虽然美国人属于乐天派,但现在越来越多的美国人为退休养老烦恼。美国雇员福利研究所的一项调查显示,49%的工薪族表示他们对自己是否有能力在退休后过上舒适的生活感到怀疑,28%的人对退休后生活感到“不阳光”。调查也反映出美国人在退休养老上有着八大烦恼,那么这些烦恼都是些什么呢?

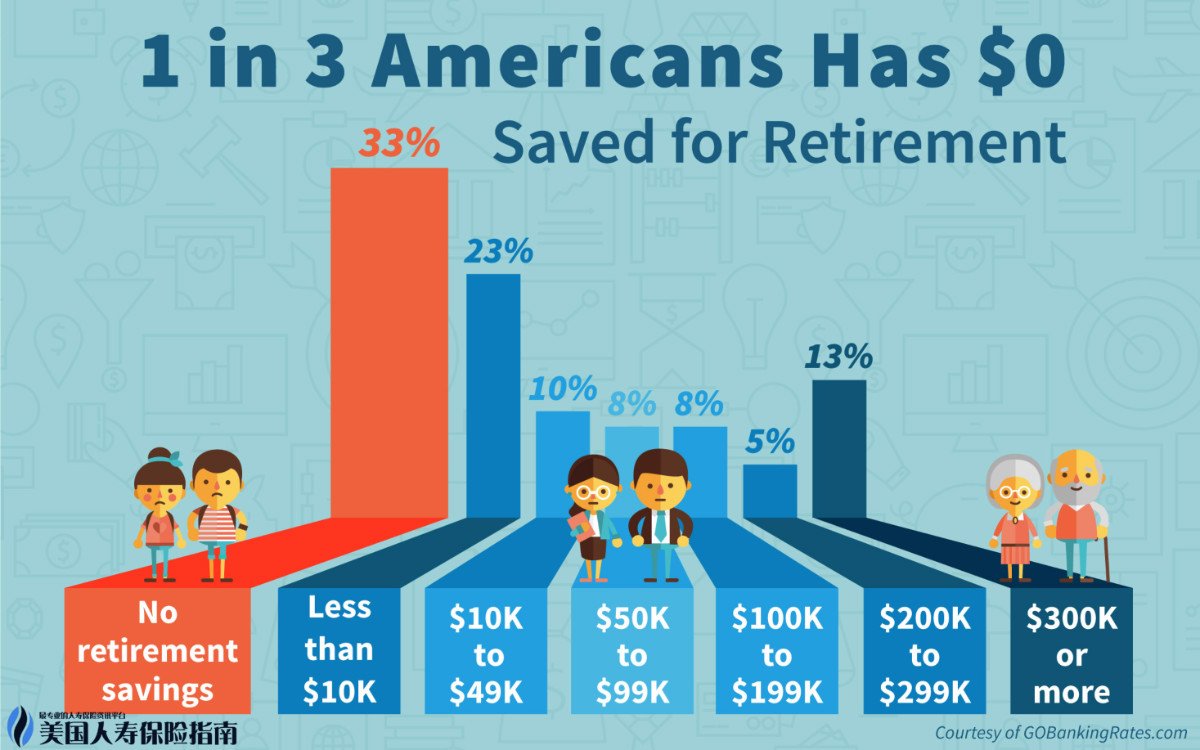

一、没有足够的退休养老储蓄。在调查中,66%的受访者表示都有退休储蓄,这是好现象,毕竟知道要为自己的养老来攒钱。但令人遗憾的是,钱是有攒但攒得太少,不足以应对退休后继续过上好日子。

57%的的受访者积攒的养老钱不到25000美元,就这点钱一年就可能花个精光。有28%的受访者更惨,积攒的养老钱还不到1000美元,完全就是点缀。

资本金融集团的理财专家认为,在一生的工作中,如果每月的收入只用于日常生活,而不能积攒一定金额的养老钱,到退休时生活必然面临困境。

一般而言,要想在退休后保持生活水平不下降,积攒的养老钱应是工作时年收入的十倍。比如一个人的年收入是50000美元,与之相匹配积攒的养老钱应该是500000美元。有了这样数目个人积攒的养老钱加上退休后领取的社会安全金,退休后生活才能有安全的保障。理财专家建议是,为了退休后不差钱,人们在工作期间,每个月10%-15%的收入应当投入到退休账户当中,如果积攒养老钱起步较晚,每个月投入到退休账户上金额应当更大。

