很多美国人依靠传统的Pension退休金,每个月收到公司机构或政府组织开来的支票资金,但这种情况正在发生改变。

人们将会发现,每月收到的支票资金,不再是自己供职过的政府机构,企业集团,是来自人寿保险公司。

根据TLT(美国人寿保险指南)的最新新闻报道是,洛克希德·马丁公司在2021年8月宣布,向Athene保险集团购买了$49亿美元的年金保险,取代传统的Pension退休金。

(洛克希德·马丁公司旗下联合研发生产的F-22猛禽战斗机产品)

(洛克希德·马丁公司旗下联合研发生产的F-22猛禽战斗机产品)

军工巨头购巨额退休年金保险

洛克希德·马丁公司,全称洛克希德·马丁空间系统公司,是世界上最大的武器生产制造商和国防承包商,名列2020福布斯全球企业2000强榜第145位,雇员超过11万人。

为解决员工的退休养老金和公司资产负债管理问题,洛克希德·马丁公司选择的退休金解决方案是:年金保险。

承保的Athene保险公司成立于 2009 年,由私募巨头 Apollo (阿波罗投资集团)打造,是一家发展迅猛,相对”年轻“的人寿保险公司。

TLT(美国人寿保险指南)的在2020和2021的季度年金销售排行榜数据指出,Athene 保险公司的固定指数年金市场排名前三。

通过向洛克希德·马丁公司承保,Athene保险公司将在此后为洛克希德·马丁公司的雇员,提供终身支付的退休养老金。

(Athene金融保险集团官方网站截图 )

(Athene金融保险集团官方网站截图 )

我的养老金有什么改变?

对于领取洛克希德·马丁公司退休养老金的员工来说,退休金福利并不受影响,绝大多数看起来就跟过去一模一样:每个月继续收到退休金,金额也维持不变。

其中最大的改变是,以前这笔退休金的保险,是由作为联邦机构的退休金担保公司(PBGC)来进行的再保险,如果洛克希德·马丁公司倒闭,或无力支付退休养老金,那么退休金担保公司将会支付一定的退休金进行兜底。

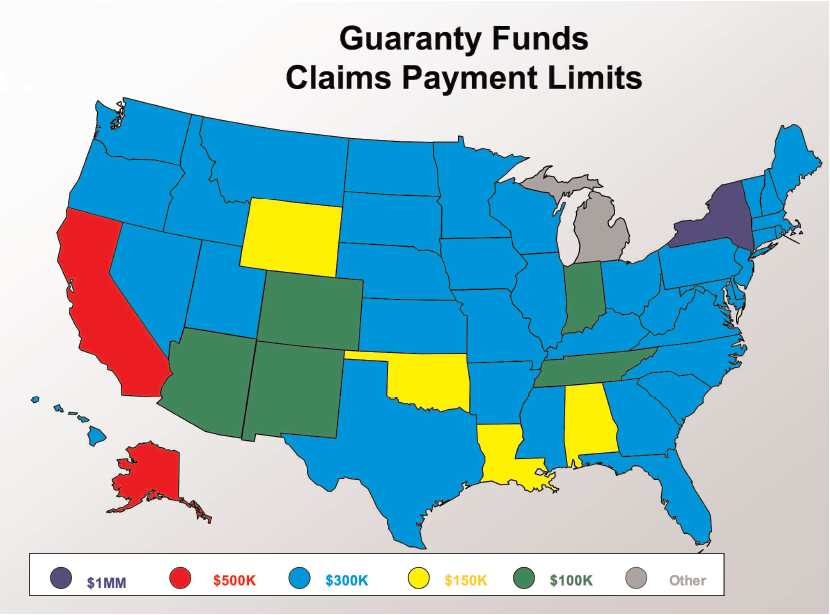

而现在,您的养老金是由商业保险公司,各州的保险局以及各州的保险担保协会及基金来负责和进行再保险。

(各州保险保证金协会将对投保人的保险账户进行再保险和理赔,上图为各州理赔上限©️insurancejournal)

(各州保险保证金协会将对投保人的保险账户进行再保险和理赔,上图为各州理赔上限©️insurancejournal)

文章小结

在上个世纪,大多数美国企业,政府都为雇员提供了自己的Pension养老金计划,如洛克希德马丁公司,惠普集团等。

80年代后,不少私营企业开始用401k退休养老计划,来替代传统的Pension养老金,但这把管理这笔钱的责任和风险都转移到了上班的员工身上。如果员工无法具备应有的资产打理能力,则面临养老金缩水的风险。

而历史相对悠久的公司,如本文中提及的洛克希德马丁公司一样,依然在公司层面管理着规模庞大的Pension计划。通过移交人寿保险集团打理Pension资金,换取公司,人寿保险集团,以及退休养老员工的三赢局面。

人寿保险公司比起军工武器制造商,电话公司,中小企业,更适合管理雇员的养老金账目和支付养老退休金的责任。上百年来,人寿保险公司以此为生。(全文完)

(>>>相关阅读:美国年金保险险种比较价格 及优缺点(2021版))

(>>>相关阅读:美国的保险公司会破产倒闭吗?)

(>>>推荐阅读:比较|指数年金和基金年金,哪一款年金保险更好?(2022版))