(美国人寿保险指南网 12/15/2022讯)根据ACLI近日发布的数据,美国人寿保险公司在2021年里,向人寿保单受益人支付了1000亿美元的理赔福利金,再度创下历史新高。

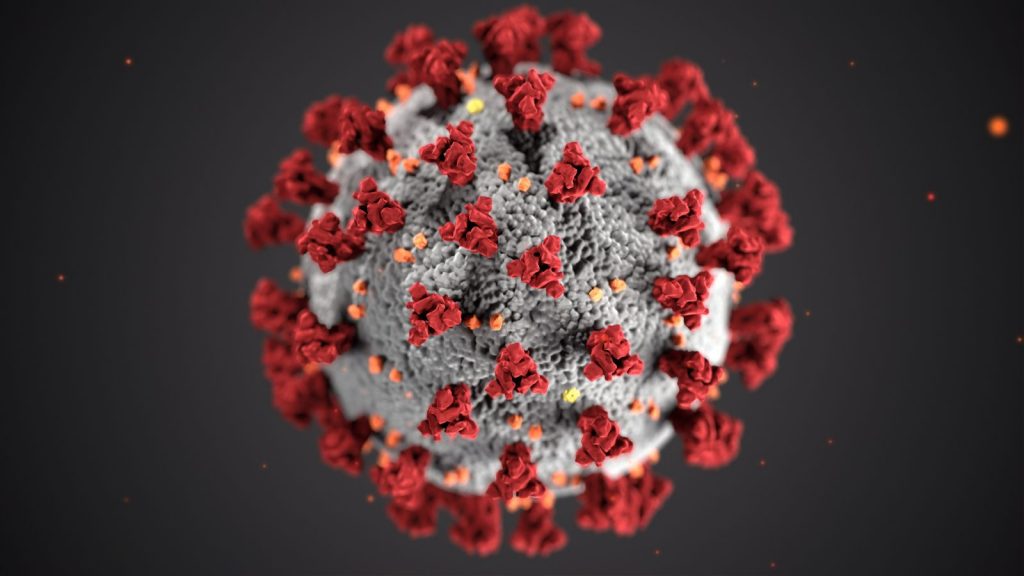

新冠病毒或成为理赔激增诱因

美国人寿保险公司在2021年里,向受益人支付的死亡理赔金总额,相比与去年,增长了10.8%。这也是自1918年的流感疫情以来,人寿保险公司支付理赔金年度增幅最高的一年。

年度数据报告中并没有明确列出投保人死亡的各项具体原因。但2021年创历史记录的人寿保险理赔金额,一定程度上来源于新冠病毒带来的死亡人数增加。

根据CDC疾控中心的年度数据,在2021年里,全美有460,513例死亡病例和Covid-19(新冠病毒)有关。这也让新冠病毒成为了2021年里的美国第三大死亡原因。

(>>>推荐阅读:(图)人寿保险的“受益人”是什么?)

(>>>相关阅读:接种covid-19疫苗不理赔?新冠病毒死亡人寿保险不理赔?这是真的吗?)

全年共申购4600万份人寿保单

由于对 Covid-19 的担忧等综合因素,在2021全年度里,美国家庭共申购了将近4600万份人寿保险保单,比起2020年,增长了6.1%。美国人寿保险理赔福利金总额再度创造历史新高,达到了21万亿美元。

当家里的经济来源支柱去世时,人寿保险理赔金,可以帮助配偶和子女,缓解随之出现的财务压力。根据投保人买的人寿保险保额的高低,人寿保险也能缓解整个家庭未来可能面临的财务问题——比如支付孩子未来的大学学费,付清房贷,或支付买房款等。

(>>>相关阅读:保额是什么?我到底需要多大保额?在线免费保额计算器 )

一些公司会给雇员购买一份人寿保险,对于雇员来说,这个保单是免费的。如果雇员身故死亡,通常会给受益人留下一笔钱。这笔理赔金,通常是工资的一定倍数。

但是免费的保单对于现代家庭来说有一定的局限性,通常保额较低,没有附加福利条款,往往不足以支付配偶或子女的中长期开销。

最后,ACLI的年度数据也揭示了退休年金保险支付的情况。在2021年,保险公司共支付了977亿美元给年金保险账户的持有人。

美国有线电视新闻网,华尔街日报也于近期报道了本新闻。(全文完)