二、过早地花费退休账户上资金。美国人喜欢跳槽,无非是在市场激烈竞争的情况把自己卖个好身价,企业的401K退休储蓄计划一般是跟人走,但一些美国人一换岗,退休养老钱反而成了用于消费的小金库。

根据调查,26%的受访者在他们换了新东家后,以前401K退休账户的投入不是用来消费就是拿出去偿还债务,这样做等于是过早地花费退休账户上资金,后果很严重。

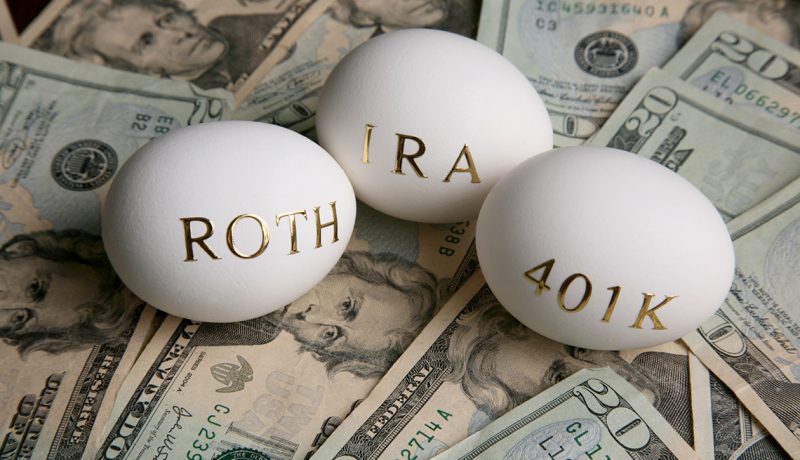

美国退休储蓄账户主要分为延税和不延税两种,个人的罗斯退休储蓄账户属于不延税的退休储蓄账户,当年投入的钱需要报税,但好处是,提前取用时不用交罚款和缴税。

由雇主提供的401K退休账户以及个人的常规退休储蓄账户属于延税性质的退休储蓄账户,这类账户的优点是投入的养老钱在当年不用缴纳个人所得税,只有当59岁半以后领取时才会根据收入情况看需要不需要缴税。

而提前消费账户上的资金,一要缴纳个人所得税,二要缴纳罚款。通常提早将普通退休储蓄账户上资金取出会有10%的罚款,过早消费个人储蓄账户上的养老钱是一件很不划算的事。

三、差钱难以攒出更多养老钱。美国人积攒养老钱面临的一大挑战是收入多用于过日子,要想再从衣食住行花费中抠出一些钱攒起来用于养老实在是不容易。

当然人们多会为眼前的生活操心,至于养老那事还远着呢,所以年轻人要能够为养老攒钱,那还需要有点战略眼光。

调查的数据也显示,美国人在家庭财务压力上,30%的人认为是工作的不稳定性,一旦遭遇公司裁员,那全家人的饭碗就可能被砸了。还有12%的美国人认为自己是“月光族”,人要成了“月光”,还有心情想着几十年后的是吗?仅有2%的美国人把规划养老视为家庭财务压力,其余的人不是没压力,能攒下养老钱的人该攒的都攒了,攒不下养老钱的拿着鞭子赶也攒不下。41%的受访工薪族无法在公司提供的退休储蓄计划中投入更多资金的原因不是他们不想,而是每月的收入都用在日常生活上了。也就是有这个心,但没这个经济实力。

四、债务太多成为养老攒钱的障碍。很多美国人并不是不想早早就积攒养老钱,但障碍较多,收入除了要应对日常开销外,还得拿出一部分收入用于还债。

调查显示,55%的工薪族有着债务上的压力,25%的工薪族称他们的债务负担比5年前还要重。有了债务这座大山,还债成了要务,为养老攒钱只能靠边站。

美国人现在也看到了债务负担对家庭生活和养老带来的负面作用,也在努力减少负债享受的习惯。

五、不清楚到底要攒多少养老钱。论起养老,没有人可以定出一个指标说必须攒够多少钱才能让晚年生活过得舒适。

尽管有专家称在美国养老至少要积攒100万美元才够,但这只是理论上的说法,多数人难以达到这样的水平。

现实中,18%的美国人是把积攒百万养老钱作为目标,21%的人积攒养老钱的目标是在250000至500000美元之间,29%的人积攒养老钱的目标是在250000美元以下。

