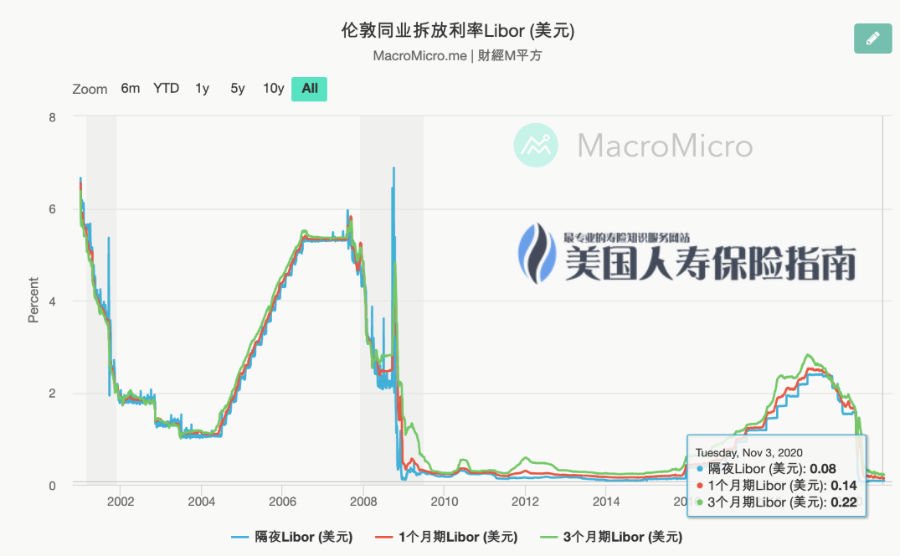

上周四美联储宣布维持短期借贷利率在0%-0.25%区间,市场借贷成本继续保持低位,这对于通常挂钩LIBOR利率,涉及大额借贷的保费融资市场里的投保人,无疑是利好消息。

市场基准利率的走低,在房地产市场,30年固定房贷利息跌破了3%,而由于借贷成本的降低,在美国引起了一轮贷款买房和重新贷款的风潮。

同期,在高净值人寿保险(财富管理)市场,得益于当前较低的市场借贷利率,使用银行贷款来进行人寿保险补充退休收入,或进行财富传承规划,也成为市场的热点。

在您了解和准备进入保费融资市场之前,我们建议您充分了解其运作机制及优缺点。

保费融资是什么?和买房的比较

保费融资,是指投保人在申请保单时,将人寿保险现金值资产抵押给银行,换取贷款支付保费的方式。

保费融资类似于贷款买房,我们买房时,只支付一部分资金给金融机构(首付),金融机构帮助我们购买下房产,而我们按照约定,偿还贷款本息。

我们以一个例子来进行说明:

45岁的王先生,打算使用人寿保单来进行整个家庭的补充退休收入规划。

保费全部自付的情况

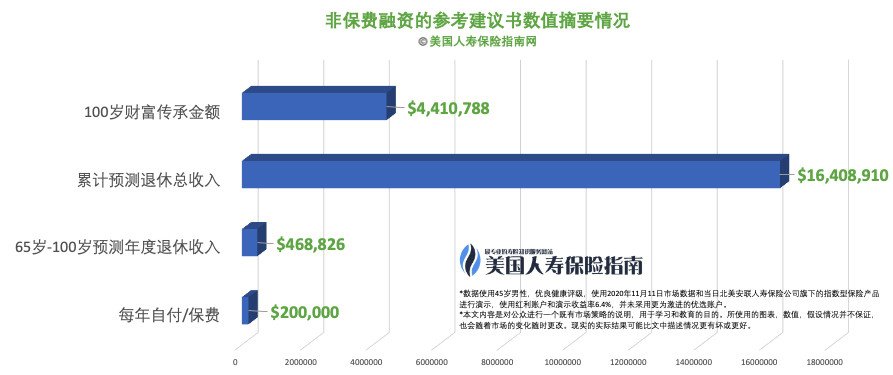

王先生准备每年往保单账户里存入$20万美元,累计存10年,共计$200万美元。经过保险设计方案计算结果的预测(如下图),王先生65岁后,每年将从保险公司领取约$46万美元的免税1退休金,领取至100岁停止。

