导语

Gin,男性,今年40岁。作为一名企业主,Gin 在别人眼中,已经实现了“财务自由”。

Gin 秉承 “移居不移民”的理念,他一直在进行各种全球范围内的资产配置,这些项目每年都产生收益,继续回馈了更多正向现金流。Gin 始终考虑的是规避金融市场的风险,不将鸡蛋放在同一个篮子里。同时,准备开始考虑规划一笔钱(Side Fund,美元),专门用于退休养老时的家庭支出。

Gin 的第一种方案是开设“投资理财账户”,即直接投入美元市场,这也是为大多数人知晓的方案,围绕这个核心原理,市场上已经涌现出各类打包出售的产品供认购;第二种方案是开设“现金值人寿保单账户”,不直接投入美元市场,这种方式随着互联网世界信息的自由流动,中文美元金融保险知识的普及,逐渐受到越来越多的华人青睐。

这两种方案各自有什么优缺点,适合什么样的情况?能不能有一个直观的对比分析?帮助Gin 进行决策?美国人寿保险指南网今天将用图表和数字说话,评测“投资理财账户”方案 VS 现金值人寿保单账户的方案。Let‘s Go。

美元投资理财账户

Gin 考虑开设了一个美元投资管理账户,每年从其他收益中拿出一部分钱,采用25年定投的方式。目标是65岁到85岁期间,由该账户提供退休养老专项支出。

我们假设该账户具备以下充分的优势:

- 账户和交易过程没有任何管理费用和成本费用

- 投资能力水平能保证收益锁定到S&P500年度收益

- 账户收益不缴纳任何资本利得税

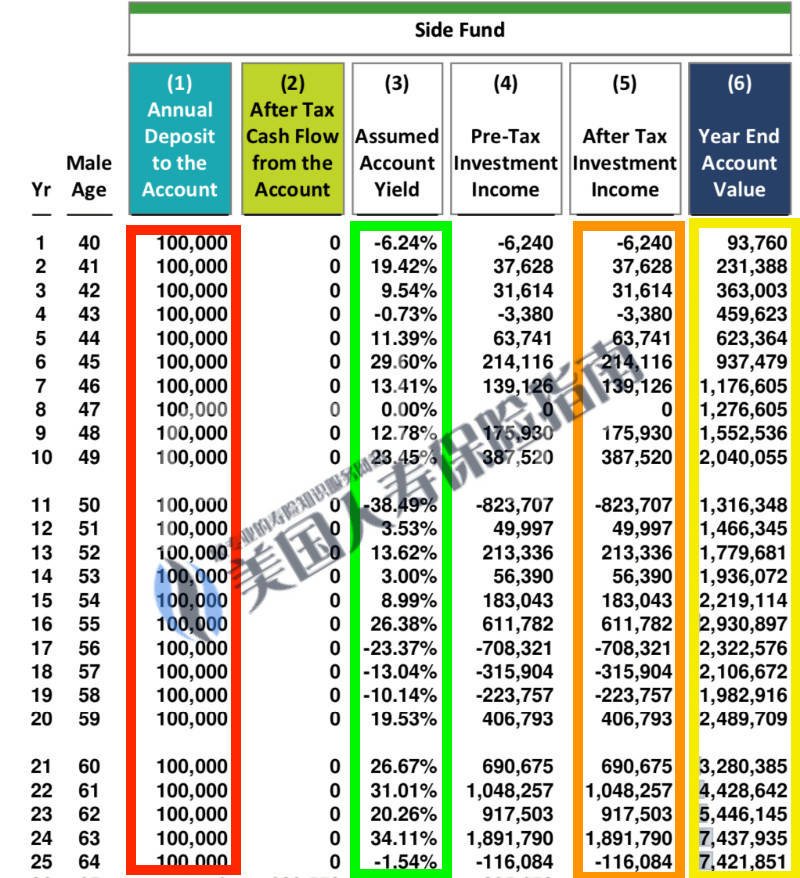

下图展示了该定投理财账户的走势和收益情况:

