在“特朗普的离职大礼包,对美险投保人又什么影响?”专栏中,我们引出了给每个美国人发钱的纾困金话题,并提及,“如果没收到纾困金该怎么办”这一问题。位于加州的陈菲会计师,对这个问题进行了专门的答疑,下面是她的投稿内容。

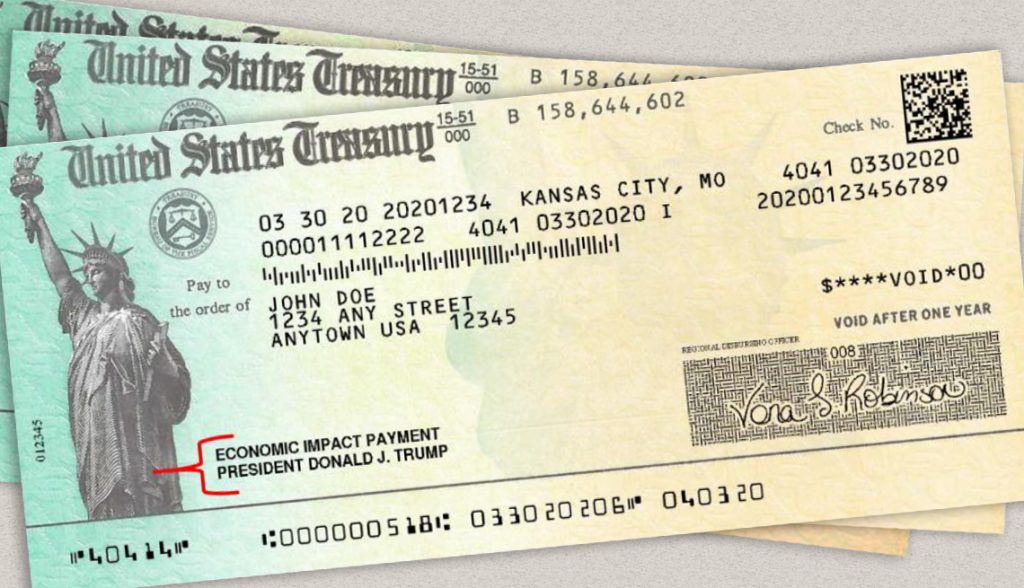

财政部救助支票样本

财政部救助支票样本

正文

2020疫情打得大家措手不及,很多人的生活和工作都大受影响。为了帮助大家渡过难关,国税局针对部分符合要求的纳税人提供了两轮纾困金帮助(Economic Impact Payment, 简称EIP)。

第一轮纾困金$1,200在2020年4月已经发下去了。

第二轮纾困金$600也在2021年新年第一天开始发放。国税局说大部分符合要求的纳税人都会于1/15/2021之前收到。

没有收到怎么办?收到金额不足怎么办?

不用急。我会一一对这些情况进行说明。

纾困金到底是怎么发放的?

第一轮发放是2020年4月,很多人没有完成2019年的报税。税局根据系统里面有的2018或者2019年的税表数据发放。

第二轮发放是2021年1月初,绝大部分人已经完成了2019年的报税。税局根据系统里面的2019年的税表数据发放。如果还是没有申报2019税表,仍然会按照2018数据发放。

疫情是发生在2020年,很多人受疫情影响,收入大幅减少。如果根据2018,或者2019数据,是不符合要求领取纾困金的。但是根据2020年数据,却有资格领取全部或者部分纾困金。这种情况下,您可以在申报2020年税表时,申请Recovery Rebate Credit,您就可以领取到您应得的所有纾困金。

所以没有收到纾困金的大家不用担心,只要您2020年税表上申报收入符合要求,您就可以在申报2020年税表时,找税局申请credit。

这个Credit 也适用于其他情况,如:

1: 2020年有新出生的宝宝,可以申请credit;

2: 2019年是用ITIN, 2020年刚刚拿到社会安全号码,可以申请 credit;

3: 2020年才是来美第六年的留学生,可以申请 credit;

4: 2019年夫妻合报税,一方是ITIN,一方是SSN,第一轮时SSN方没有拿到纾困金,可以申请credit;

一个宗旨,只要您2020年税表情况符合要求,您就可以申请拿回应得的两轮纾困金补助。

当然,如果您2020年收入逆风而涨,而不符合领取纾困金的资格。恭喜您。只要第一轮,第二轮纾困金已经到了您的账户,这就是您的了。不管您2020年的收入是100万,1000万,还是多少,已经到手的纾困金都不用还回去给税局。

纾困金需要交税吗?

不需要。$1200和$600的纾困金,全部免税,不需要申报。

需要注意的是,疫情领取的所有失业金是需要报税的哦。(完)

作者介绍:

免责申明:本文为原创文章,如需转载,请注明作者及出处。本文章提供的信息仅供一般参考。这些信息不构成也不旨在构成法律建议,并且您不应基于本文章提供的任何信息行事或不行事。请就您的具体情况咨询您自己的顾问。本作者/公司不承担任何法律责任。

美国人寿保险指南网鼓励行业专家的实用经验分享,或能帮助华人社区进行具体答疑解惑的行业优质稿件。投稿邮箱: [email protected]