在前几天,一些读者写来电子邮件告诉美国人寿保险指南网的编辑,“感觉你们这个行业都是服务很有钱的客户,不知道有没有办法对我们这样中产阶级家庭提供帮助。”

同时,在寿险指南社区编辑自身的生活体验中,无论是在社交媒体里,还是在微信朋友圈里,每天也会频繁出现出面向“高净值人群”的金融保险类营销资讯;传统的电台或报纸媒介里“财富传承”等金融保险广告内容,也高频次地覆盖着华人社区——来自旧金山地区的一名读者告诉美国人寿保险指南网,“电台上天天都有人寿保险的广告”——在这种营销氛围的长期耳濡目染下,我们很容易自动把“人寿保险”和“财富”、“有钱人”等关键词建立联系,并产生“人寿保险跟普通人似乎没什么关系”,“有钱人才会去买人寿保险”的主观感受,并主动“敬而远之”。但,这是真的吗?

美国人寿保险指南网的insurGuru©️寿险学院专栏,今天就来分享一些对于这个观点的看法。

1.“有钱人”可能并不需要人寿保单

在美国人寿保险指南网的insurGuru©️寿险学院 第2讲“我需要人寿保险吗”一文中,我们分析了可能需要人寿保险的群体,其中,“有钱人“对于人寿保险的需求,排在了最后一位。

从财务的角度上来看,真正的“有钱人“,在财务上,已经能完成自我保障,当他们遭遇一些“损失”时,自己能承担对应的财务问题。换个说法就是,能用钱解决的问题,通常就不是问题。因此,他们对功能本质为“Indemnity”的人寿保险功能需求,并非那么迫切。

人寿保险保单这个工具,对于这一类群体来说,更多是用于资产保障。在到达一定年龄后,由于美国社会制度(税法,遗产认证等)的原因,自然而然会考虑用到人寿保单这个工具。

2.最需要保障的,是美国普通家庭

根据2019年皮尤研究中心的报告,家庭年收入在 $40,500 到$122,000 之间,就算是中产阶级家庭。

作为社会的主要阶层,我们面临这住房,医疗,教育,和养老等诸多问题。这些问题,作为政府,只是给出了保底方案,如果追求一个“Above Bottom Line”的生活,都是需要额外用钱来解决的。

在过去的30年里,美国普通家庭收入的增幅,完全落后于住房,医疗,教育,和养老方面的增幅,而债务比例随着物价和消费的上涨,逐渐增加。

在过去的30年里,美国普通家庭收入的增幅,完全落后于住房,医疗,教育,和养老方面的增幅,而债务比例随着物价和消费的上涨,逐渐增加。

虽然美国中产阶级群体,在全国人口的比例,一直维持在52%1比例左右。但对比过去,一方面,普通家庭背上了更多债务,需要对更多的风险进行兜底,另一方面,面对落败的收入增幅,收入不足支付家庭生活,夫妻全职上班,家庭成员一人兼做多个工作,逐渐成为了常态。正如《财富》杂志近期封面报道指出的那样:“中产阶级,正在缩水2”。

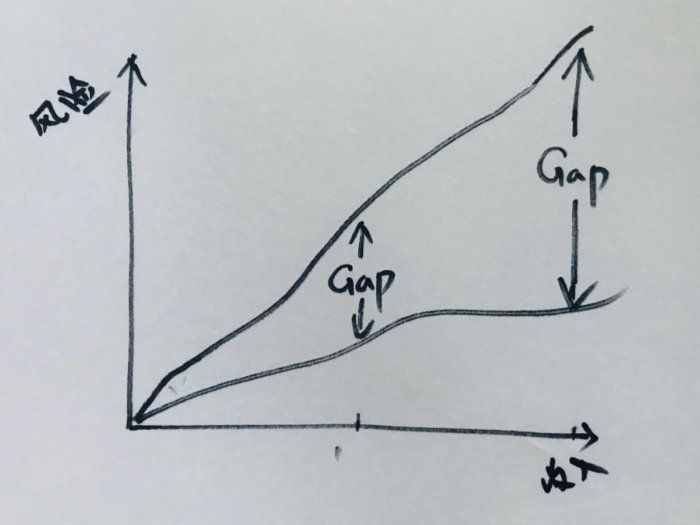

在这样的社会发展进程中,每个普通家庭面临的风险和收入这两者之间的Gap逐渐扩大——以正常的劳动力付出和收入回报速度,根本不足以填补这个日益扩大财务空洞(Gap)——甚至超过了旧有的金融保险产品(非消费类)提供的杠杆保障能力范围。