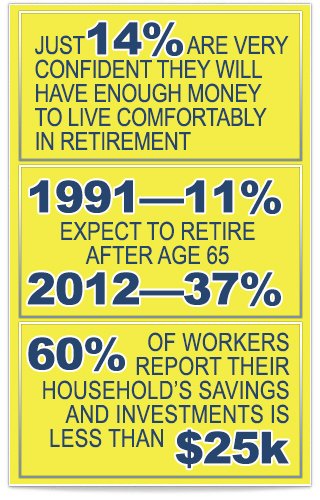

要想积攒比较理想的养老钱,收入要有多少用于养老储蓄计划呢?20%的人认为收入的20%至29%要用于养老储蓄,23%的人认为这不够,需要30%以上。

对于这么高的养老储蓄比率,多数美国人只能是望洋兴叹。事实上,一个家庭能将收入的10%用于养老储蓄这就算是烧高香了,而且还是会过日子的家庭才有可能做到。

六、未预料到的医疗支出。人到退休后,养老首先是解决衣食住行,所谓退休日子过得潇洒,在吃饱喝足之后,还要有经济实力去做自己喜欢做的事或是周游世界。

周游世界是一笔大开销,如果退休后收入不是很高,这项较为奢侈的晚年生活支出也可以省略,周游世界做不到,自己家院子里溜达不应当成问题。

美国人退休后一般不会为衣食住行这些生活的基本开支操太多心,调查反映出只有大约16%的人会对退休后能否有足够的钱满足日常生活之需感到底气不足。美国人对退休生活最感到担心的是医疗花费,这才是关键。人老了病就多,而且医疗费用需要花多少钱人们也无法预测。

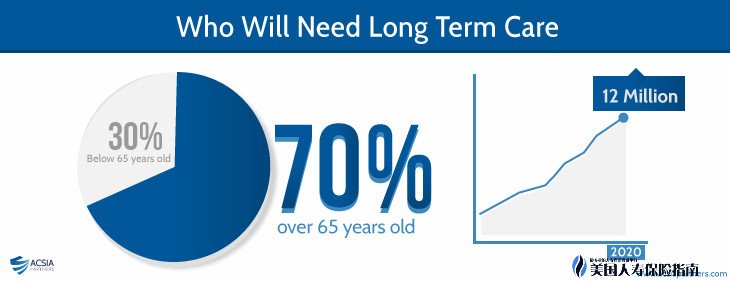

美国人中有29%的人对退休后是否有能力支付医疗花费感到担心,39%的人对晚年需要护理的花费心里没底。虽然美国工薪族65岁以后会享受政府提供的医疗保险,但一些方面自付额也是负担。芬德利投资公司的研究报告显示,美国65岁退休的夫妇在其余生中的医疗费用开支,除了医疗保险可以涵盖的外,个人平均还要自掏腰包的金额在227000至240000美元之间,而且这还不包括长期护理的费用。

所以说,退休后的医疗费用和长期护理费用是老年人不可忽视的 支出,解决的方法当然还是靠钱,人们会购买自负额较低的医疗保险和长期护理保险,这就需要在退休前做好财务规划。

七、对退休支出不切实的期待。在大多数人心目中,退休后生活上的开支一定会比退休前要低。

未退休人群中有58%的人认为他们退休后的支出会比工作时要低,而在已经退休人员中,48%的人报告称他们在退休后的支出上却有下降,30%的已退休人员称退休后开支与工作时没有变化,而21%的人在退休后的开支比退休前还高。

一般而言,退休后人们在基本生活之需上的开支会比工作时要低,最明显的是交通支出会大大降低。退休后人们的房子会越住越小,车是越坐越大,过去是自己驾车上下班,退休后可改为乘坐公共汽车。

