高效和从容。(全文完)

(>>>相关阅读:专栏|常被忽略的投保7个细节,聪明的您都注意到了吗?)

(>>>相关阅读:专栏|用人寿保险理财规划退休收入的常见“问题”和“误区”)

(>>>相关阅读:专栏|美国“健康保险”和“人寿保险”竟然不是一个东西!手把手教您如何识别和挑选正确的保险)