(美国人寿保险指南网 05/04/2023 讯)加州保险局就建立“加州居民长期护理保险”的提案进入精算审计环节,该精算报告将不晚于2024年1月1日正式提交给州立法机关。

该报告提出,建立加州政府运营的长期护理保险计划,向加州居民的工资中直接征税,来支付这笔保险费用。

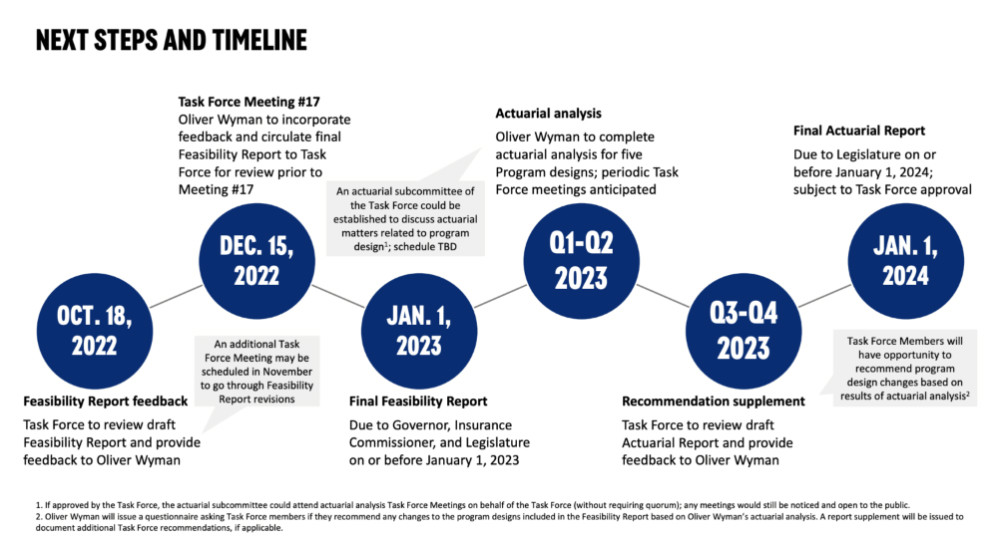

法案进展时间线(2022.10-2024.01)

加州保险局在2022年向州政府递交了可行性报告*,并提供了示例时间表。在该报告的时间表中,假设了 2025 年 1 月 1 日是对于州政府经营的长期护理保险的生效日期。

前车之鉴:华盛顿州长期护理法案

在美国人寿保险指南网的系列报道中指出,华盛顿州是全美第一个直接向工资中征收长期护理税收的州。该法律自 2023 年 7 月 1 日起执行。

由于普遍认为华州政府提供的保险产品方案不及商业人寿保险公司的保险产品方案,大量华盛顿州居民抢在截止日期前自行购买商业保险,来申请豁免这笔税收。

根据华盛顿州就业保障部6月中旬的数据显示,华州总体就业人员数量为3,800,000人,其中有478,090华盛顿州居民进行了突击投保,突击投保人数占整体就业人员的13%。

美国各大人寿保险公司在这轮突如其来的投保浪潮中不堪重负,不得不先后宣布暂停华盛顿州业务。

华盛顿州长期护理养老法案的实施,是成功,还是失败,目前尚不得而知。但对于全美其他州的立法机构和居民,提供重要的参考价值。

(>>>相关阅读:华盛顿州推广全民长期护理保险(LTC),是福利还是对中产阶级的变相加税?)

(>>>相关阅读:华州长期护理保险投保量激增,多家保险公司中止华州申请)

行业观点

美国人寿保险指南网认为,加州保险局并不会过早向立法机构提交最终精算报告。

保费的征收方式大概率是向华盛顿州学习,直接从工资中强制扣除。

我们的顾虑是,考虑到华盛顿州的突击投保情况和各大保险公司的“抱怨”,加州政府可能采取“回溯一刀切”的态度,比如,2025年签字生效,但规定只有2024年1月之前的私人投保保险可以豁免这笔税收。

BH Financial 保险顾问 Heather Xiong CFP®️认为,征税填补资金空缺是政府首要任务,提供福利是其次,我们尚不清楚加州政府经营的这款养老护理保险的性能和指标,但在满足政府自身正常运营的首要前提下,提供“公平”,并非“效率”这一特点,我并不认为该保险福利会优于商业保险公司的产品。本身有养老护理规划需求和要求的人群,可以积极采取行动提前选择更灵活更全面的方式提供护理费用。

Top商业长照保险产品排名

Simplicity Life 合伙人 Chistopher Yen在接受采访时表示,“更多人投保肯定不是坏事,但是从营运的观点,华州一共才780万人,在法案筹备期间的突击投保一下子瘫痪了美国人寿保险公司长达4个月时间。加州人口规模是华州的5倍,这可能造成人寿保险业的资源挤兑和大规模的停滞。关注这一类的客户,可能需要提前购买。”

美国人寿保险指南网将进一步跟踪报道。(全文完)

*”Long Term Care Insurance Task Force”,CDI, https://www.insurance.ca.gov/0500-about-us/03-appointments/ltcitf.cfm

(>>>相关阅读:美国Long Term Care 长期护理保险险种介绍 价格 优缺点 理赔必读和购买年龄窗口 )

(>>>推荐阅读:科普贴|美国长期护理的费用 )

(Update 20230831)