人们退休后,消费习惯也会发生一些变化,过去不经常出现的旅游消费有可能成为一大消费。医疗健保会伴随人们的老龄化而有可能成为老年人更大的支出。

所以简单地将退休后支出会减少作为思考退休后生活经济保障的想法可能会与退休后实际情况有出入,而额外增加的退休生活支出就会造成老年人晚年生活一大烦恼。

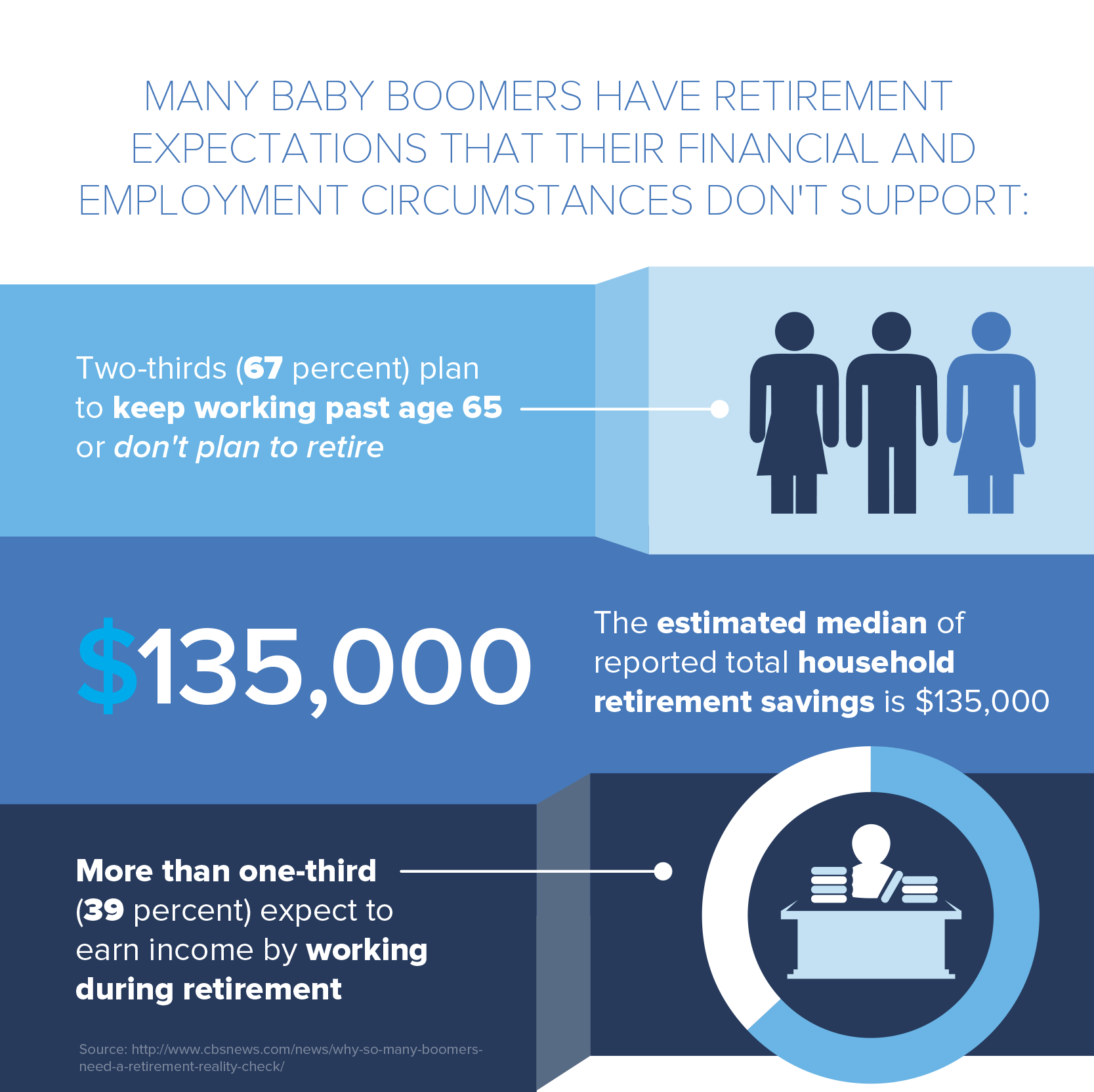

八、意外的提早退休。随着人类寿命的延长,延迟退休也成为人们攒钱养老的一种方式。延迟退休能给予人们更多的时间去积累养老钱,也会使差钱的头痛问题有所缓解。

1991年美国65岁以上人群中有11%的人还在继续工作,到了2013年,65岁以上人群继续工作的人数比例上升到14%。当然继续工作不意味着还要做全职工作,兼个差、打个半工也多少能带来一些收入。

让美国人烦恼的是,65岁以前就有可能提早告老还乡,遇到公司解聘人员,年龄越大越容易成为裁员对象,而且被裁员后再找到工作的几率也低。

即使人们希望65岁以后还能继续工作,但身体是否健康也是个问题。在退休人员中有近50%的人称他们不得不退休的原因是由于身板不济,想继续为人民服务都没了革命的本钱。

本文非原创,经本站整理修改后发布