关于年金和美国退休养老金的关系,美国人寿保险指南社区成员整理了最常见的3个问题,并做了最简洁的回答和说明,希望能帮助到规划提前退休的读者。

我能用我的IRA退休账户或者401K账户里的钱来买年金吗?

-可以。你可以把IRA或401K账户里的钱,放入到年金账户里。正确的转换过程可以免税,并非支出提取免税。

年金收入会影响社安退休金金额的计算吗?

-不会。

退休后,年金收入对社安退休金会有影响吗?

-有。虽然年金账户不影响社安局对退休金金额的计算,但是却在国税局税务方面可能造成影响,具体如下:

我们绝大多数人在退休后的收入来源,主要由以下5个部分构成:

- Social Security社安养老金账户

- Pension/SEP/401K/403B/IRA/年金账户等

- 人寿保单账户

- 储蓄账户/投资账户

- 房产销售或出租收益或房屋反向贷款资金

退休后,IRS国税局依然要根据每个人和家庭的年度收入情况,计算出AGI,并以此进行征税。

如果社安养老金是你的唯一收入,TurboTax告诉我们,你甚至都不需要报税。

但在本文里,我们关心的是从IRA,SEP,401K转到年金账户的情况,从这种年金账户里每年的提领,等于是有了新的收入,是要计算出AGI,进行报税和纳税。同时,这种情况下,Social Security社安养老金,也要重新考虑税务的问题。

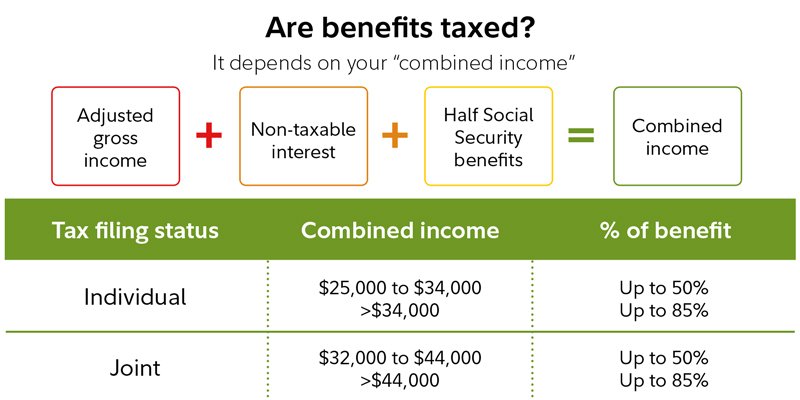

以下是由AARP提供的“社安养老金需要纳税吗?”的简要说明表格。从表格中我们可以看出,如果每年从年金账户里领钱,这笔钱将需要重新计算AGI。如果退休夫妻联合报税,总收入超过$44,000,则社安养老金的85%,要按照当年的税率进行纳税。

问答小结

本文我们分享了美国退休年金常见的3个问题,特别就“年金收入和社安养老金的关系”,进行了一个简单的说明。在实际情况中,AGI的计算结果因年金账户的属性,支取方式而异。如果您有这方面的需求,请扫码我们的二维码,联系美国人寿保险指南社区里,专业的退休财务规划师和会计师的服务。

(>>>推荐阅读:小工具|美国个人退休金智能计算器,算算每个月我要存多少钱?)

您的评价?请点击星标评分

[总票数: 9 平均分: 4.1]