图1,美元投资理财账户25年运行情况

第1列是该账户每年定期存入的金额,这种方式类似于市面上销售的美元定投基金理财产品。金额$10万/年,累计投入25年,累计$250万美金。

第3列代表接下来的25年里,该投资账户的年收益率。这一列的收益率是对未来的预测。因为尚未发生,美国人寿保险指南网采用了过去25年(1994-2018)里,S&P500指数的历史年度收益率,作为最接近真实情况的预测。

第4列和第5列是每一年的税前和税后收益。美国人寿保险指南网做了最有利该账户的假设,即收益没有任何税费的情况,因此两者一致。

第6列是该理财账户的总金额,也往往是我们关注的重点之一。

从这个图里我们可以看出,在第11年,50岁的时候,股指大跌-38.49%,账户缩水$80多万;而第17到19年,损失近$120万;59岁以后股指大涨,连续5年拉升,将账户余额拉升至$740万。

美元人寿保单理财账户

Gin 同时也在考虑另一个方案,使用开设现金值人寿保单账户的方式,每年投入$10万,定投25年。目标是65岁到85岁期间,从该账户提取免税的专项退休养老收入。

我们假设该账户符合以下情况:

- 指数型保单账户

- 合理的Funding策略 和 良好设计的 保单账户Structure方案

- 6.2%保单预期年化平均收益率(同期S&P500对应的保单年化平均收益率为6.2824%)

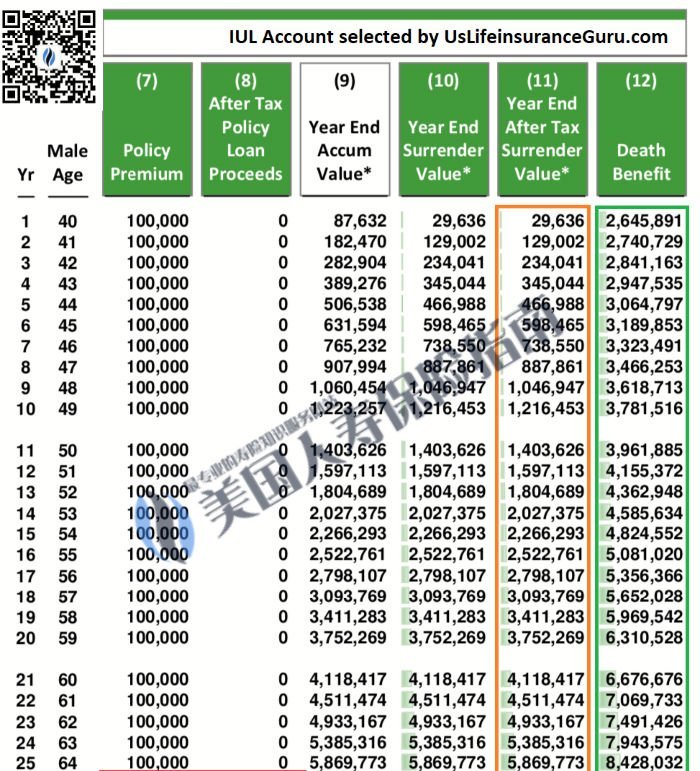

下图展示了该人寿保单账户系统的运行情况:

图2,IUL保单账户运行情况

图2,IUL保单账户运行情况

第7列是每年存入该保单账户的金额,从40岁到64岁,一共25年,每年存入 $10万。

第8列是从保单账户中取钱的情况,在65岁之前都不取钱,因此为0。

第9列是保单开户公司记账方式,显示每年扣除成本后的总累计金额。

第10列和第11列是该保单账户当年的现金价值金额,这个数值是我们关注的重点之一。

第12列是保单的保障功能这一块在当年提供的理赔总金额。

从这个图里我们可以看出,该保单账户在第7年的时候,现金值余额打平了投入的钱。在股指大跌的第11年,第17,18年和第19年,由于该保单账户提供“保底”功能进行风险管理,因此保单账户并不会像投资账户一样跟随市场缩水。

美元投资理财账户 VS 人寿保单理财账户

初一看来,美元投资理财账户在Gin到达64岁末尾的时候,账户余额达到$7,421,851,人寿保单账户此时是现金账户金额$5,869,773和保障理赔金$8,428,032的组合。

一边是740万,一边是580万➕840万的保障理赔金,只看数字的话,Gin 也犹豫不决,可以怎么选呢?