保费融资的情况

如果使用保费融资的方式,王先生每年向银行借贷$50万美元,存入保单账户,累计借贷10年,共借贷存入人寿保单账户$500万美元。

王先生每年向银行支付$10万美元的本息还款。15年后,王先生用人寿保单账户里累积的现金值,一次性偿还银行所有剩余贷款。

王先生65岁后,每年将继续从保险公司领取约$58万美元的免税1退休金,领取到100岁停止。

王先生65岁后,每年将继续从保险公司领取约$58万美元的免税1退休金,领取到100岁停止。

自付保费和借贷保费的对比

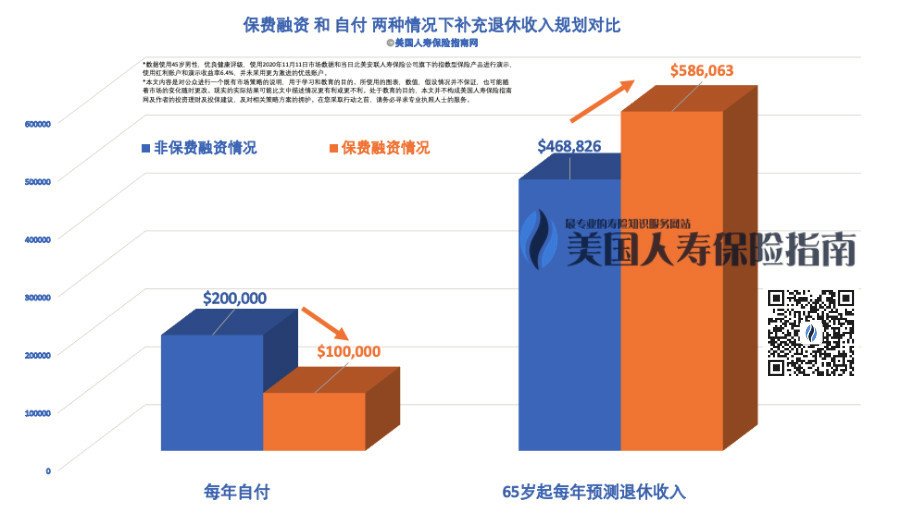

从上图我们可以看出,王先生在自付的情况下,需要自掏腰包$200万美元,而回报预期的退休收入流为每年$46万美元。

而对比保费融资的方案,王先生每年支付$10万美元给银行,累计自掏腰包$100万美元,而预期的退休收入流为每年$58万美元。

自掏腰包的资金从$200万降低到$100万,在同等条件情况下,预期的退休收入流,却提高了$12万每年,这就是通过保费融资,实现的市场化杠杆效应。

自掏腰包的资金从$200万降低到$100万,在同等条件情况下,预期的退休收入流,却提高了$12万每年,这就是通过保费融资,实现的市场化杠杆效应。

我适合保费融资吗?

杠杆意味着风险,保费融资也并非适合所有人。

由于现金值人寿保单本身提供了一层杠杆,而使用保费融资,意味着又加上了一层杠杆。双重杠杆的存在,对于借贷利率上涨的环境极为敏感,这里是保费融资潜在的风险之一。

其次,产品及方案的选择也是关键的一环。

双重杠杆的作用下,保险公司与保险公司之间,产品与产品之间,即便是微小的性能指标差异,经过时间因素的加权,都会造成保单现金值产生较大的差异。

因此,在进行保费融资之前,投保人需要和专业化的人寿保险财务顾问的合作,具体对比和分析不同保险产品的性能和指标。

选取资管能力较强,成本相对较低,现金价值增值收益率潜力相对更高的人寿保险公司及其发行的特定产品,并结合“风险承受能力”和“收益潜能”的动态平衡,来敲定保费融资建议书方案。

最后是第三个关键因素,在于我们能否以较低的利率,拿到金融机构的私人贷款。

而在当前的低利率市环境下,金融机构更倾向于大额借贷,比如每年借贷50万美金。而大额的借贷,通常意味着投保人需要具有较高的资产净值,或者有足够的抵押品。当具备这些条件后,有助于银行批准保费融资的申请。

在美国人寿保险指南社区中,有读者反馈,某金融机构在近期批准给他$500万美元的信用额度,年利率仅为0.9%。

而朝着乐观的一面看待的话,如果市场回报率稳定,而借贷利率维持或继续走低,将形成利于投保人的利差环境,这种情况更会显著提高保单的达成率。

文章小结

文章的末尾,我们打算再次强调,“杠杆,意味着风险。”

保费融资,是对本身已经具备一定“杠杆”人寿保险产品,进行了再一次的杠杆放大。

信用评级及利率市场的波动,都可能让过高的杠杆融资方案出现损失。我们可以回顾身边的历史,1994年南加州橙县政府,因为加息引发杠杆爆仓,导致了市政最终破产2。

“赌利率会走低,来将现有资产组合翻3倍…这种类型的赌博,简直难以想像。” ——Charles Fish, 12/31/1994

因此,保费融资设计方案上让人“心动”的数字和“杠杆比例”,也许是最不应该成为我们决定融资借贷申请保单的因素。

融资方案风险水平的评估,风险的管理和应对机制,应是保费融资的关键。

作为一个金融制度发达成熟的市场,美国人寿保险行业里,存在不同的保费融资解决方案供应商。在进行保费融资类型的人寿保险配置时,投保人面临的问题,依然是我们一再强调的,“面对不同的选择,到底哪一个更适合我?“这样的市场双向选择难题。

美国人寿保险指南网一贯提倡“Learn Before You Buy”原则。投保人通过了解保费融资的基本运作原理,能把握到“风险承受能力”和“收益潜能”之间的平衡要领,在专业人寿保险经纪的协助下,投保人也能对不同的保费融资产品及保险方案的优缺点及风险,进行对比分析。

而正是这样的对比过程,能帮助投保人家庭完成关于“保费融资”和“人寿保险”的自我教育,并在这个学习的过程中,审视内心的风险偏好,并最终作出决策。

(全文完 ©️美国人寿保险指南 未经授权,严禁转载)

Disclaimer:

*本文内容是对公众进行一个既有市场策略的说明,用于学习和教育的目的。所使用的图表,数值,假设情况并不保证,也可能随时更改。现实的实际结果可能比文中描述情况更有利或更不利。本文并不构成美国人寿保险指南网及作者的投资建议,及对相关策略方案的拥护,也不构成美国人寿保险指南网及作者对随之而来的税务后果的保证。

1.使用人寿保险公司合同约定的方式借贷或支取,投保人具备某些特定的税务优势,具体支取和借贷条件需以保险公司及保险局的规定文件为准,文章内容不作为税务或法律建议。在对本文内容中包含的任何信息采取行动之前,请咨询专业人士。

2.”ORANGE COUNTY’S BANKRUPTCY: THE OVERVIEW; Orange County Crisis Jolts Bond Market”, Floyd Norris, 12/08/1994, New York Times,https://nyti.ms/3eVgF43