每年的9月,是全美范围内的人寿保险关爱月——Life Insurance Awareness Month (简称LIAM) 。在人寿保险关爱月里,由Life Happens主导,各机构和组织将在社区中推广免费教育活动,帮助投保人学习和了解人寿保险知识,了解如何规划人寿保险计划,以满足他们的人寿保险需求和实现对家庭的保障。

2021年度的人寿保险关爱月的代言人,是4次获得格莱美奖的著名歌手、制片人,同时也是一位母亲:凯利罗兰 (Kelly Rowland)。

美国人寿保险指南社区(theLifeTank)也是这项活动的荣誉支持者。在今年的人寿保险关爱月里,我们将分享2021年度的公众教育材料,帮助投保人和读者了解2021年关于美国人寿保险的基本数字。

25岁到40岁更接受人寿保险

在传统刻板印象里,人寿保险属于很“古旧”的年代。但事实上,随着美国人寿保险产品的不断升级换代,更容易接受新事物的年轻人,成为了人寿保险持有率最高的群体。

在25岁到40岁的美国千禧一代中,人寿保单持有率达到49%。而有接近45%的人,准备在接下来投保,远超过40岁-60岁的美国居民群体。

超过一半的25-40岁阶段的年轻人担心,发生意外后,整个家庭可能面临关于“钱”和“收入”上的困扰。

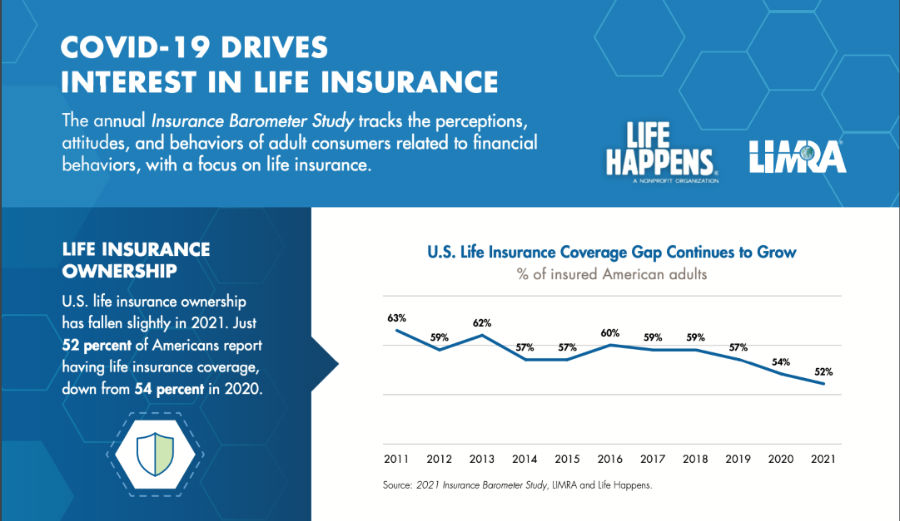

新冠疫情推动人寿保险投保

根据权威机构LIMRA的数据图表,美国社会的整体人寿保单持有量从2011年至2021年,出现了逐步下滑的趋势。

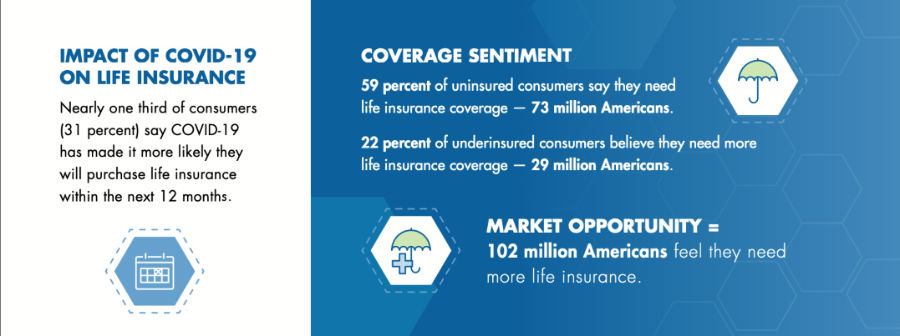

随着新冠病毒疫情的出现,超过1亿美国人感觉到需要更多的人寿保险保障。

将近1/3的受访者认为,因为新冠病毒疫情的原因,他/她们会更有可能在接下来的一年中,申请人寿保险。

和伴侣谈“钱”,至关重要

在2019年的人寿保险关爱月报道中,美国人寿保险指南©️指出,和伴侣和家人开诚布公地讨论未来的财务状况,至关重要。

对于每一个家庭来说,稳健的经济基础,是幸福生活的基础。

人寿保险可以用来支付那些费用?

为了帮助理解这个问题,我们首先把每个人或家庭,在生活中可能面临的开销,分为了下面3大类,分别对用人寿保险的两种不同功能目标。

用于保障及理赔的人寿保险

1.当下必须要支付的开销

-税金

–处理遗产的费用

-信用卡债务

-汽车贷款

-房屋贷款或房租

-自付额或超出医疗保险覆盖范围的开销

-丧葬费用

2. 持续的日常开销

-食物

-住房

-水电煤气网络等账单

-交通的费用

-健康医疗保险费用

-维持家庭开销的费用

–经营生意的开销

大多数消费者通过购买人寿保险,来确保可以让我们所爱的人,继续维持现有的生活品质。

用于理财规划的人寿保险

除了上面两类开销,人寿保险还被用来支付下面几项常见的未来开销,它包括:

3. 未来的开销

–高等教育学费

–配偶或爱人退休需要的资金

–财富传承计划

-特殊的慈善捐赠项目,比如Memorial Fund

正如我们所看到的那样,人寿保险可以通过各种形式的使用和规划,让您和亲人保持稳定的财务基础。

如何行动起来?

对于希望采取行动的消费者来说,美国人寿保险指南网提供了免费的“人寿保险保额计算器”(点击访问),来帮助读者评估所需要的保障大小金额。

对于寻求保障型的公众,我们提供了免费的“人寿保险比价工具”(点击访问),帮助希望申请消费型定期人寿保险的读者,用来分析和对比不同保险品牌的价格。

对于寻求理财型现金值类人寿保险,考虑使用这类保单进行财富规划,退休规划的读者,可以访问由美国人寿保险指南网提供的“美国人寿保险指南投保指南”专题,了解不同产品和财务规划方案,为接下来面对专业人寿保险经纪和财务规划人员,深入讨论家庭财务状况,做好准备。

如果需要了解更多关于人寿保险的知识,请访问 insurGuru©️保险学院页面。(全文完)

(>>>推荐阅读:2018年美国人寿保险关爱月回顾:对公众普及“生前福利”教育)

(>>>推荐阅读:2019年关爱月回顾:80后最务实,70后最担忧 )

(>>>推荐阅读:2020年关爱月回顾:环顾现实 )

(>>>推荐阅读:2021年关爱月回顾:80后90后成为投保主力军 )

关于Life Happens

Life Happens是一家非盈利性组织。 该组织不属于任何产品,公司或保险顾问。 官方网站https://lifehappens.org