在当下的美国,大规模的财富转移正在悄无声息的进行着。

根据《纽约人寿财富观察》调查报告,在过去的十年里,17%的成年人从父母、配偶、家庭成员或其他人那里继承了财富,尤其是婴儿潮一代(22%)。这一现象,被称为“时代财富大转移”。

预计在未来十年内,15%的成年人将从父母、配偶、家庭成员或其他人那里继承财富。然而,近半数的继承人,并未准备好管理这些财富。

现金房产股票保险是主要继承资产

在预期继承财富的人中,58%预期会继承现金,43%预期会继承房产,28%预期会继承股票和债券等投资,24%预期会继承人寿保险的收益,21%预期会继承珠宝或其他家族传家宝,14%预期会继承年金保险。

平均来说,继承财富的成年人,预计将收到价值738,724.23美元的遗产。

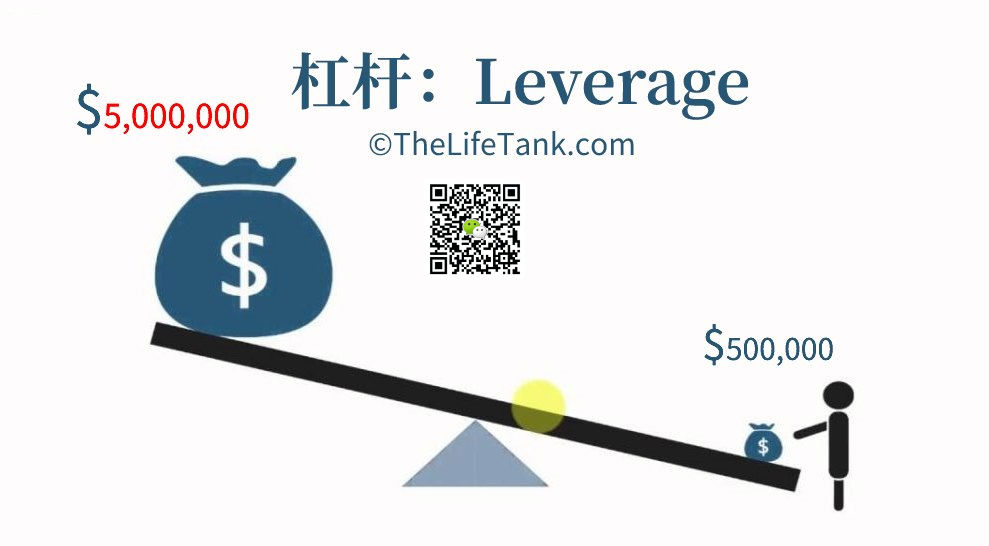

这种现象突出了财富传承的现实性,我们应该如何选择合适的工具?如何合理合法避开税务问题?如何有效的利用金融杠杆撬动更大财富?这些问题的答案,将帮助我们更好的理解和管理好积累的财富。

(>>>推荐阅读:保险杠杆是什么?买保险就是买杠杆吗?保险杠杆最高多少?)

(>>>推荐阅读:保险杠杆是什么?买保险就是买杠杆吗?保险杠杆最高多少?)

人寿保险在财富传承过程中的作用与优势

在财富传承中,人寿保险发挥着重要的作用。

在预期继承财富的人中,24%预期会继承人寿保险账户的收益。

人寿保险不仅可以为继承人提供经济保障,还可以作为一种有效的财富传承工具。

更重要的是,人寿保险的收益是免税的,这是其作为财富传承工具的一个重要优势。

应用人寿保险进行财富传承的实例分析

让我们通过一个具体的案例来了解人寿保险如何在财富传承中发挥作用。

老王,今年55岁,身体健康,喜欢打高尔夫。他总是开玩笑说自己一定能活到100岁。老王一直在考虑自己的财富传承问题,他选择使用更加简洁的合约形式,将手上部分实体资产,注入到保险合约中,转移给妻女,并配合合理的杠杆,留下一笔约500万美元的资金。

老王面临三种不同类型的人寿保险产品选择:

-

- GUL(保证理赔型万能险)

- GVUL(保证证券型万能险)

- GIUL(保证指数型万能险)

这三种保险产品都有各自的优点和缺点,但核心目标是,每年固定缴付保费一笔,保证身故理赔$500万美元,都可以作为财富传承的工具。

-

- GUL保险:这种保险产品没有任何“多余”的附加理财功能,它的唯一目的,就是以相对低的保费,给子女或受益人留下一笔保证的理赔金。

- GVUL保险:这种保险产品除了有保证的身故理赔外,还有现金价值,通常参与证券股票投资,可能能拿回一部分钱来。

- GIUL保险:这种保险产品提供了保证的身故理赔功能,同时还有现金价值功能,通常参与指数投资,最后又新增了保证退还保费的功能。

老王选择的这三种不同类型的用于财富传承的人寿保险产品,都有各自的优点和缺点,但都可以作为财富传承的工具。这个案例清楚地展示了不同类型的人寿保险在财富传承中的作用。

通过选择合适的人寿保险产品,我们可以有效地管理财富的流动性,以及杠杆传承我们的财富。

(>>>相关阅读:【财富传承案例】55岁到70岁的资产传承保险保费价格 及优缺点对比|3款主流财富保险GUL/GVUL/GIUL保费价格及优缺点对比评测 )

文章小结

财富传承可能为一些人缓解经济上的压力。但是,我们的日常生活经常受到通货膨胀、信用卡债务增长和意外支出的影响。

根据调查,缺乏应急储蓄(29%)、医疗保健成本(27%)和信用卡债务(26%)是美国人公然的最大三项财务风险。

财富传承的紧迫性和现实性是我们无法忽视的问题。随着“大规模财富转移”的进行,我们需要更好地理解和管理我们的财富,以确保家庭或家族的财务安全。

人寿保险作为一种有效的财富传承工具,其免税的优势使其在财富传承中更具吸引力,它可以为我们的家人提供财务安全保障,并帮助我们更好的进行财富管理。(全文完)