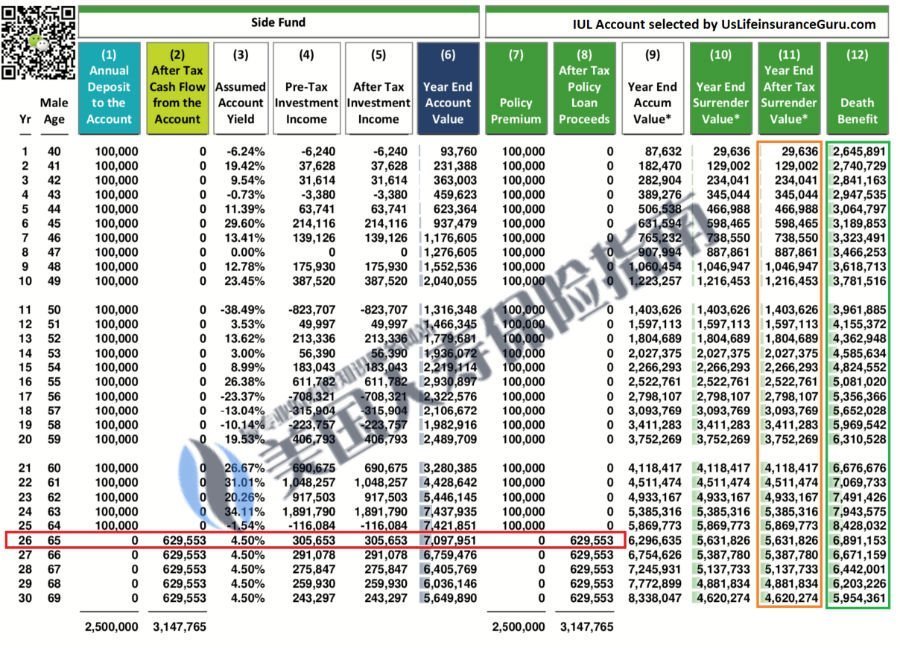

图3,美元投资理财账户和现金值人寿保单账户的对比

图3,美元投资理财账户和现金值人寿保单账户的对比

红框部分显示,在65岁以后,这两种方案每年会给Gin提供 $629,553 的免税收入(我们假设了投资理财账户的收益完全免税的理想情况)。

同时,由于Gin已经退休了,从管理风险的角度(如坚决避免在退休后遭遇第11年时,账户几乎腰斩的情况),投资理财账户不再投入到高风险的市场中,转为终身年收益率4.5%的理想投资品。

但随着年龄的增加,Gin发现,到了81岁的时候,投资理财账户方案里的钱已经完全耗尽,无法提供收入。此时,人寿保单账户现金值(第11列)还有还有$139万余额,同时还这个高龄阶段还提供了$236万的理赔金。如下图红框所示。

当Gin 85岁时,美元投资理财账户已经干涸了4年,未达成规划目标。人寿保单账户现金值此时为$83万,并留给受益人$220万起的理赔金,完成了从65岁到85岁,每年提供免税收入的设计目标。如下图紫框所示。

