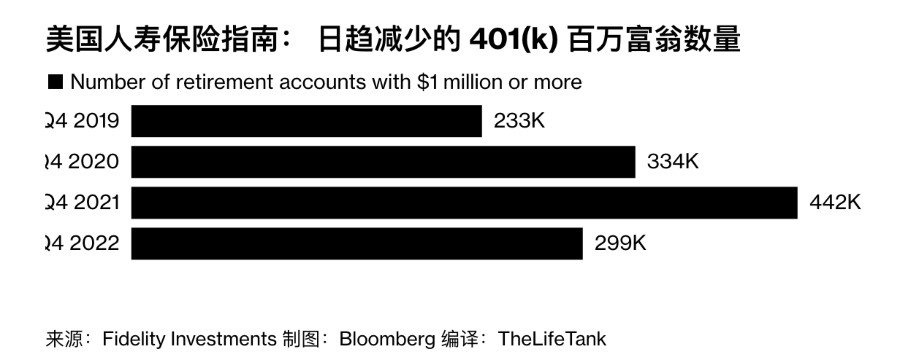

(TheLifeTank 02/24/2023 讯) 全美401K百万富翁的数量,锐减了三分之一。

Fidelity 富达投资的数据显示,在2022年底,雇员401K账户里超过1百万美元的账户数量,仅仅只有299,000个。据统计,每个退休账户平均损失了20%的资产。

相对于之前的一年442,000的百万账户数量,下滑了近32%。

如果刚好在2023年里退休,那么或成为较坏的一年。

昔日市场狂热造就百万富翁

Fidelity 富达投资是全美最大的公司雇主401k退休账户服务提供商之一,管理了超过3000万个退休金账户。

根据TheLifeTank©️在2019年9月的报道,Fidelity 富达投资统计了公司旗下的401K退休账户,超过$100万美元的百万富翁数量,在当年创下了历史新高。

由于401K账户资金通常都投资了证券市场,在新冠病毒疫情开始第2年的市场狂热环境中,短期出现了大量新401K百万富翁。

然而,从2022年中开始的市场大跌,结束这场狂欢。

如何守护好前几年的获利资本,避免资产损失,成为了401K账户主人面临的问题。

(>>>相关阅读:百万退休金账户创历史新高,我的年龄应该存多少钱比较合理?)

如何投资1百万:远未结束的下跌

Smart-beta ETF先驱Rob Arnott在昨天接受采访时表示,股票市场的下跌“远未结束”。

对于401K或IRA账户上有超过1百万美元资产的家庭来说,怎么来打理这比百万资产,避免更多的损失,守护好未来的资产,成为今年最重要的事情。

而涨跌波动起伏日趋剧烈的证券市场,不应该是准备退休一族家庭的理财首选。

进行资产保护功能的人寿保险公司产品,以及2023年创下了近十多年来记录的保证年化收益率承诺,为成熟理性的401K账户投资者,提供了一个稳健的解决方案。(全文完)

(>>>相关阅读:退休账户百万富翁人数锐减29%,“绝不亏钱”成2022年度目标)

(>>>相关阅读:“绝不亏钱”,资产型人寿保险的FLOOR核心功能是什么意思?)

(>>>推荐阅读:赚$100万难吗?掌握这20个好习惯,您最终会成为百万富翁)