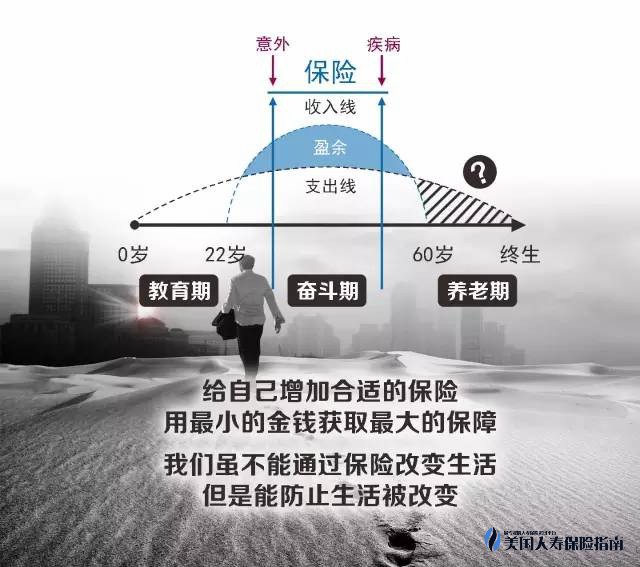

随着越来越多人意识到:意外时,医药治疗费不够时,是不是要你自己掏? 生病了,社保报不掉的部分就诊费,是不是要你自己掏?年老时,品质养老的成本,是不是要你自己掏?人走了,维持生活的费用,是不是家人要自己掏?更不幸的是,如果有房贷债务的,是不是也要你的家人从自己口袋里掏?如此棘手的问题,怎样解决?是保险!

主动要求投保的朋友越来越多,但同时,买保险也是一门大学问,买错保险比不买保险更痛苦!那么,如何才能合理配置一个家的保单呢?可牢记以下几点:

首先年龄越小保费越便宜。别小看年龄的差别,一般相差1岁,每年保费就少缴2%左右,因此,投保人选择生日前几天投保与过了生日再投保,保费都是有差别的。

其次年龄越小健康状况越好。要知道,在投保健康险、人寿保险时,保险公司对于被保险人的身体状况审核是很严格的,一旦有问题,很可能被延期承保、除外责任、加费承保甚至被拒保。

再次越早投保保障期限越长。正如这样一段话:1岁的时候投保是保一辈子,30岁投保也是保一辈子,1岁比30岁多保30年,而且每年保费还少很多。既然任何人都逃不开生老病死,躲不过意外或疾病,保险迟早都要办,为啥不趁年轻、趁健康尽早办?

首先需要明确的是,很多父母早就习惯了把最好的留给孩子,但在“买保险”这件事上,绝对不能把孩子放在第一位,而对自己不管不顾,这是绝对的不负责任。

要知道,假如小A有一个幸福的家庭,爸爸妈妈和他/她。万一很不幸,小A得了一场大病,这时候,是不是还有爸爸妈妈可以为他/她挣钱去治病?是不是还有爸爸妈妈可以陪护、照顾?可如果是爸爸妈妈有个什么闪失呢?小A能做什么?如果没有充足的保险保障帮忙度过难关,小A的将来是不是会比较艰难?

