美国人寿保险涨价了吗?

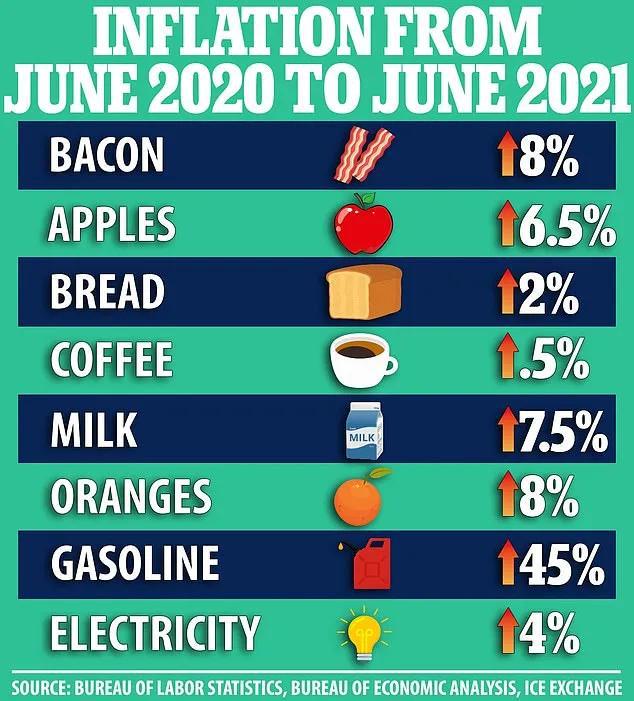

2021年6月,全美出现了5%的通货膨胀率,这是2008年以来的第一次,也创下了美国近10年来的最高水平。

一些在年底更新换代的人寿保险产品,出现了保费趋于翻倍的趋势。我们不经要问,鸡蛋涨价,汽油涨价,难道人寿保险也“涨价”了吗?

回顾经济刺激法案历史

2021年4月,美国人寿保险指南网发布了新闻报道,指出了国会对7702条款的修订情况及影响。在新法规的影响下,人寿保险保单允许投保人或投资者,存入比之前更多的保费资金。

这到底是政府指导“涨价”?还是投保人的重大利好?

在调整后的7702相关法规框架下,各大型人寿保险集团在2021年底前,相继发行了新人寿保险产品。美国人寿保险指南网在社区经纪机构的协助下,选择了热门的Whole Life(储蓄分红保险)及Indexed Life(指数型万能保险)这两类险种的两款代表性品牌产品,以GuildeLine保费模式,做一个对比情况说明,供读者对比参考。

1. Whole Life分红保险对比

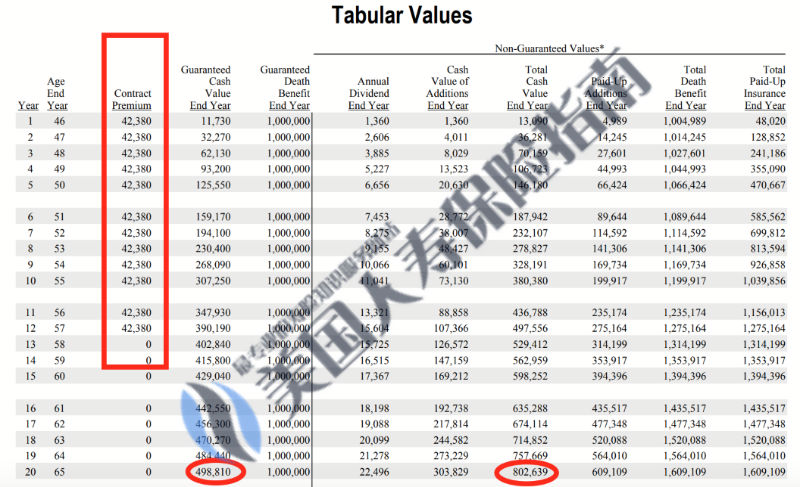

( p1. 12Pay-100万分红保单Whole Life/2021.10)

( p1. 12Pay-100万分红保单Whole Life/2021.10)

