富兰克林说过,税和死亡是人生逃不过的两件大事。年底花销巨大也是省税的关键节点,我们为您整理了几招利用税务政策合法省税的技巧!

技巧一:延迟收入

正值年底,大家对所有的收入进账都有了一个预估。

我们要做的第一步就是计算今年的个人收入,包括股票收入、资本利得等等。

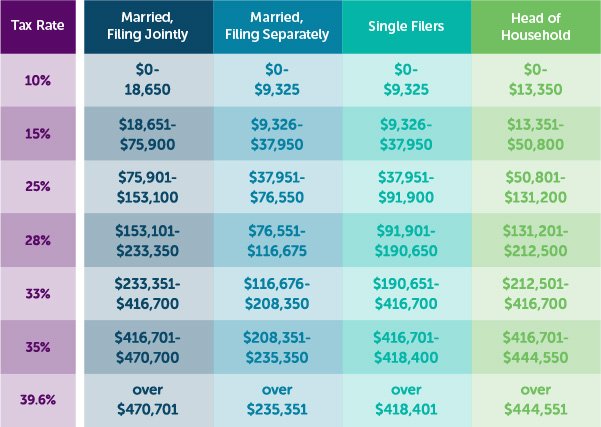

美国2017年的税率区间(tax bracket) 根据应改打税的收入分为7档(如下图),分别是:10%, 15%, 25%, 28%, 33%, 35%, 39.6%。

以单身人士来说,个人收入的税率的关键分界点分别是:$9,325,$37,950,$91,900,$191,650,$416,700,$418,400和$418,400以上。

如果夫妻合并报税,税率的关键分界点分别是:$18,650,$75,900,$153,100,$233,350,$416,700,$470,700和$470,700以上。

如果您和您的伴侣收入刚好在区间分界点附近,税务规划对您的家庭尤为重要。

如果接下来年底的收入会把您推向上一个税率区间,您可以考虑把收入推迟到明年,而不显示在今年的税表上。举例来说,您如果在年末有售卖个人资产或房产的打算,利得部分会把您推上更高一个税率区间,您不妨拖一拖等到2018年初再卖。同样的,如果有赚钱的股票,如果觉得市场还不错,不妨等到2018年再卖。这样capital gain就是2018年的了。

具体操作:

- 个体工商业者,提前给广告账户充值或预先支出

- 销售类从业者预先开支,增加下一年库存

- 长期规划,请参考技巧三

当然,延迟收入的前提是你认为明年你的税率会比今年要低。

技巧二:充分利用资本损失,最小化资本利得

同样的道理,年底税务策划的另一个重要战术就是”loss harvesting”。

如果您今年购买了股票亏钱了,可以充分利用这笔损失最大限度地降低资本利得的总额。卖掉亏本的投资,损失可用来抵税,从而帮助减轻您的税收负担。如果你的亏损比盈利多,你可以有最多3000块来抵扣其他的收入。如果你的亏损比盈利多超过3000块,可以把在明年继续使用。 这部分亏损只要你活着,可以一直一年 一年地使用下去。请务必查看个人投资账户信息,了解投资状况。

技巧三:增加退休账户投入,减少应税收入

常见的另一个省税方法就是通过向退休账户存钱来减少应税收入。

在退休账户里面存入5000美金,就相当于个人应税收入减少5000美金。常见退休账户包括传统IRA,401(K)等。这一类账户的好处不仅仅是存入的金额可以抵扣,同时帐户内的存款利息、股息与投资收益所得可以延迟纳税,只有到规定年龄领取时,账户资金才算收入需要申报个人所得税。

但是请注意,存入账户的金额是有最大限额的。2017年传统401(k)的额度为$18,000,传统IRA的额度为$5,500。另外一方面,如果你有意把传统IRA转成Roth IRA而2017年又正好收入较少、税率偏低,可以利用这个机会在年底之前完成转换,来年4月15日报税时以转换的这部分要纳入2017年收入报税。把传统IRA转换成Roth IRA没有收入限制,也没有转换多少的限制,你可以转换10万,也可以转换5千。但需要了解的是,开设Roth IRA有较严格条件。如果2017年您的AGI在18万6到19万6之间(夫妻联合报税),开设Roth IRA有很多限制,超过19万6就不可以开。Roth IRA 转换非常适合未来税率很高的人士。

如果你把10万IRA转成Roth IRA,假设25%的税率,你要付$25,000的税,但换来的是以后永远不需交税。假设6%的年增长率,40年后10万会变成102万,这102万不需要交一分钱的所得税,你的代价只是今天交了$25,000的税。而且Roth IRA 没有70岁半必须开始往外拿钱的规定。关于401和IRA,如果想了解更多,可以通过在本文留言进行沟通交流。

技巧四:慈善赠与

很多热心的民众年底都会给教会、医院、学校等慈善机构捐款,按照IRS规定,慈善赠与可以抵税,现金、实物赠与的抵税额可以达到AGI的50%,股票、基金等有价证券的抵税额则是AGI的30%,如果你当年的赠与超过AGI抵税的上限,则可以递延 5年。可以捐一些价格上涨的股票和地产,这样可以按上涨的股票或者房产的市场价值,而且不用交这些资产的资本利得。

技巧五:免税赠予

免税赠予可以最大化个人的税务优惠的同时为家人提供经济支持。2017年,个人赠予免税限额为$14,000,若夫妻联合赠与则为$28,000元。少于、等于这一数额不需要申报,也不需要交赠与税,大于这一数额则要填写709表格申报, 交赠与税。如果你当年不交赠与税,则以后会从每人一生549万美元的生前赠与额中扣除。如果你每年的赠与额少于年度赠与豁免额,则不占用一生549万的赠与额。

需要注意的是,这里特指的是公民和绿卡持有者。赠与是否要课税取决于四种因素:

- 赠与人的身分

- 受赠人的身分

- 财产的种类

- 财产所在地,如果赠与人是非居民外国人,赠予的年度免税额将会有所不同。

需要说明的是赠与税是由给钱的人交,收钱的人不用交。如果你收到来自国外的赠与,如果金额大于10万美元,你需要申报,但并不需要交税。美国对资金的进出基本是没有什么限制的,更欢迎外国的资金流入美国,但911后为防范海外流入的钱或流向海外的钱用于恐怖活动或是洗钱、逃税,对超过一定金额的资金流动要求当事人要申报,但申报并不一定要交税。

使用年度赠与豁免的方式主要有两种:

一、是给子女开设监护人账户

二、是给自己买人寿保险,指定子女作收益人,或是出钱给子女买人寿保险。

综上所述,提前配置开支,配置投资和退休账户,配置资产和买入人寿保险是一件符合投资人长远利益的有效方案。