致美国人寿保险指南网用户及读者:

节日快乐。

I. 卷首语 – 行业回顾

2019年,可以说是美国人寿保险业界发生翻天覆地巨变的一年,对华人社区的影响,尤为巨大。

AG49法规的进一步规范,让不同的美国保险产品几乎很难进行“公平”地比较,这在一方面避免了保险公司之间的竞争,但也进一步加大了华人社区公众理解相关保险产品设计方案的难度。

同时,2017CSO生命表格的强制使用,让全美各大保险公司在2019年里,被迫对旗下的产品进行了推陈出新。很多保险公司借此契机,对保险产品线进行了升级换代,向市场推出了具有更多附加条款福利竞争力的产品。大量新产品几乎是同一时间涌入了市场,这种情况,不光是对华人消费者,还是对华人从业者,都造成了选择困境和学习成本增加的问题。

而对于华人关注的外国人保险市场,也在2019年里经历了一次重新洗牌。传统保险公司的离场,新兴保险公司的加入,部分美国保险公司开始实行外国人和本国人完全一视同仁的规则,保险公司对待外国人的审核标准,在“宽松”和“收紧”两个尺度之间不断反覆的变化和调整… 对于投保人和从业者来说,这些看似并不关联的市场行为,却给“外国人投保”的背后增加了极大的不确定因素。

美国人寿保险指南©️,作为华人了解美国金融保险知识及资讯的核心窗口,在第一时间对相关事件进行了全方位的报道,并被业界广泛转载。

美国人寿保险指南©️的使命是,帮助华人全面了解美国人寿保险知识和资讯,分享财务规划的经验和重点,让用户获得能真正保障自己和亲人所需的产品。

II. Fun Fact – 年度数据

在2019年过去的11个月里,美国人寿保险指南©️ DAU 持续稳步增长。同时,管理团队通过采样的数据统计分析,也发现了很多有趣的一面,并与我们的读者分享。

01.哪些国家和地区的人在使用美国人寿保险指南©️?

美国人寿保险指南网©️社区的用户,主要来自于美国本土,占比在80%左右,和去年维持不变。其次分别来源于中国大陆,香港。2019年里,加拿大地区的用户超越了台湾地区,排行上升到第4名。

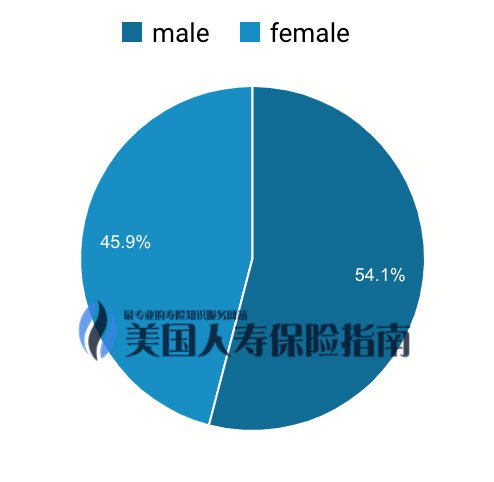

02. 女性多还是男性多?

女性用户占比达到45.9%,比去年同期仅仅减少了1个百分点。男性用户占比超过一半。我们的分析认为,对于兼具“保障”和“理财属性”的美国金融保单来说,女性群体更加关注“保障”,而男性更倾向于“投资进取”。有这样的比例,表明女性在财务方面的关注程度,和男性不相上下。

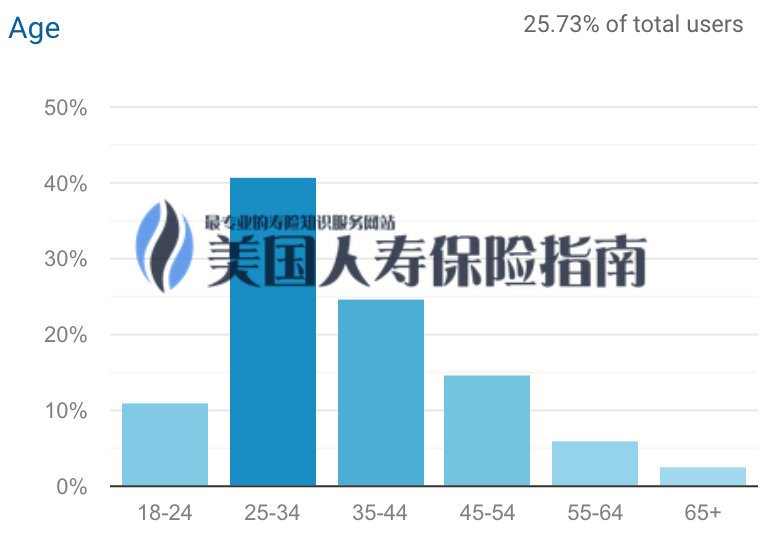

03. 用户群体年轻化

在美国人寿保险指南©️的用户中,25岁到34岁之间是最大的一个用户群体。而18岁到24岁的群体,占据了用户数的超过10%。insurGuru™️社区经纪人的实际报告也印证了这一点,由于年轻人的保费相对偏低,投保年轻化成为了一个重要特点。