上图(p1)是一份旧Whole Life(中文称为储蓄分红保险)人寿保险产品,将于2021年年底下架。

45岁的男性投保人,选择了12年的缴费期。12年间,红色竖条方框显示,投保人需要存入保费$50万8560美元,理赔保额是$100万。

左下角的椭圆形框部分指出,20年后,当投保人65岁时,这张储蓄分红保单保证能有$49万8810美元的账户余额。

而右侧的椭圆形框则指出,在20年后,预测的保单账户现金值为$80万2639美元。

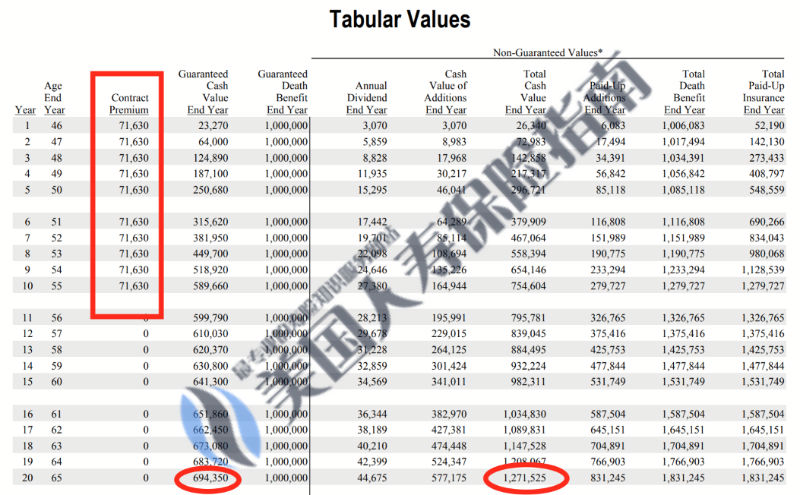

( p2. 10Pay-100万分红保单Whole Life/2021.12)

( p2. 10Pay-100万分红保单Whole Life/2021.12)

上图(p2)是一份新的Whole Life(中文称为储蓄分红保险)人寿保险产品,将于2021年12月上架。

45岁的男性投保人,选择了10年的缴费期。10年间,红色竖条方框显示,投保人需要存入保费$71万6300美元,理赔保额是$100万。

左下角的椭圆形框部分指出,20年后,当投保人65岁时,这张储蓄分红保单保证能有$69万4350美元的账户余额。

而右侧的椭圆形框则指出,在20年后,预测的保单账户现金值为$127万1525美元。

2. IUL指数保险对比

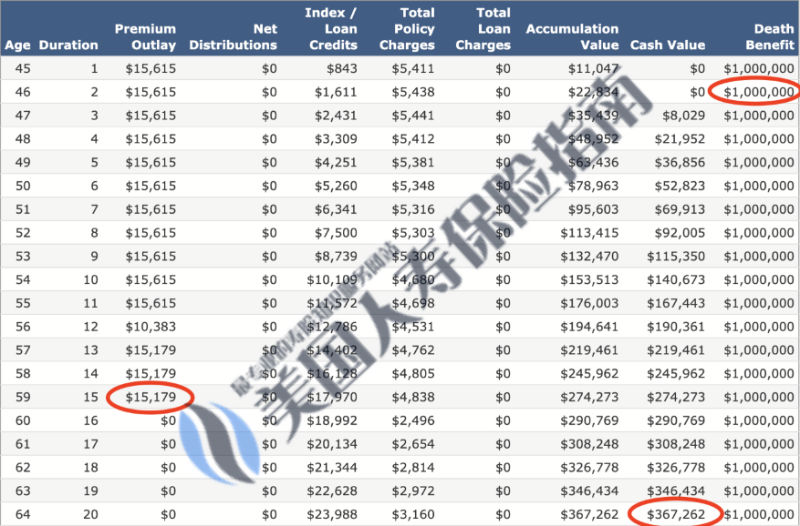

( p3. 15Pay-100万指数保单IUL/2021.9)

( p3. 15Pay-100万指数保单IUL/2021.9)