行业的发展总是与社会的演化相匹配。在金融保险领域,当旧有的产品不足弥补新形势下的需求,势必演化出新型的金融保险工具,对家庭风险进行兜底,同时提供更高的杠杆,来弥合日益扩大的Gap区域。

这里反而印制了上述第一点——“有钱人”几乎不存在Gap区间,因此对金融保险的保障功能,需求根本不高。

因此,真正迫切需要人寿保险产品,不是“有钱人”,而是是广大的华人普通家庭。

3. “人寿保险” 非 保险,而是金融工具

美国人寿保险指南网社区里的经纪人在实际的工作观察中发现,大多数消费者对于“保险”二字的传统印象根深蒂固。特别是年轻一些的个体或家庭,通常会主观觉得“不需要人寿保险”,“买个人寿保险可能很花钱”,从而主动选择把“人寿保险”这个工具推得离自己很远。

然而,美国市场的人寿保险产品,很多已经属于金融产品,而非传统意义上的消费型“保险”产品。它是一种名称里含有“保险”二字的金融工具,能够帮助我们管理由社会发展带来综合风险。

在认知不对称的情况下,很多年轻的华人个人或家庭,从最初那一刻,就主观选择放弃了持有这款金融工具的“最大优势”。

这么讲的原因是,从常识来看,人一生中最值钱的,正是“时间”。越早的进行金融保险规划,支付的“时间”成本越多,付出的金钱成本就相对越少,换回的长远保障,也越多。这也是由这类金融保险产品的性质所决定的。

现实是,往往是等到人到中老年,随着事业的发展开始更深层次的直面社会制度的游戏规则,以及随着人生的历练开始认真思考对家庭成员的风险进行管理,这时,才开始积极主动寻找可以利用的“工具”。届时,当再度转向这款工具时,因为没有了最值钱的“时间”做成本支撑,通常需要支付高额的成本对抗已经随时间扩大的Gap,而换回的保障,对比之下,通常还不尽如人意。

文章小结

从本文中,我们分享了关于“最需要人寿保险的,其实并不是‘有钱人’,而是我们这样普普通通的家庭”这一观点。对于我们每一个华人普通家庭来说,要做的并不是对抗生活必需品的通货膨胀,而是使用美国金融体系提供的各种工具,管理风险和收入之间的巨大Gap,为涨幅最大的医疗和教育花销做更多的储备,并面对退休时的财务需求。

在美国社会制度规则下,人寿保单正是一个广泛使用的金融工具,而非传统意义上的“保险”产品,用来帮助面对这些问题。尽早的进行规划选品,可以使用“时间”来大幅降低风险管理成本,还能为我们换取更多的长远保障。

最后,合理选品和设计的人寿保单其实不贵,甚至比预期可能还便宜。更重要的是,掌握好这个金融工具,在充分发挥出“时间”优势,管理好由社会发展带来综合风险的同时,还能帮助每一个家庭形成长期储蓄理财的习惯,这也是美国人寿保险指南网分享这篇文章的目的这一。

美国人寿保险指南社区里的执牌中文经纪人,也大多来自于普通华人家庭,和所有人一样,我们都会面临如何应对这些由社会发展带来的风险问题。

在感同身受的同时,我们希望用我们的经验和专业知识,通过分享的方式,帮助到不同年龄层次的读者,消解认知误区,尽早建立家庭风险管理机制。如果你需要我们的帮助,请扫描页面底部二维码或电子邮件联系,进行预约评估。

(>>>相关阅读: 评测|纽约州投保人已缴存14年的保单账户带给我们什么样的经验教训?)

(>>>相关阅读:评测|相差$186万收益,同一投保人,专业设计方案 VS 一般方案 )

(美国人寿保险指南网 insurGuru©️寿险专栏)

附录:

01.”The American middle class is stable in size, but losing ground financially to upper-income families”, 09.06.2018, Pew Research Center, https://pewrsr.ch/2U9aaCC

02.”The Shrinking Middle Class”, 12.20.2018, “Fortune Magazine”, https://bit.ly/2GTyxLO