04. “剁手党”可能更爱扫货美国保险

分析显示,最喜欢网上购物的“买买买”一族,是最关注美国人寿保险指南©️的群体。“科技咖”排到了第3位,爱运动一族和吃货分别排行在第4,第5名。而我们一直认为理应排名进入Top3的”理财投资“一族,实际只排到了第8位。

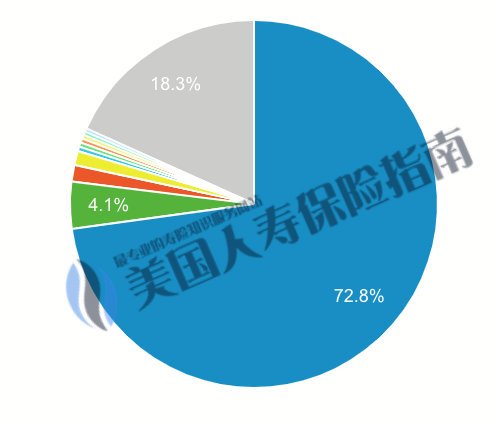

05. Apple 用户 远超 Windows 用户

在美国人寿保险指南©️的用户群体中,使用苹果操作系统的用户占据72.8%以上,使用微软Windows操作系统的用户在18.3%。在更加细分的手机用户访问群体领域,使用HUAWEI(华为)手机品牌的用户,在该类目里仅次于苹果手机用户,排行第2。

更多细分的详细数据报告,后续将向insurGuru™️保险学院注册的独立代理经纪和Financial Professional提供。

III. 社区活动

美国人寿保险指南网坚定不移拥护网络中立法案,并支持捐助维基百科基金会。

每月向Direct Relief进行定期捐款,Direct Relief是一家非营利性,无党派机构,致力于给遭遇紧急情况和贫困民众提供必要的医疗资源。

南加州 Pacific Life 园区举办的2019 Susan Komen Race for the Cure® ,以女性健康为主题的5K健行募款活动。

橙县社会服务署和当地教会为1200个未成年寄养家庭举行活动的志愿者服务。

橙县社会服务署和当地教会为1200个未成年寄养家庭举行活动的志愿者服务。

IV. 展望2020:“教育”和“改变”

“教育,是一个国家的第一道防线”。同理,财富教育,也是每一个家庭保护财富的第一道防线。

然而,在一个文化选择与价值取向极度多元化的国度里,什么是“正确的教育”,以及如何有效区分教育行为和营销行为的边界?并没有一个统一的答案。

从不同角度和渠道学习,并使用“常识”来进行判断,不断地完成自我提升和超越,可能是应对这样一个复杂多变世界的唯一方式。

因此,美国人寿保险指南©️将在2020年里,在持续着力于提高团队学术修养和体验水平的同时,也将和第三方金融保险教育培训品牌携手合作,深入华人社区开展美国金融保险教育,为华人消费者提供一个新的角度和渠道,来获取美国金融保险的相关知识。

同时,作为北美唯一的互联网金融保险知识中文服务机构,美国人寿保险指南©️将继续传递美国主要保险公司信用评级资讯,并秉承“常识”的价值判断原则,为用户提供通用的保单评测方法和相关经验分享,成为投保人在了解和学习美国金融保险知识道路上的一个重要参考工具。

美国人寿保险指南©️深信“教育”的本质,“一棵树摇动另一棵树,一朵云推动另一朵云, 一个灵魂召唤另一个灵魂。它没有声响,它只是让走在前面的人,做好自己的事,走好自己的路,然后,任由改变自然发生。”

在新的一年里,我们邀请您的加入,一同等待改变的发生。(完)

(>>>相关阅读:美国人寿保险指南网 2021年度报告 )

(>>>相关阅读:美国人寿保险指南网 2020年度报告 )

(>>>相关阅读:美国人寿保险指南网 2019年度报告 )

(>>>相关阅读:美国人寿保险指南网 2018年度报告 )