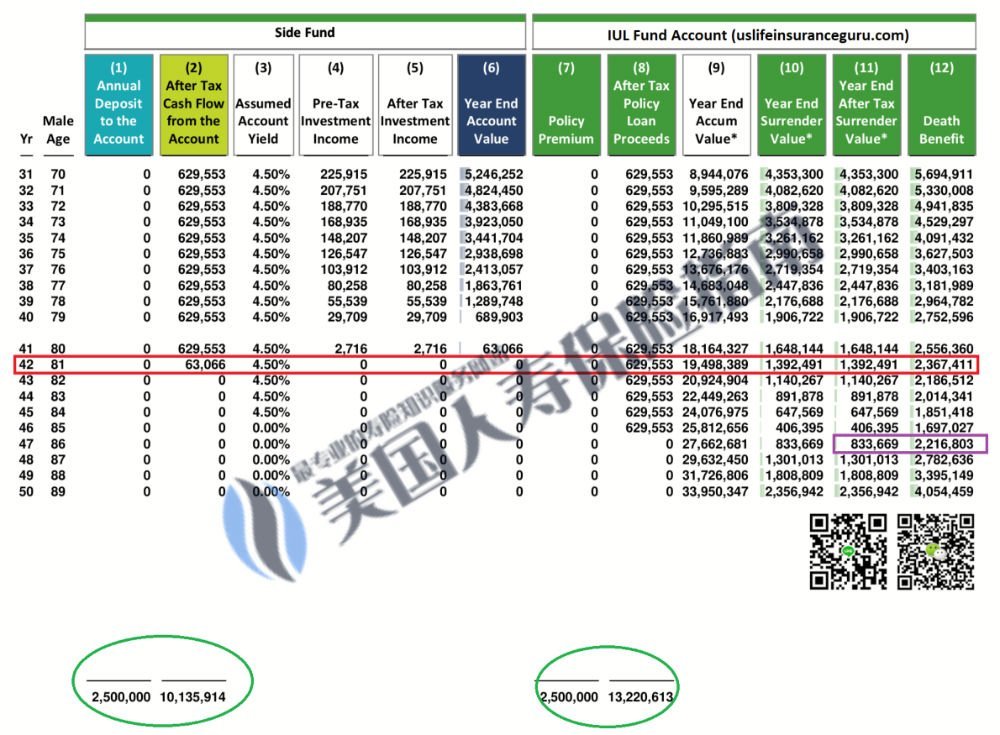

图4,两种方案资金使用情况对比

至此,Gin 累计投入 $250万美元,

- 从美元投资理财账户方案中,累计提取$1013万美元,杠杆比为1 : 4.05。

- 从现金值人寿保单账户方案中,累计提取$1322万美元,杠杆比为1 : 5.28 ,同时,还留给后人一笔$221万美元的免税财富传承。

评测总结

至此,我们是不是可以说,现金值指数型人寿保险账户方案就比完全免税的投资理财账户方案好呢? 美国人寿保险指南网无法给出回答,就正如我们很难回答“筷子和刀叉哪个好?”这个提问一样。因为这两种方案是两种完全不同的产品,完全不具有可比性。

如图3所示,如果你想通过一个10年的理财方案,实现快速积累现金回报目标的话,锁定S&P500的零成本零税率的投资理财账户方案以$2,040,055 比 $1,216,453 的成绩,展示了更快达到目标的能力。

但是由于未来的风险无法预测,到了第11年,投资理财账户方案又承受了账户价值缩水接近一半的风险。

因此,本文希望表达的是,站在风险管理的立场,现金值指数型人寿保险账户方案是一个更好的风险管理方案。在市场中,参与者不用担心下跌的年份对账户价值的冲击。

原则上,我们不愿意让每一分钱去冒风险。如果一个方案,能提供同样的收入,甚至更多的收入,而且能更加持久地提供这种收入的能力,此外,还具有更小的市场风险,我们为什么不选它呢?

(>>>推荐阅读:[评测]如何使用家族保险信托,实现每年$30万的退休收入和财富传承规划?(上))

该策略适合哪一类美元资产配置群体?

…请订阅解锁阅读了解

(全文完 扫码联系美国人寿保险指南网专业北美经纪人,了解更多专业服务和报告。)

延伸阅读:

01. [专栏] 人寿保单算是资产吗?

02. [专栏] 人寿保单的生前福利是什么?如何选购和评测?

03. 生前信托是什么?设立生前信托的费用及作用

Disclaimer:

*本文内容是对公众进行一个既有市场策略的说明,用于学习和教育的目的。所使用的图表,数值,假设情况并不保证,也可能随时更改。现实的实际结果可能比文中描述情况更有利或更不利。

*本文并不构成美国人寿保险指南网及作者的投资建议,及对相关策略方案的拥护,也不构成美国人寿保险指南网及作者对随之而来的税务后果的保证。

*本文内容不作为税务或法律建议。在对本文内容中包含的任何信息采取行动之前,请咨询您的律师或会计师。