在接触美元类人寿保险时,市场上有着各种各样的“神话”和“误区”。

因为人寿保险,不像法律要求强制购买的汽车保险,房屋保险那样大众化,所以,很多人并不完全了解它的使用价值。而道听图说的消息,往往会让更多人掉入偏见的误区。

TheLifeTank©️传递的观点是,每个人,都可以从拥有某种特定类型的人寿保险中受益。美国人寿保险指南网©️编辑整理了4个关于人寿保险最常见的误区,供读者参考。

误区1: 我太年轻了,不需要人寿保险

很多人认为,只有在年长以后,才需要人寿保险。这是关于人寿保险的最大误区。

根据调研,大部分家庭成员是在孩子出生后,意识到家庭责任的增长,进而申购了人寿保险。

我们的经验是,保险越早买越好。很多懂得利用保险和时间的高净值家庭,在专业规划人员的协助下,通常在孩子出生的1个月后,就为其购买了终身保险。

越早申请,优势越明显,这体现在诸多方面。最直接的优势是,年轻的时候,身体通常最健康,申请保险的成本是最低的。

其次,越早申请,保险所能提供的福利,和所能达到的目标就越多。在美国人寿保险指南©️网的“知识贴|如何用保险,实现子女‘大学教育金储蓄’和家长的‘退休金储蓄’2合一功能”一文中,专栏作者就向读者展示了越早申请保险的这部分优势。

(>>>推荐阅读:理财,退休收入,重大疾病保障…5个选择美国保单的理由)

误区2: 公司给我买了人寿保险。如果我换工作,我也能带走着这份保险

一般而言,公司帮助员工申购的人寿保险,是为保护公司自身的利益为主。

不少公司申购的人寿保险,受益人是公司自己,保险理赔金是用来弥补因该岗位工作无法完成时,给公司带来的直接或间接的损失。

基于以上的原因,不少公司申购的团体人寿保险,是不能因为离职而被带走的。

其次,公司帮助雇员购买的部分人寿保险,在离职情况下,虽然可以带走,但通常需要申请,或额外支付一笔资金,从公司手上买回所有权。

其次,公司帮助雇员购买的部分人寿保险,在离职情况下,虽然可以带走,但通常需要申请,或额外支付一笔资金,从公司手上买回所有权。

最后,公司帮助申购的员工人寿保险,通常属于团体保险。这类保险的保额,通常是由工资为主要因素计算的,而不是家庭实际需要的保障金额。

因此,在工作提供了团体人寿保险的情况下,申请补充的个人人寿保险,可以帮助我们的家庭实现最大化的保障。

(>>>相关阅读:离职换工作,处理公司提供的团体人寿保险的5个常见问题指南)

(>>>推荐阅读:离职换工作,我的401K怎么半?|四种办法的优缺点对比 )

误区3: 人寿保险只有在去世后才有用

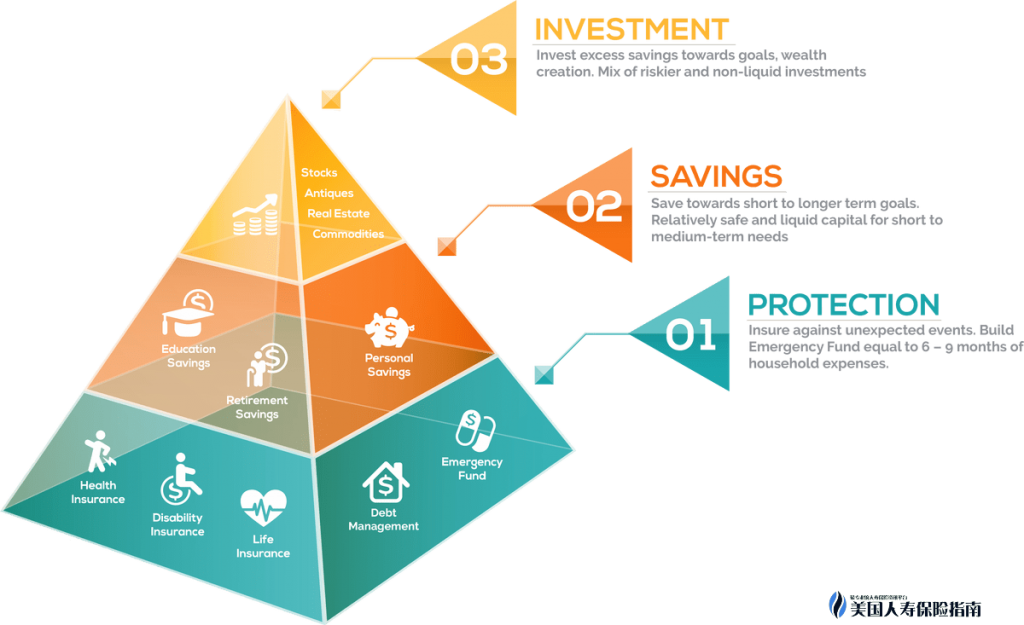

事实: 人寿保险是一款风险管理工具。

“去世”这种情况,只是诸多财务风险的一种。

我们的一生中,还面临“活得太久,钱却没有了”,“发生疾病无法工作,需要一大笔钱补贴家用”,“退休后,需要补充的退休金”等诸多财务上的风险。

人寿保险可以进对上述风险进行长期有效的管理,确保我们实现财务上的安全。

我们可以通过配置正确的人寿保险,对65岁后的退休生活,进行退休收入的补充;也可以使用人寿保险,帮助我们支付退休后可能面临的高昂的重大疾病医疗费用;对于想要留一笔遗产给家人或社会的群体,使用人寿保险进行财富的积累和传承,更是美国社会最常见的一种方式。

在生活的每一个阶段,投资不同的人寿保险产品,将会使我们收益。当然,正确的保险产品方案,和符合家庭状况的适用性评估在这个过程中必不可少。

(>>>推荐阅读:合伙做生意,如何用人寿保险合约来保护自己?)

误区4: 我不需要人寿保险,因为我的房产和存款资金足够我将来的生活

您说的很多,有存款,有房产,足够应付很多未来的变故。

您的现金积蓄和房产,可能足够提供一辈子的稳定退休收入现金流,但您是否考虑过任何在退休后面临的大笔开销情况?

老年的护理服务费用,每月或每周一次的家庭看护服务费用,遭遇重大疾病后寻求额外高效的治疗,临终费用等等,都是突如其来的一笔重大开销。

老年的护理服务费用,每月或每周一次的家庭看护服务费用,遭遇重大疾病后寻求额外高效的治疗,临终费用等等,都是突如其来的一笔重大开销。

要知道的另一件事,是您的房屋抵押贷款,或者用来提供退休金的反向房屋贷款。

如果我们没有足够的资产,并且也不打算还清贷款,那么我们的家人无法保留房产。

更进一步来说,如果我们使用了政府的医疗救助医疗计划——不少华人家庭使用了白卡来为父母支付保健费用——那政府也会启动在父母身故后的费用偿还计划(Recovery Program)。

人寿保险单提供的各类理赔金,可以帮助减轻,在年老退休后面临这些大笔开支的部分负担。(全文完)

(>>>相关阅读:【科普贴】如何使用人寿保险来给自己增加退休收入?)