(TheLifeTank.com 03/11/2023 讯)美国排名第16的硅谷银行(SVB Financial Group)在3月10日星期五宣布破产,成为了自2008年华盛顿银行倒闭案后,美国历史上第二大银行破产事件。

TheLifeTank X 畅聊 Youtube频道

银行业破产牵连科技行业

硅谷银行是美国第16大银行,客户主要是科技业从业者和风险资本投资的创业公司,客户包括Airbnb,Uber,Meta,Linkedin等知名互联网企业。

NewYork Post的报道称,流媒体公司Roku在硅谷银行的存款达$4.87亿美元,这笔存款占公司现金及其等价物总资产的26%。

同期据网友匿名未经证实的爆料,Meta向美国证券交易委员会(SEC)提交的文件显示,在2022年12月31日时,Meta在硅谷银行有约100亿美金的现金和等价物,占到Meta总资产的14%。

在 SVB 迅速倒闭后,美国科技业的部分公司开始忙于凑集资金,用来支付工资和账单。

挤兑的人群 Creator: Justin Sullivan | Credit: Getty Images Copyright: 2023 Getty Images

挤兑的人群 Creator: Justin Sullivan | Credit: Getty Images Copyright: 2023 Getty Images

自2000年10月1日起,截止硅谷银行破产时的近20年间,全美累积有564家银行破产。银行破产后该怎么办?背后的保险制度如何运作?

(>>>推荐阅读:瑞信Credit Suisse危局:华人美国保单钱袋子面临未知 )

保险制度保护下的美国银行业

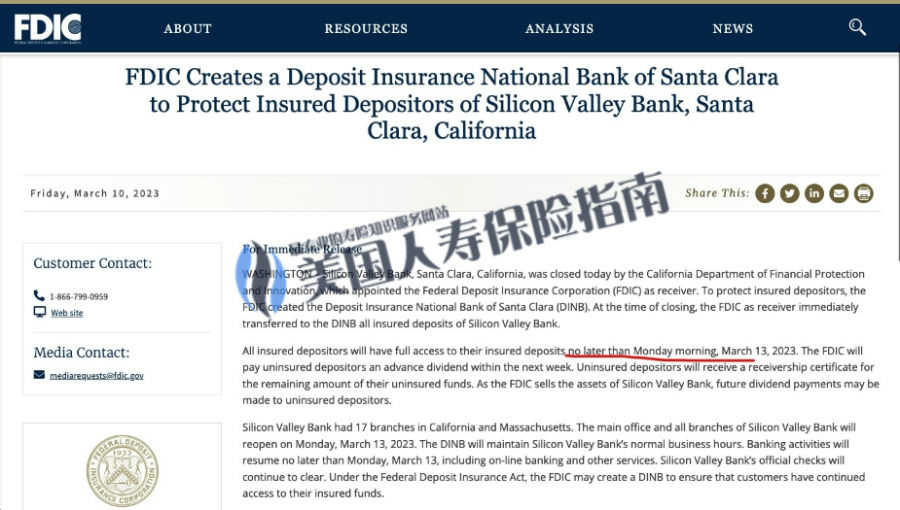

在美国,如果一家银行破产,FDIC(美国联邦存款保险公司)将根据其存款保险计划来处理理赔事宜。以下是FDIC理赔程序的一般概述:

- FDIC 接管银行:一旦银行宣布破产,FDIC 将接管该银行并开始清理和管理该银行的业务。

- 通知银行客户:FDIC 将通知银行客户,包括储户和借款人,关于银行的破产情况,以及关于如何获得他们的存款和贷款信息的方法。

- 理赔申请:银行客户可以向FDIC 提交理赔申请,以获得他们在该银行的存款。理赔申请可以在FDIC 网站上在线提交或通过邮寄申请表格完成。

- 理赔支付:FDIC 将根据其存款保险计划的规定,支付存款理赔金给符合条件的客户。目前,FDIC 对于每位银行客户的存款保险额度为每户 25 万美元,因此如果一个客户在该银行的存款金额不超过 25 万美元,则可以得到全额理赔。

总的来说,如果银行破产,FDIC 会开启理赔程序,并尽其所能为客户提供帮助,以保证他们的存款得到保障。

©️FDIC官方通告

在硅谷银行宣布破产不到24小时,美国联邦存款保险公司第一时间发布了公告,并给出了具体的时间线,兑现储户的资金理赔。(全文完)

(>>>相关阅读:美国保险公司会破产吗?破产后我的钱和保单怎么办?)