个人退休账户,雇主退休账户,政府雇员养老金账户,个人养老金账户…美国市场上存在各种类型的退休储蓄理财渠道,这些理财方式各不冲突,原则上是财力所能及前提下多多益善,形成互补。

在今天的问答专栏里,美国人寿保险指南网邀请了Humming Life的年金先生,在本文中解释什么是个人养老金,以及关于它的6个常见问题。

1. 个人养老金是什么?

个人养老金,是在我们退休后,保证能给让我们每个月领取退休收入的持续稳定现金流。这笔每月领取的资金,一直持续到我们去世为止。“活多久,领多久”,是个人养老金的特点。

个人养老金和雇主(如公司,学校)提供的退休金(401k,403b),政府提供的养老金(社安退休金),个人退休金(IRAs)形成了全面的互补。

2. 个人养老金计划是怎么持续支付一辈子的?

和传统的收入型年金保险一样,个人养老金是我们和人寿保险公司签署的一份合约文件,保险公司在合约中承诺,保证给我们支付一笔钱,还保证支付我们一辈子,直至去世。

这个任何投资市场上的金融产品不一样,这类计划提供了长期的收入保险,避免发生“活得太长,钱却没有了”的情况。

3. 谁为个人养老金提供担保?

个人养老金由人寿保险公司来对这笔终身的收入提供担保。

根据我们在个人养老金账户存钱的多少,保险公司保证我们每月能领取的金额,并提供终身的领取保证。

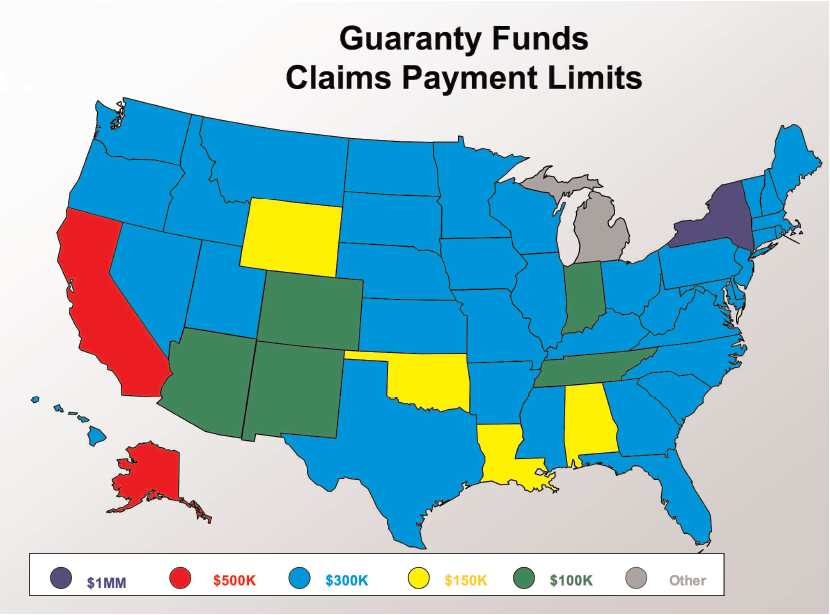

保险公司是在各州层面接受监管,由各州保险担保协会IGA对投保人提供再保险。当保险公司违约或资不抵债时,由各州担保基金SGA投保人进行赔偿。

(各州保险保证金协会将对投保人的保险账户进行再保险和理赔,上图为各州理赔上限©️insurancejournal)

(各州保险保证金协会将对投保人的保险账户进行再保险和理赔,上图为各州理赔上限©️insurancejournal)

4. 建立个人养老金,需要多少启动资金?

虽说在一些州,开设可启动个人养老金计划,最低只需要$100块就可以了,但这可能并不利于养老金的积累。个人养老金存得越早,存得越多,我们退休时,领取得相应就多一些。不少账户要求最低入金开户,一般是$5,000美金开户,每月再定存的方式。

但是,启动金额够小,这方便了我们随时建立个人养老金,在建立之后,可以存入更多的存款。

5. 个人养老金和年金有什么不同?

尽管个人养老金和年金都是保证终生收入的退休理财渠道,但传统的收入型年金,通常是年龄比较大的投保人——接近退休或已经退休——且一次性投入平均约 100,000 美元或更多的投保人来使用的。

而个人养老金则是越年轻越好,让我们可以更早地以较小的金额逐步增加储蓄——这很像按月定投定存的方式,这和我们将钱存入储蓄账户或 401(k) 的模式一样。

最后一个问题:个人养老金要花多少钱?

个人养老金没有开户收费,前置收费,以及持续费用。人寿保险公司和我们签署合约后,给出保证。其中产生的所有成本费用,包括每个月给我们支付的分销人工费,管理费等,都由保险公司的资产管理盈利能力决定,并体现在我们支取的终身退休金上。 再次强调,个人养老金没有与帐户相关的未来或经常性费用。

这么听起来似乎有点怪,怎么有不花钱的事情?

我们存到个人养老金里的钱,由保险公司放入他们的通用投资组合中,这个投资组合中的绝大部分是固定收益类投资品,其它一部分进入到其它投资品里面,保险公司自负赢亏。

这么做的好处是,通过保险公司,保险公司承担了所有的投资风险。如果哪一年保险公司的投资组合表现不好,这由保险公司自己承担,而不是我们。(全文完)

(>>>推荐阅读:数据|我们的保费都去了哪里?保险公司都怎么理财?)

(>>>推荐阅读:比较|指数年金和基金年金,哪一款年金保险更好?(2022版))