我们常常听说,美国人寿保险保单可以配合IRA等账户用来做一个家庭的免税退休收入规划,那这个规划到底是怎么一回事,规划的专业性到底怎么样,有没有一个实战案例帮助我们了解这个规划的过程呢?

Michael Clementi,来自有着30年历史的财富管理机构LifePro,向美国人寿保险指南网的投稿分享了他们最近的一个退休收入规划案例展示报告,展示了在退休规划中进行风险管理的过程,insurGuru©️保险学院对投稿内容进行了一定本地化的翻译编辑和排版。

正文

Linda,女性,今年46岁,在加州尔湾某科技公司担任经理,打算在61岁的时候退休。她希望退休后每年能保持在9万美元年收入的生活水平(经过通货膨胀指数调整后,在61岁大约需要$130,347/年),我们预期这期间的平均回报率为6%。

为了达到这个退休目标,Linda开始投资股票,自己打理退休账户,投入到低管理费用的共同基金。虽然Linda每天要花很多时间盯这个账户,回报也可能不错,但是时间久了,Linda对日复一日的看盘,交易,为市场上涨狂喜,为市场波动揪心的生活状态感到了疲乏和厌倦。同时,Linda要负责公司部门大小事务,高强大快节奏的工作几乎要占去她绝大多数时间,两者在时间上很难兼顾。

如果没有专业规划和帮助的话,Linda将会在退休后,采用传统4%支取策略提取她的退休账户。这和经过专业退休规划后的方案有什么不同,本文的分析将给出图表对比。

Linda的资产账户情况

Linda现在的个人退休账户(IRA)里面,有$341,571的余额。同时,Linda的Roth IRA退休账户里,还有$113,119的余额。

Linda在一家尔湾科技公司上班,持有价值 $187,064的公司股票,同时,Linda每年还额外购买2万的股票。

Linda说,她一年的收入是15.6万美元,而且自己有一套出租房,每年收租金1万3千美元。

我们整理一下Linda的资产状况,制作出了这个表:

Linda想要的是什么?

Linda希望脱离过去那种耗时且无止境的理财方式,投入更多时间到家庭,享受和子女、家人的生活,周游世界。她的目标跟我们绝大数人的一样:

- 退休后有稳定的经济来源

- 退休后的经济来源能稳定地、长久地维持在一个质量水平上;

- 规避市场波动的风险,不想继续为此操心劳神;

- 没有税务的烦恼——美国是一个万税万税万万税的过度;

- 避免资产被通货膨胀贬值风险;

如果Linda按照自己的方式继续下去

如果Linda按照当前的方式继续下去,她的退休后的财务和资产状况会怎么样呢?下图是绘制的图表:

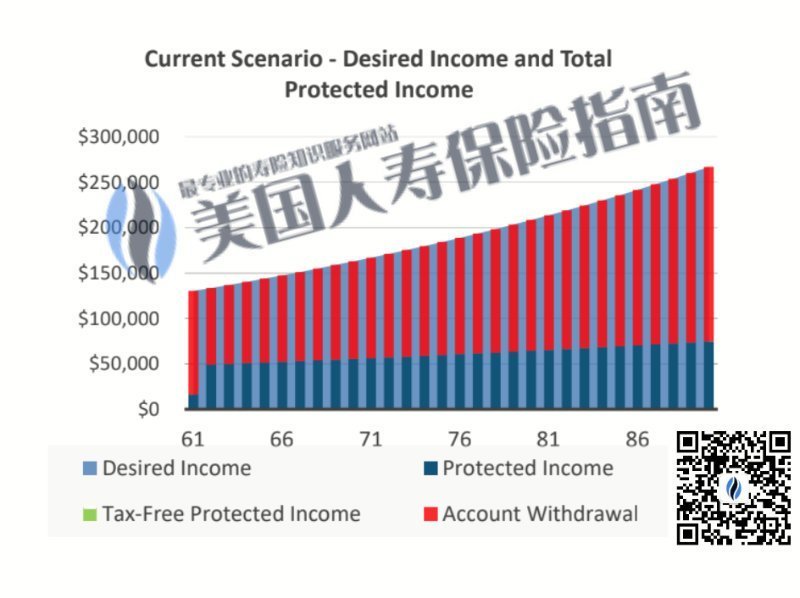

Linda当前的规划展示了她的财务状况,淡蓝色代表了她希望每年拿到的目标退休金(计算了通货膨胀率),而深蓝色表示有保证的收入来源:房租收入和社安养老金。红色部分是每年必须从各种其他账户里提取的钱。红色部分和深蓝色部分相加,就是每年需要的目标退休养老金。

从上图我们看出,红色提领部分越来越多,而在目前的规划里,提领部分都来源于和股票市场直接相关的账户,一旦市场产生波动,将会影响到退休收入。下图是一份以Linda现状而分析的退休预测表格,分为保证的收入来源(蓝),年度支取(红),资产情况(绿)三部分。

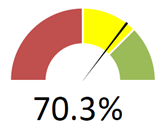

经过对本案的计算,Linda成功在财务上退休的几率为70.3%;10年后,成功在财务上退休的几率降低为57.8%。这是为什么呢?答案是:收入构成和风险。

我们需要帮助Linda管理的风险有

1.可持续性的风险

对于65岁以上的夫妻来说,有50%的几率至少一位可以活到91岁。可持续性本身并不是一个风险,但它风险的放大器。如果我们活得足够长,那么遇到股市崩盘或者金融危机的几率就大大提高了。如果我们活得足够长,随着我们日益衰老,患上慢性疾病,需要医疗照顾的几率也大大增加。我们的钱,在那时候还够不够用?能不能支付医疗账单?这就是一个需要考虑的问题。用来控制这个可持续性问题的解决方案是,规划一部分用来提供终身收入的方案。

