位于加州洛杉矶的行业研究机构IBIS,在2019年5月发布了”全美人寿保险及年金行业市场报告“一文,解读了美国保险市场的新动向。在该报告中指出,人寿保险和年金行业的资金,是全美最大的投资资本来源之一。 美国人寿保险公司持有市面上20%的美国公司债券,保险公司是美国大中小型公司最大的资金融资渠道,许多公司都依靠人寿保险公司来扩展业务或进行融资交易。

但是,美国人寿保险公司的主要服务对象是保单持有人。我们投保人通过投入时间和资金,间接支持保险公司参与上述各类市场投资行为,并依靠社会制度赋予保险行业的法规“优势”,达成财富保值,遗产规划和免税退休储蓄规划的目标。

这就是美国人寿保险保单能作为补充退休收入渠道的渊源背景。但美国人寿保险公司有近千家,各类保单产品成千上万,哪些保险公司,或者说,哪一类保单产品设计方案,才真正适合我们“最大化退休收入”的需求呢?

在本文中,insurGuru©️保险学院将分析,什么是“对”的退休收入规划保单,并结合实际案例分析,对比不同的保险产品,彼此之间存在的差异,以及,对作为投保人的我们,钱袋子的直接影响。

最大化退休收入规划的选品原则

使用美国人寿保险保单进行补充退休收入规划,要想达到“最大化”的预期目标,必须选择“现金值积累潜力”相对较强的保单险种。

因此,没有现金值能力的定期寿险,不在我们的考虑范围之内。

UL险种的现金值增长能力有限,通常并不用来进行“退休收入”规划,也不满足本文“最大化退休收入”的评测需求,我们也将它排除在外。

而VUL类险种是一个高风险的险种,如果在退休时遭遇2008年股市下行的风险,前几十年累计的财富可能一下腰斩。虽然目前进化派生出了Guranteed VUL险种,但整个险种对于投保人自身的投资水平和风险管理能力要求较高,加上整个VUL险种在市场上的整体占有率也只有6%左右,因此insurGuru©️保险学院不将它纳入本次的评测范围内。

在insurGuru©️保险学院刚刚完成了储蓄型终身寿险(Whole Life)和 指数型万能险(IUL)的险种评测中,我们指出了 IUL 提供了更强的现金值增长“能力”。

综上所述,美国人寿保险指南©️评测的选择对象是通常被认为“现金值积累潜力”能力较强,风险相对较低的指数型保险险种,该险种也是最常见的用来进行补充退休收入规划的保单账户险种。

选“错”产品或设计方案的代价

保险公司这么多家,指数型保险产品少说也说近百款,效果都是一样吗?

答案是:效果完全不一样。

各个保险公司的成本核算方式、资产管理能力和擅长领域各不相同,旗下的指数型保险产品的现金值能力也各不相同。

如果我们的需求是“最大化退休收入”,但是选品上却选择了一款“保障型”的指数型保单产品,又或者是,选“对”了产品,却被设计了一份“不对”的方案,那么多年以后,我们的保单账户上的现金值,将会产生不小的差异。

具体我们会少拿多少钱?以下美国人寿保险指南网旗下的insurGuru©️保险学院对此进行的评测。

案例对比分析

Elizabeth,30岁,女性,经营了一家不错的化妆品电子商务品牌。作为一名1099自雇业主,或者说“创业者”,Elizabeth没有传统的退休账户,在对比了税务优势后,Elizabeth考虑使用人寿保单账户,给自己配置一份免税退休收入计划。

Elizabeth打算每年存入$2万美金,连续存15年,在60岁后开始领取免税的退休收入,领到90岁为止。

产品A和方案1

在明确了“最大化补充退休收入”的需求后,理财顾问向Elizabeth推荐了一家著名保险公司的一款擅长“现金值积累”能力的指数型保险产品A,并进行保单设计。

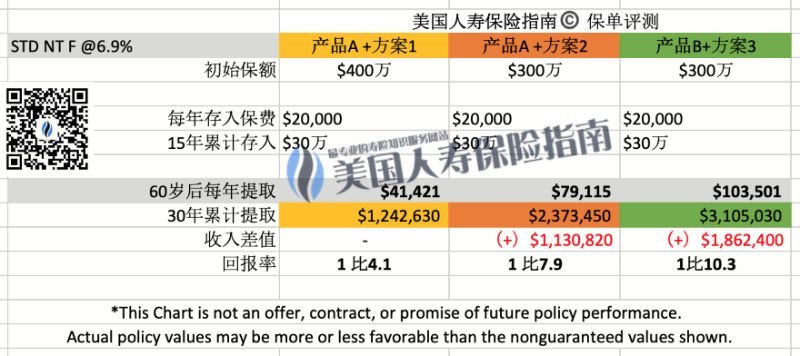

第一个设计方案的保额是$4,000,000美元,Elizabeth每年存入$2万美元,连续存入15年。使用该方案默认的6.9%的平均市场预测利率,在60岁到90岁之间,Elizabeth每年能从保单中预期提取$41,421的免税退休收入。

