保险设计服务具体是什么?

保险账户设计服务,英文称为Policy Account Design,简写为PDA。

在选好了保险产品后,我们需要专业人员设计一份保险账户方案,来实现财务上的目标。

终身保险产品本身是空无一物的房子,而第2个环节的保单账户设计服务,是对这所房子进行装修设计,达到我们所需要的居住要求。

我们用一个“买房”和“买保险”的对比比喻,来描述这3个环节。

| 买房3部曲 | 买保险3部曲 |

| 1.选购具体的房子 | 1.选购具体的人寿保险产品 |

| 2.选购室内外设计方案/升级方案 | 2.保险财务顾问进行保单账户设计 |

| 3.承建房根据设计方案施工 | 3.人寿保险公司执行设计方案 |

- 选好和购买基础房(选好适合的人寿保单产品)

- 由建筑设计师(人寿保险财务顾问),结合房子的特性(该保险产品内部提供的工具,性能,和其他指标),设计室内外设计装修方案(账户设计方案计划书)

- 最终由承建方按照该设计施工方案(人寿保险公司执行设计方案)建造,实现居住的目的。

不同于购买样板房,选购和投资美元终身人寿保险,并没有“拎包入住”跳过“装修设计环节”这种情况,保单账户设计这个过程必不可少。

因此,您需要向您的人寿保险经纪,或人寿保险财务顾问,索取保险账户设计方案文件存档。

什么时候需要保险账户设计服务?

根据美国人寿保险指南网©️绘制的“投保3步攻略流程图”,投保人在选择了保险产品后,紧接着就需要根据不同的个人需求目标,由专业人员进行量身定做的保险方案设计。

这一份保险方案设计文件,也被称为保险方案书,英文被称为Illustration。

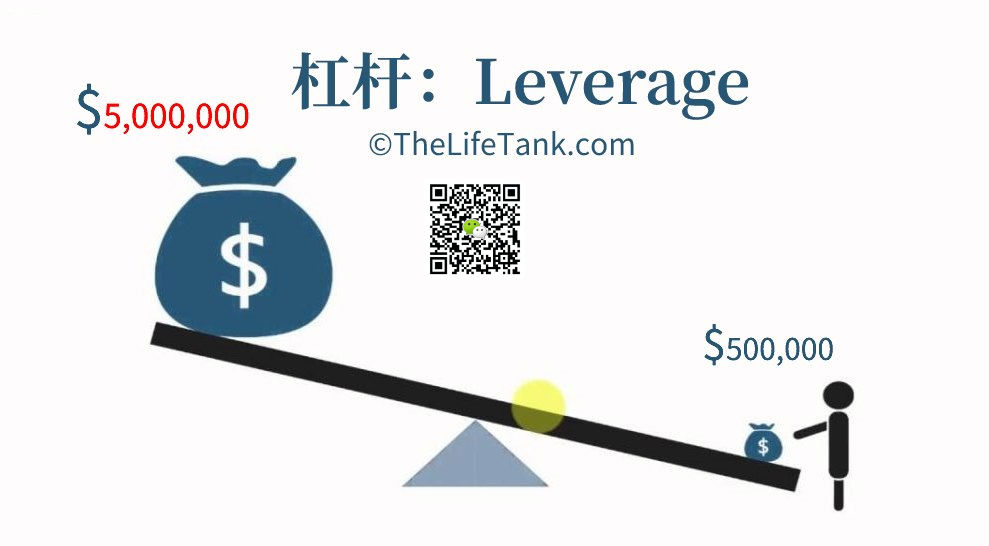

高品质的保险设计方案,能有效管理市场杠杆风险,实现“多赢”的目标。

(>>>相关阅读:攻略|终身保险的保险设计方案是什么?有什么争议和看点?)

不利的保险账户设计有什么危害?

不利的保险账户,往往只能实现“单赢”。

这种设计理念,会给投资人带来不同程度的风险和危害。

TheLifeTank©️按照从轻到重的严重程度,列出了3类主要的危害。

- 过低的投资回报率 在保单评测栏目中,TheLifeTank©️评测组指出,投保人所选择的设计方案,并不利于资产的积累,面临$186万的潜在收益损失。【>>>具体案例分析请点击这里】

- 损失时间成本 在对一名来自纽约投保人所提供的终身保单进行审计的过程中,工作人员发现投保人损失了长达10多年的时间成本。【>>>具体案例分析请点击这里】

- 多年后自动断保 常见于与自己的保险经纪失联的情况【>>>具体案例分析请点击这里】

聪明的投资人,会认识到自由市场和专业领域的优势,理性面对成本和回报之间的关系。 ——TheLifeTank©️

我的保险账户会有风险吗?

如果您希望寻求Second Opinion,或认为现有的保单账户存在隐患——如长期无法和自己的保险经纪人取得联系,多年没有收到过保险账户年度对账单等,为避免多年后被自动断保,失去保费和理赔福利,您可以向收取专业服务费用的人寿保险财务顾问(编者注:并非保险经纪人或保险代理人),寻求以下服务:

- 保险账户审计服务

- 保险账户救助服务

在寻求这类服务前,建议您准备好以下三份文件:

1.申请保险账户时的合约设计方案文件

2.正式保险合约文件

3.最近一年的年度保险账户对账单。

根据社区统计,具备信托责任的人寿保险财务顾问,其每小时的咨询费用会根据具体案例和保单资产总额浮动,价格通常在$150-$350/小时之间。

文章小结

通过对美元类终身保险“投保3部曲”的解释,我们帮助投保人或投资者,解答了“什么是保险账户设计服务PDA”,以及它会如何影响我们的人寿保险资产,如何审计和救助现有保险账户等一系列的问题。

同时,美国人寿保险指南网©️提出的“ LBYB – Learn Before You Buy” ——“在申购之前先学习”的原则,并通过保险学院和投保案例分享,帮助世界范围的华人家庭全面了解美元资产型人寿保险的知识,从而获得真正需要的产品和服务。(全文完)

(>>>推荐阅读:投保攻略|如何迈出第一步?详解和保险顾问必须讨论的4个常见话题)

(>>>推荐阅读:(图)美元人寿保险的年度对账单是什么?每年保单收益计息怎么看?)

关于LifeTank©️ – LBYB

LBYB – Learn Before You Buy,是TheLifeTank.com – 美国人寿保险指南©️提出的一种个人及家庭进行金融保险配置的指导理念。鉴于美国人寿保险及年金保险极其多元化的金融工具属性,这类产品在财富积累和传承领域的应用,已经超越了传统意义上的消费型保险产品。缺乏相应的基础知识教育和片面教育的影响,可能在多年后会对您的利益造成伤害。在申请保单之前,美国人寿保险指南©️提倡消费者和投资人,事先学习和了解这类金融产品的基本运行原理和功能,寻专业人员的协助,从而得到真正能保护家庭及财富的方案。