美国人寿保险指南编者注:在美国,保险经纪人,房地产经纪,自雇行业的从业者大都是拿1099表申报税务。很多从业者都是1年来找1次注册会计师,然后将全年的收入进行一个计算,在4月15日之前完成申报。这个行为虽然不能说不对,但是对于报税者来说,可能忽略了美国税中的一个要求,就是国税局要求报税者在一定情况下预缴税款,否则,国税局就要直接收罚款,而且直接加在税表里,很多经纪人可能并不知道,他们一直在缴付罚款。这样的罚款,在会计师看来,是非常不值得。今天我们请来了社区注册会计师April Chen,来讲讲什么是预估税(又称为:预交税,预缴税),和预估税罚款。以及,如何避免稀里糊涂交了罚款。

正文

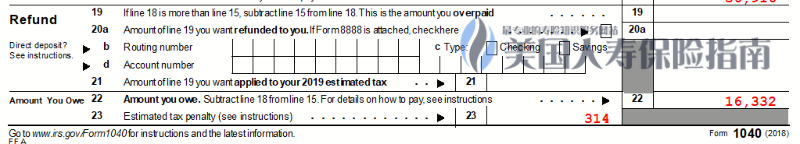

上面这张图,是税表1040第二页的最后两行。不知道有多少纳税人看到自己税表的时候,有注意到第23行的 预交税罚款(Estimated Tax Penalty)呢。

上面这张图,是税表1040第二页的最后两行。不知道有多少纳税人看到自己税表的时候,有注意到第23行的 预交税罚款(Estimated Tax Penalty)呢。

在帮助美国人寿保险指南社区里的经纪人查看去年税表时,发现对方并不知道有预交税罚款这一项。这也是很多纳税人,尤其是拿1099表的经纪人,容易忽视的问题。

作为自由职业的经纪人,除了需要交纳个人收入所税之外,还需要为自由职业收入缴纳15.3%的社会安全税(Social Security Tax)和医疗税 (Medicare Tax)。上面的案例中,藏在税表里的罚款是$314,虽然不是很多,但也相当于一次家人朋友的聚餐,一张短途旅行的机票,一个月的保费,或者将近100杯的咖啡。

下面我们给大家分享,如何避免被美国国税局(IRS)“撸羊毛“。

预交税罚款是什么?

美国国税局规定,如果您在申报税表时,预期要缴纳$1,000或以上的税金,一般需要缴纳预交税。您可以通过在赚取工资所得,或者自已通过表格1040ES来预扣或者缴纳预交税。如果您没有通过预扣支付足够的税款,您可能被征收罚款。这就是预交税罚款。

预交税罚款怎么避免?

1.了解自己的收入状况,提前做好准备

了解自己这一年当中可能会有的收入,为自己可能收到的利息,股息,自由职业(经纪人行业)所得,资本利得等收入,提前每个季度平均缴纳预交税。

2.需要缴纳多少预交税,才够安全

一般而言,纳税人在报税时,所欠税款

-

- a):不到$1,000,或

- b): 至少支付的报税年度90%的税款,或

- c): 上一年税表的100%税款;对于调整后总收入 (Adjusted Gross Income) 达到$150,000的纳税家庭来说,

则需要预交上一年税款的110%,

就可以避免预交税罚款。

由于在2018年新税法生效,美国国税局有针对2018年预交税罚款减免所需的门槛从年度税款的90%降低至80%。

如何缴纳预交税

预交税需要平均按照每个季度缴纳。每季度截止日期分别是4月15日,6月15日,9月15日,下年度的1月15日。

如果遇到假期,顺延至下一个工作日。如文章顶部税表截图,该纳税人2018年实际欠税局$16,018.00 ($16,332-$314)。

如想避免罚款,该纳税人应分别于2018年4月15日,6月15日,9月15日,和2019年1月15日交纳$4,004.00或以上为最佳。

预交税的交税方式

我们可以通过网上IRS Direct Pay, EFTPS,以及邮寄表格1040ES和支票等方法,每季度提交预交税。

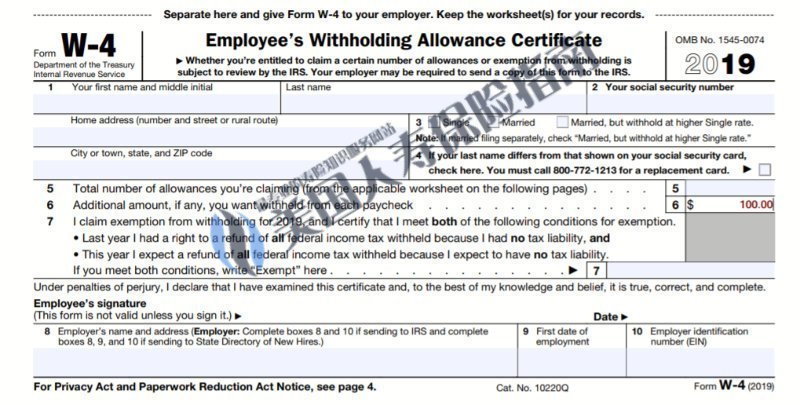

如果有一份额外W2的薪资收入的话,也可以填写W4的时候在第六行,Additional Amount, 要求公司每张薪水中多扣额外的$50, $100等您所需要预交的税额。

申请预交税罚款豁免

如果您是因为意外,灾难或者其他不寻常的情况,而不能支付预交税,同时这个罚款是不公平。您可以提供证明,向IRS国税局申请罚款豁免。

如果您报税年度或者上一年度,年满62岁退休或因故残疾,同时预交税缴纳不够是有合理原因而非故意忽略,也可提供证明,向税局申请罚款豁免。

虽然您可以因为一些不可抗力的原因,向税局申请预交税罚款豁免,但是我们还是建议大家一早做好规划,避免罚款。

文章小结

对于刚开始拿1099表的经纪人(房产,保险,证券),自由职业者,或中小自雇主,了解自己的税务情况,按照正确的流程规则进行申报,可以避免这类不必要,且容易被忽略的罚金。

美国人寿保险指南社区建议,在Review税单和处理税务相关问题的时候,寻求专业会计师的帮助,用专业的服务,来保障每一个纳税人的最大化利益。

附录:

01.洛杉矶保险经纪人推荐