该设计方案里,Elizabeth累计投入$30万美元,预期30年里累计支取$1,242,630的退休收入。

Elizabeth觉得这个产品A和方案的组合看起来不错,只看数字的话,$30万换来$120万,投入和回报比达到1 : 4.1的保险杠杆比率。但且慢,正如insurGuru©️保险学院的“美国保险投保指南之误区篇”一文提到,即使是同一家保险公司的同一个产品,经过不同专业度的保单设计人员之手,即使按照同样的需求来理解和设计,也可能出现截然不同的效果。如果进行优化设计,差距会有多大?

产品A和方案2

选择的保险产品维持不变,我们来看看方案二,新方案将保额降低到$3,000,000,对保单进行了重新设计,在同样的存钱方式和6.9%的预测利率下,在60岁到90岁之间,Elizabeth每年能从保单中预期提取$79,115的免税退休收入,投入和回报比达到1: 7.9的保险杠杆比率。

新的设计方案里,Elizabeth预期30年里累计从保单中提取$2,373,450美元,足足比前一个设计方案多领取了$100万美元的免税退休收入。

从上面的对比可以看出,同一需求,同一产品,不同的设计方案,如果选择了“不对”的设计方案,那么在30年间,Elizabeth的退休钱包里,将会直接少了$100万美元。

更换产品B后的方案3评测

美国人寿保险指南网的评测并没有止步于此。接下来,我们假设Elizabeth持有美国绿卡,或是美国公民,名下有自己的房产,在美银行的现金存款也超过$10万现金,有着稳定的收入,良好的信用和一定的社会地位。insurGuru©️保险学院通过选品和对比分析,按照“最大化退休收入”的需求,选定了新的指数型保险产品B进行重新的方案设计和评测。

那么问题来了,产品B的这套设计方案,对我们钱包的影响会有多大呢?

insurGuru©️评测小组仍然采用了$300万美元的保额,年存入$2万美元,连续存入15年的计划进行评测。经过更加专业及有针对性的选品和保单设计后,其他因素都不改变,也使用与之前一致的“6.9%”的平均市场预测利率,那么在60岁到90岁之间,Elizabeth每年能从保单中预期提取提出多少钱呢?

答案是:$10.3万每年的免税退休收入。

在该设计方案里,Elizabeth累计投入$30万美元,预期30年里累计支取$3,105,030的退休收入。投入和回报比达到1: 10.3 的保险杠杆比率。

文章小结

对比方案1和方案2,我们会发现,同样的资金投入(30万),同样的投资时间长度(15年),在预期的退休收入上,不同产品,不同方案,产生了截然不同的结果。

方案2比方案1帮助我们多拿了$100多万的退休收入,而如果投保人不幸地选择用方案1替代了方案3,那我们的钱袋子里将足足减少了$186万的收入。

通过本文的对比评测,美国人寿保险指南希望投保人了解到 :在使用人寿保单账户进行“退休收入”规划时,保险产品的选品,以及产品对应的保单设计方案,这两则将直接影响我们的退休钱袋子。

如果保单选品和设计方案缺乏专业性,等投保人到了退休需要拿钱的时候,就会觉得用保单来做退休收入规划的结果差强人意,甚至觉得,“人寿保险是骗人的”。而事实上,正如文章开头的调查报告指出,用美国人寿保险来作为补充退休收入来源,本质上是有着坚实的财务基础的。

“帮助华人全面了解美国人寿保险知识,从而获得能真正保障自己和亲人所需的产品。”

——美国人寿保险指南网©️

最后,美国人寿保险指南一直强调 LBYB(Learn Before You Buy )原则,寿险指南社区网站里也提供了保险学院,保险产品中心,理财保险产品评测,投保攻略指南等大量专题供投保人参考。当我们掌握一定基础知识后,请务必寻求专业的人寿保单规划人员,或只收取专业服务费的保险经纪人/保险顾问的协助,在退休收入这个人生重大决定上,找到真正能更好实现我们需求的产品和方案。 ( 全文完)

(>>>相关阅读:评测|纽约州投保人缴存14年人寿保险账单真实分享 )

(>>>推荐阅读:【知识帖】保险杠杆是什么?买保险就是买杠杆吗?)

Disclaimer:

*为遵守美国金融保险业法律规定和保险行业合规,我们不能在面向公众的评测文章中提及具体的保险公司名称和具体的哪一款产品的名称。

*文章出现的数字,金额仅仅作为教育和信息分享交流之用途,并非保单实际的合同内容,也不是保证的回报数值,不具有任何法律效应。实际情况以英文保单内文为准。

附录:

01. “Life Insurance & Annuities Industry in the US – Market Research Report”, May 2019, IBISWorld, https://bit.ly/2ksj5PF