长期护理保险是什么?

Long Term Care保险,简写为 LTCi,中文称为长期护理保险,长期看护保险,或长照险。

长期护理保险是为因年老、疾病或伤残而需要长期照顾的被保险人提供护理服务费用补偿的健康保险。 这是一种主要负担我们因为年龄增长后的专业护理、家庭护理及其他相关服务项目费用支出的保险产品。

1.传统 还是 新型?

我们在购买之前,需要了解即将购买的长期护理保险,属于以下两类中的哪一类:

两者的优缺点

传统类长期护理保险功能目标专一,通常具有价格优势,可以享受部分税务抵扣优惠,如下表:

“新型”的长期护理保险,通常提供更多的保障,和更多的选择权,具有更多财务规划灵活性的特点。

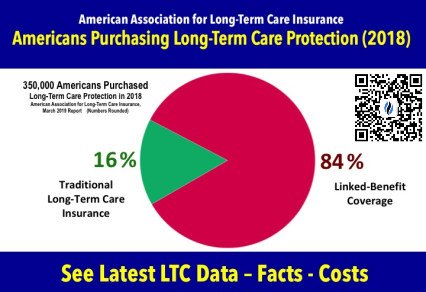

根据全美长期护理保险协会的统计数据显示,在2018这一年里,有350,000名投保人购买了含有长期护理保障的产品。其中,16%的产品是传统型长期护理保险,而84%的产品属于新型的长期护理保险。

2. 买长期护理保险要花多少钱?

我们以美国长期护理保险协会(AALTCI)发布的 2019 长期护理保险价格指数报告为例,提供给消费者,作为长期护理保险保费价格的起始参考。

55岁单身男性,3年保障期,$16.4万美元的长期护理费用保障额度,2019年的全国平均保费是$2,050。

55岁单身男性,3年保障期,$16.4万美元的长期护理费用保障额度,2019年的全国平均保费是$2,050。

55岁单身女性,3年保障期,$16.4万美元的长期护理费用保障额度,2019年的全国平均保费是$2,700。

55岁单身女性,3年保障期,$16.4万美元的长期护理费用保障额度,2019年的全国平均保费是$2,700。

55岁家庭夫妻双方,3年保障期,每人$16.4万美元的长期护理费用保障额度,2019年的全国平均保费是$3,050。

55岁家庭夫妻双方,3年保障期,每人$16.4万美元的长期护理费用保障额度,2019年的全国平均保费是$3,050。

3. 如果没有生病,保费会不会白交?

对于“传统”的长期护理保险来说,是的。如果一辈子平平安安,无病无灾,那么既不能退还保费,也不能得到额外的身故理赔。

对于“新型”的长期护理保险来说,需要我们在购买时确认我们的身故理赔金额(也称:保额)。如果我们需要用到长期护理,那么保险公司将进行“长期护理”的理赔。如果我们没有用到“长期护理”,这份保单自动转换为一张进行“身故理赔”的人寿保险,在我们去世时进行理赔。

4.中途可以退还我的保费吗?

绝大部分“新型”的长期护理保险产品,提供了“退还”保费的选项。我们在申请购买长期护理保险的时候,需要事先了解是否提供该功能。

一些“新型”的长期护理保险,在没有发生理赔的情况下,提供100%全额退还保费。对于长期护理保险行业标准来说,通常是6年后可以申请退还保费。

不同的保险公司和不同的长期护理产品,具有不同的退还保费条款,在申请购买时需要和保险经纪确认。

5. 出具诊断报告后多久能理赔?

投保人在这里会接触一个专业名词:Elimination Period,中文译为“等待期”,或“免责期”。

它是指,当我们需要长期护理服务的时候,需要等待多少天,保险公司才会进行理赔。

长期护理保险等待期通常的选项有:

- 0天

- 30天

- 60天

- 90天

从价格的角度来说,等待期越长,保费越便宜,而从理赔的角度来讲,等待期越短,我们就可以立刻理赔。

6.人不在美国境内赔不赔?

对于世界居民客户群体来说,配置美元币种的长期护理保险,需要在申请时确认该产品的理赔条款:人在海外赔不赔,赔多少,怎么赔?

少数美国人寿保险公司提供了长期护理的国际理赔服务,但是每月的长期护理费用理赔金额进行了限制。

对于不常居住在美国的本国人,或者外国人来说,在投保前需要了解:

- 国际理赔附加条款需要额外付费吗?

- 理赔的限额是多少?

- 哪些类型的长期护理开销才可以理赔?

7. 理赔是给我现金,还是实报实销的报销?

当我们符合理赔条件后,保险公司将按照以下两种方式进行理赔。这时候,根据我们所购买的产品的不同,我们得到赔偿金的方式也不同。

第一种方式是“现金理赔”,即,保险公司直接将赔偿金以“现金”的方式支付给我们,然后由我们支配支配这笔费用。

另一种方式是”报销“,“实报实销”。我们先付钱给医疗中心或长期护理机构,保险公司将对我们的开销进行”报销“。

两种方式有各种的优点,在购买长期护理保险之前,我们需要确认不同产品理赔的方式。

8. 什么时候买长期护理保险最合适?

在insurGuru的视频专栏“长期护理到底是什么,什么时候买长期护理保险最好”一文中指出,长期护理保险的购买窗口期是50岁到62岁。

对于财务预算比较充足,希望较早配置长期护理保险的家庭来说,提前购买( 最低购买年龄的业界标准通常为40岁 ),可以获得保费上的部分年龄优势,也可以得到部分新型长期护理保单提供的“一定现金值增长潜力”的优势。

文章小结

为解决和满足投保人关心的“长期护理费用”的问题,美国的人寿保险保险公司提供了两大类的选择。在过去的20年间,从早期的传统型长期护理保险,到现在以附加条款Rider + Whole Life创造性技术型解决方案进入市场的新型混合型长期护理产品,美国市场上的长期护理保险产品也不断的更新升级。

>>>点击进入【保险产品中心和产品功能评测】栏目

我们列举了选购长期护理保险的几大常见问题,希望消费者能根据自身的情况和需求,协同专业保险经纪或财务顾问,来判断自己需要哪一类长期保险险种和对应的产品。(全文完)

(>>>推荐阅读:“长期看护”理赔和“慢性疾病”理赔的区别是什么?这两种保险是不是一样的?)