致美国人寿保险指南网(TheLifeTank.com)读者:

2023,新年好。

在过去的一年里,经济衰退预期,似乎成为了市场的主旋律。然而,经济下行是整个社会面临的整体问题,并非美国人寿保险行业独自面对的挑战。

在新年里,美国人寿保险指南社区(英文名:TheLifeTank)总结了过去一年的年度关键词:挑战。

在2022年,随着基础科学技术的飞跃发展,全新的商业产品带来的冲击,对社会现有制度和人寿保险行业形成了新的挑战。本文是美国人寿保险指南©️编辑团队总结的,由于科学技术的显著进步,对人寿保险行业带来的两大全新挑战。

分子纳米医学带来的挑战

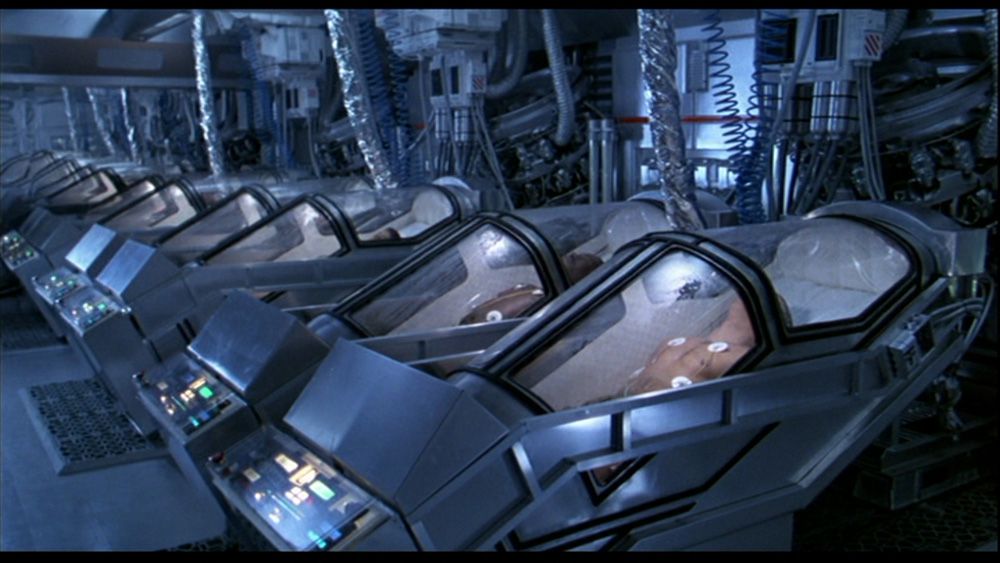

人体冷冻技术是一种试验中的医学技术,将人体作深低温保存,以期在未来利用先进的医疗科技解冻复活及获得治疗。

©️Star Trek 人体冷冻仓

©️Star Trek 人体冷冻仓

这项技术的研究持续了几个世纪,一直被认为是星际旅行的关键。这很在科幻电影里看到的画面,星际旅行者将自己冷冻起来,度过漫长的飞行时间,然后再解冻“复活”。

目前,人体胚胎的冷冻和复苏早已具体应用在了商业医疗领域。前沿分子纳米医学技术的发展,也让人体冷冻技术正式投入了商业应用。

根据TheLifeTank©️的研究数据显示,有200具身体和大脑——其中不乏一些名人(如:美国MIT人工智能实验室创始人马文·明斯基;中国重庆科幻作家,“三体”编审作者杜虹等)——冷冻保存位于美国亚利桑那州的储存设施,等待“复活”的那一天。

科幻电影中的人体冷冻仓

科幻电影中的人体冷冻仓

美国人寿保险公司当前的政策,是依然对这类“死亡”进行理赔,商业人体冷冻机构目前也建议使用人寿保险理赔金,来支付冷冻的相关费用。

而随着冷冻再生技术的发展,“死亡”的定义可能将会改写,人寿保险公司面临了全新的挑战。

自2023年,美国人寿保险指南社区©️为特定客户群体,提供人体冷冻申请及对应人寿保险服务。

AI人工智能带来的挑战

传统意义上,人寿保险被认为是围绕“死亡”的行业。

在过去几千年里,人类对死亡的干预,医学技术的发展,主要是建立在“推迟”死亡这个行为上。到了现代,人寿保险公司也有极大的经济动力,来推动基础医疗技术的发展,延长人们的平均寿命。

对人寿保险行业的第一个挑战,是安乐死(医生协助型)的出现,它完全站在了“推迟”或“延缓”死亡的对立面,在出现之初,挑战了人寿保险行业的规则。

在之后的几十年间,整个美国社会和人寿保险行业也不断调整和互相适应这些挑战。尽管依然存在着争议,医生协助型安乐死,已经在美国下面这8个州,在有限程度上具备合法性:

- 俄勒冈州

- 华盛顿州

- 蒙大拿州

- 佛蒙特州

- 加州

- 科罗拉多州

- 夏威夷州

- 新泽西州

- 德克萨斯州

同样在不断进行着自我调整的人寿保险行业,也达成普遍共识,“医生协助型安乐死”并不是自杀。因此,如果作出了安乐死的决定,也不会影响人寿保单或年金保单的理赔。

而人工智能AI的出现,再一次挑战了人寿保险行业规则。

尽管经过多年的社会演变,人寿保险行业和“医生协助型安乐死”达成了共识。但全新的“AI控制型安乐死”的出现,或将再一次挑战了人寿保险行业的标准。

客户不再寻求医生的协助,而是转向人工智能。AI根据用户的提问,帮助用户做出“生死”的决定,从而让整个过程不再需要额外的“医疗协助”。

新的方法:由AI控制,通过注入氮气的安乐辅助装置

新的方法:由AI控制,通过注入氮气的安乐辅助装置

在过去,这听起来像是科幻电影的内容,但随着“AI控制型安乐死”用户需求的出现,这类商品已经进入了现实,据称已迎来了第一个用户。

这类由人工智能控制的自主生死系统,是否构成“自杀”,尚未定论,但无需质疑的是,整个社会和人寿保险行业,又需要新一轮的时间来不断调整和适应这个新挑战。

——TheLifeTank.com责编团队(全文完)

(>>>相关阅读:2021年年度报告)

(>>>相关阅读:2020年年度报告)

(>>>相关阅读:2019年年度报告)

(>>>相关阅读:2018年年度报告)