2.股票市场的风险

一些准备退休的人可能会大把押注在股市上,根据28原则,可能80%的人会亏钱。还有一些投资股市的人可能过于保守,错失了机会。股市波动性很大,2008年一场金融危机,让很多人的退休金账户减半,打断了原有的退休计划。当快要退休的时候转移掉这个风险,是一件很重要的事情。

3.收入税率的风险

目前美国的税率处于历史平均最低的状态,而美国的国家债务又堆积成山是历史的最高点。我们建议美国人寿保险指南的读者用常识去思考“债务和税率”的问题。因此,对财富的积累来说,选择正确的“税率渠道”就至关重要。如果我们现在有$1,000,000在一个延迟交税的401K退休金账户里面,这笔钱里面,有一部分是肯定要交税的,并不属于我们,而是属于政府。如果税率保持在30%,那么等到退休时,这笔退休金里有$300,000都得交给政府。

4通货膨胀的风险

通货膨胀是我们经济生活中的一部分。食品和服务的价格逐年变得越来越贵。在30年的退休日子中,3%的通货膨胀率将削弱我们退休金50%的购买力。我们不光要保护我们为退休的继续和资产,还要让它们跑赢通胀。

最终的解决方案

通过对4种风险进行管理,我们最终的解决办法是,从客人的IRA账户转出了20万美元,投入到一个固定指数年金产品上,并附加有终身收入附加条款(Rider)。我们将在Linda 61岁的时候,启动这个附加条款。同时,打算每年用来购买公司股票的2万美元,重新规划为一款15年期的指数型保险(IUL),用来为61岁后提供免税的退休收入。

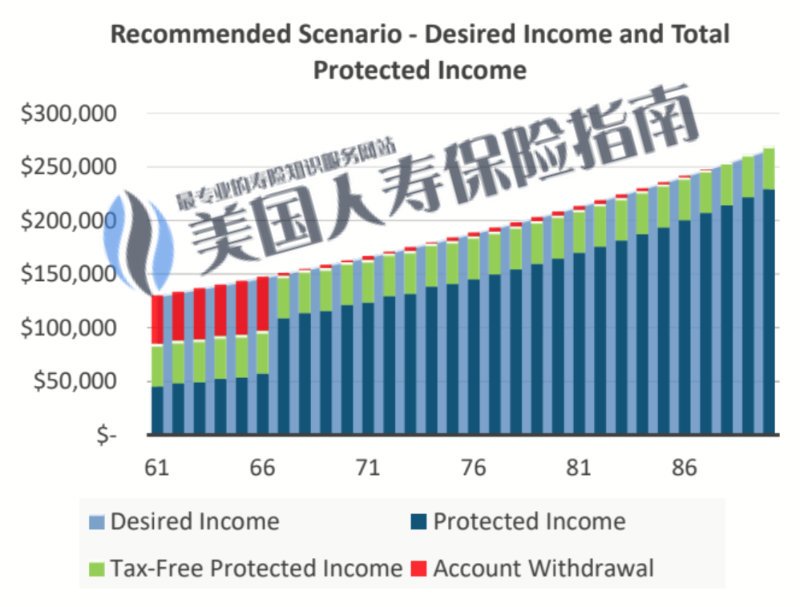

上图是基于风险管理的角度,经过专业规划设计后的收入构成方案。我们可以看出,Linda的收入来源,发生了重大改变。深蓝色有保证的收入来源部分得到显著提升,绿色的免税退休收入部分进行了补充,承担最多市场风险的红色支取部分,被有效压缩在最低的收入比例上。

上图是基于风险管理的角度,经过专业规划设计后的收入构成方案。我们可以看出,Linda的收入来源,发生了重大改变。深蓝色有保证的收入来源部分得到显著提升,绿色的免税退休收入部分进行了补充,承担最多市场风险的红色支取部分,被有效压缩在最低的收入比例上。

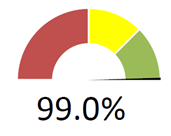

上图是一份经过专业设计和规划的退休预测表格,分为保证的收入来源(蓝),年度支取(红),资产情况(绿)三部分。对比之前,我们会发现,蓝色有保证的收入部分,占退休前6年的收入来源的65%以上,随后比例达到99%。对红色部分所占收入来源比例的依赖性逐渐降低。

另外一个巨大的变化是在绿色一栏资产方面,Linda当前的规划并没有注重资产的积累,资产最多累计到5百万美元,而经过专业规划后的方案,在90岁时资产总额已经超过了8百万美元,足足多了3百万美元,这也是留给子女的一笔不小的财富。

文章小结

| Linda当前的方案 | 专业规划后的方案 |

成功退休的几率 |

成功退休的几率 |

| 有保障的退休收入比例:35% | 有保障的退休收入比例:97.8% |

| 90岁时的总资产:$5,426,276 | 90岁时的总资产:$8,750,621 |

| 退休收入合计:$2,004,260 | 退休收入合计:$5,599,122 |

| 年金收入 : 0 | 年金收入: $2,131,023 |

| IUL 收入: 0 | IUL 收入: $1,200,000 |

| 社安退休金: $1,177,276 | 社安退休金: $1,441,114 |

通过专业规划人员的案例分享,我们希望美国人寿保险指南的读者,也可以参考这种方式,对我们的退休收入结构进行分析和对比。同时,通过该案例分析,了解到多种退休收入渠道策略或家庭美元资产配置策略,帮助我们顺利的达成安全退休养老,颐养天年的目标。

(©️LifePro 美国人寿保险指南网 编辑)