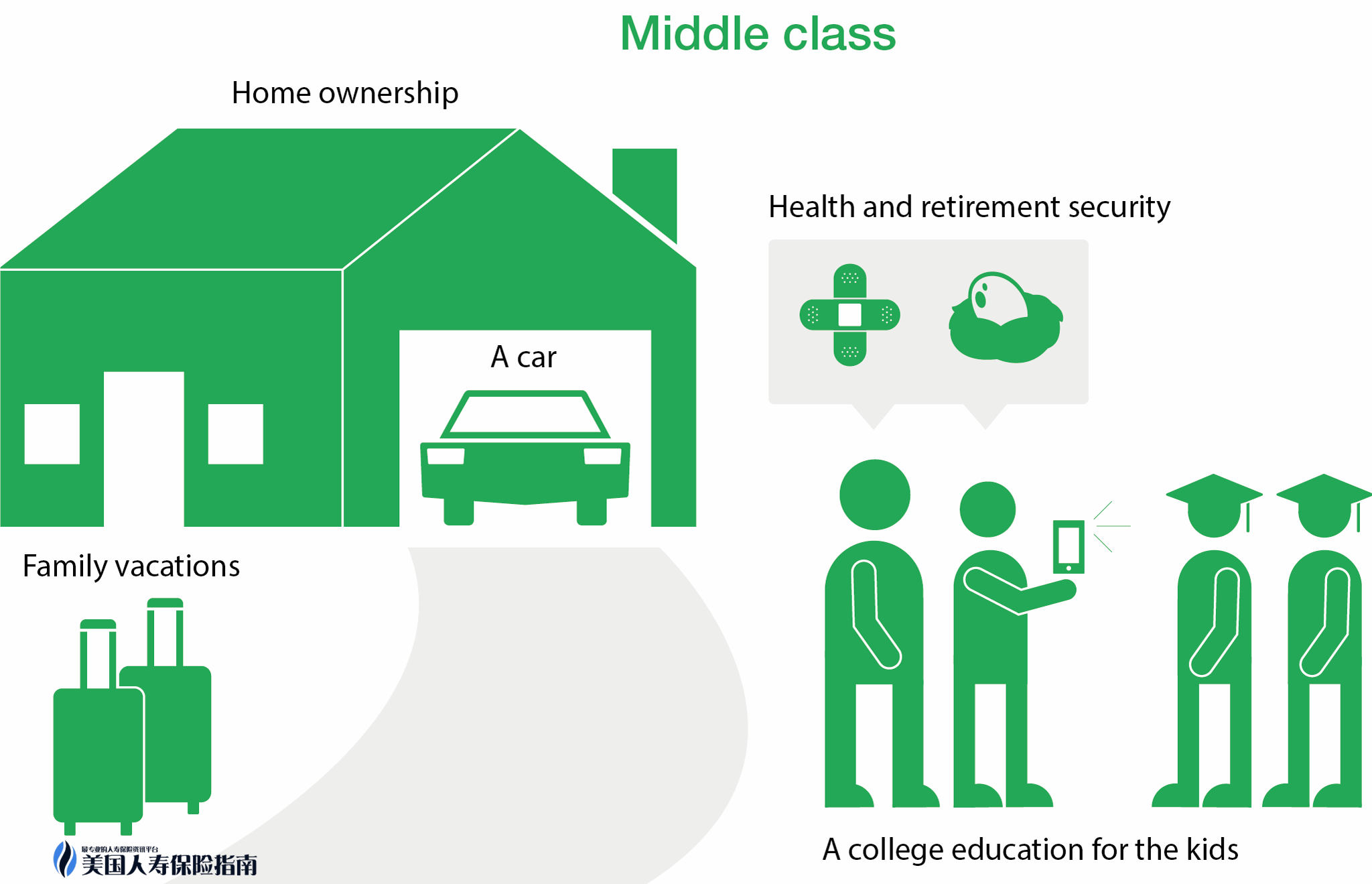

家庭“顶梁柱”作为一个家庭的主要经济来源,不仅需要为前途努力拼搏,还要赡养老人、恩爱夫妻、教养子女,面临巨大的生活压力。

当他们身强力壮,有赚钱能力时,他们是家庭的保护伞。但如果有一天不幸降临,家庭“顶梁柱”倒了,这可能就是一个家庭的“巨灾”,一个家庭的命运可能随着被改变,由谁来承担房贷、车贷、养老费用、医疗费用、教育基金等各项支出,由谁来保证家人的生活不被改变?

依照科学的保险规划,应该先购买意外险、健康险(含重大疾病、医疗险)、寿险,接下来才考虑教育金、养老险、分红险等险种。

都知道,在所有的投资理财中,保本是最重要的,但你知道什么才是最根本的吗?人!

而意外险、健康险、寿险等就是为最主要的“人”服务的,它可以确保在意外、疾病甚至离开后,有一笔钱可以给到当事人或者家属,让其病有所医、残有所靠、走有所留。保险不会改变现在的生活,却可以保证将来的生活不被改变。

试想,买房、买车后,你需要在一定期限内按时还贷,以现在的行情来看,一般房贷会还上10年、20年甚至30年,这就意味着你一直都没有“闲钱”,而一旦此时遭遇意外或疾病,急需一大笔医疗费,谁来为你买单?会不会因此而拖累家人?

而且,最极端的情况,一旦提早离开,剩余的房贷谁有能力偿还?是靠爱人的一己之力?还是让年迈的父母、年幼的子女去分担?

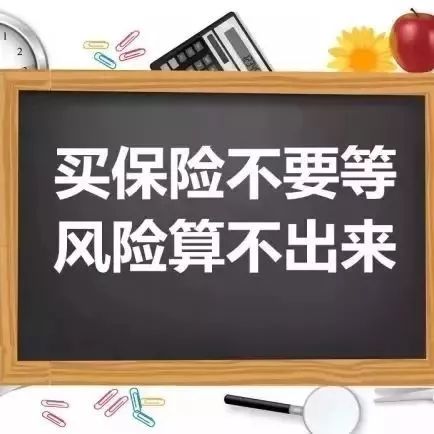

重大疾病已越来越年轻化,意外更是毫无预兆。保险产品往往越早购买越省钱,且容易被承保,年轻一族宜尽早做好保险规划,不要等到保险挑你的时候才想起挑保险。

想象一个现实,如果你最好的朋友或者最亲的亲人里面,有一个人患了重病或者发生意外,需要50万现金,周围这几个朋友知道你手头有50万现金,只有你拿出来才可能解决问题,这50万虽然是你多年积蓄,但是我相信很多人最后还是会选择拿出来,至少会拿出一部分;假若你真能忍心见死不救,那么以后的人生,巨大的愧疚感可能会不停折磨你的心灵和身体!

而如果你劝他们现在都买了保险呢?一旦有什么不好的事情发生,有保险顶着,是不是不论是亲戚朋友还是你,都比较好过?

由于保险产品期限通常较长,许多人买后往往将保单束之高阁,久而久之,甚至忘记了已购保单的保险责任,以至于重复购买同类型保单,或者没有及时调整保额。对自己保单的这种不清不楚,可能直接影响到保单的效力、理赔、以及保单收益等一系列保险权益。

那么保单“年检”该如何着手?业内专家建议,保单“体检”可根据家庭总体收入情况,从基础信息、保障范围、保障额度、保障权益四方面入手,每年至少对所持保单作一次检查,以便充分了解自己的保险权益,并根据家庭情况的变化进一步完善保险方案。