上图(p3)是一份适用于旧7702法规的指数型人寿保险产品,已下架。

45岁的男性投保人,选择了15年的缴费期。红色竖条方框显示,15年间,投保人累计存入保费$22万7685美元,终身理赔保额是$100万。

而右侧的椭圆形框则指出,在20年后,预测的保单账户现金值为$36万7262美元。

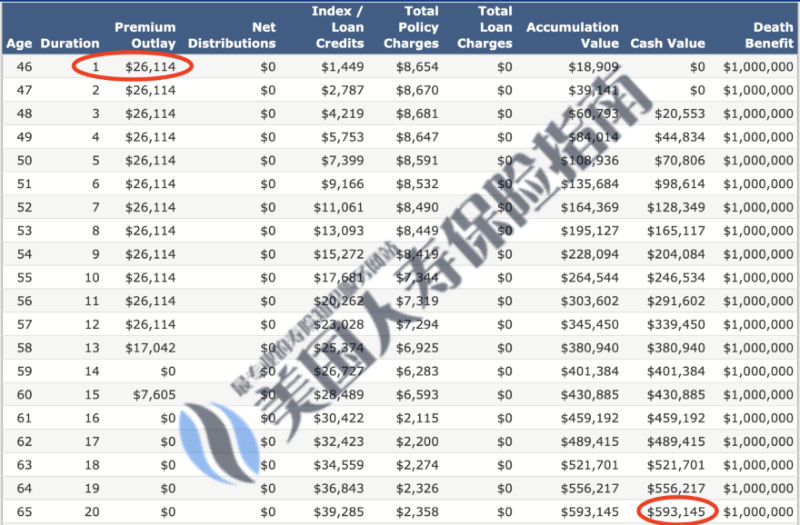

( p4. 15Pay-100万指数保单IUL/2021.11)

( p4. 15Pay-100万指数保单IUL/2021.11)

上图(p4)是一份采用新7702法规的指数型人寿保险产品。

45岁的男性投保人,同样是15年的缴费期。红色竖条方框显示,15年间,投保人累计存入保费$33万8015美元,终身理赔保额是$100万。

而右侧的椭圆形框则指出,在20年后,预测的保单账户现金值为$59万3145美元。

文章小结:我们的观点

如果您是寻求人身保障,那么按照购买消费品的思维,人寿保险身故理赔的成本,显著增加了。

如果您是寻求资产管理,那么按照买入资产的逻辑,新的人寿保险产品给了我们更高的资金入场额度,意味着相对更高的现金值杠杆。

不同的家庭收入情况,不同的人生阶段需求,以及对金钱的理解程度各不相同,如何看待因法规调整带来的人寿保险保费的调整,以及如何看待保费投入和中长期产出之间的利益得失,是见仁见智。

在人寿保险领域,我们需要坚持指出的是,投保人面临的真正问题,从来不是“买不买得到”的问题,而是能否找到真正匹配自己家庭财富及知识水平所需要的保险解决方案的问题。

在美国人寿保险指南社区的“百万保险保费价格对比评测”一文中,我们不断指出,美国,是一个充分竞争的成熟市场经济国家。发展长达百年的行业领域,带给了我们极大丰富,甚至过于丰富的选择。

投保人面临的真正困境,并非选择太少,而是市场的声音过于吵杂,各种各样的选择太多,而又缺乏专业的引导和全面教育所随之带来的问题。

一位从业30多年的人寿保险理财顾问,曾向美国人寿保险指南社区坦言,在各类社交媒体营销和FOMO情绪影响下,一些原本条件非常优秀的投保家庭,匆匆忙忙做了决定,从而失去了接触到对自己更加有利的专业金融保险机构和设计方案的机会。

而近年来随着1035Exchange保单Trade-In案例数量的明显增加,TLT社区也感受到这类华人高净值家庭开始了寻求更加全面的人寿保险理财知识教育的历程,并开始重新审视手上的美国人寿保险保单是否合理。

寻求专业领域,具备信托责任的专业人寿保险人员的协助,是美国人寿保险指南网的一贯宗旨。在这类投保体验过程中,我们不光能在当下,立刻避免掉销售型人员给投保人不断输出的FOMO紧迫情绪,追求到保险给我们带来的Peace of Mind,更能在一个中长期的投保阶段里,通过和专业人员共同合作,积极应对不断变化的市场利率环境和法规政策,守护好自身的长远利益。(全文完)

(>>>相关阅读:7702保险法规是什么?修改后对我有什么好处?)

*美国人寿保险指南网为内容出版方(Publisher),本文内容并非投保建议,说明,或要约,文章仅用于一般性公众教育。