在我们申请美国人寿保险保单产品时,用什么去判断一家保险公司“好不好”?我们也常常看到,一家保险公司的名字后面,有一个或者几个字母“A”或“B”,这到底是什么意思?在美国人寿保险指南网的insurGuru©️寿险学院里,我们将介绍保险公司信用评级这把权威“尺子”,帮助投保人衡量保险公司的实力。

保险公司排名和评级的权威机构

信用评级在世界范围内已有百年历史,但对于建立在债券、股票基础上的保险公司信用评级,却刚刚开始30多年。对于美国人寿保险公司来说,主要有四家主要的评级机构进行综合评级,它们是:

- 贝氏(A.M. Best Company)

- 标准普尔(S&P Global)

- 惠誉(Fitch Ratings)

- 穆迪(Moody’s Investors Service)

标普、惠誉和穆迪是国际上最权威性的三大专业信用评级机构,主要定位在商业领域,除保险业外,还涉及广泛的政府或私营企业债券工具信用评级。

贝氏(A.M. Best)是唯一一家专注于保险行业信用评级的机构。它成立于1899年,是美国证券交易委员会(SEC)和全国保险专员协会(National Association of Insurance Commissioners)指定的国家认可的统计评级机构(NRSRO)。因此,贝氏(A.M. Best)是我们评价一家“美国保险公司好不好”的核心尺子。

保险公司为什么要评级?

请专业评级机构对保险公司进行评级,通常都价格不菲,那么为什么这么多保险公司还要主动的进行评级呢?

信用评级是保险公司的“名片”

保险公司信用评级是独立的第三方利用其自身的技术优势和专业经验对保险公司进行评估,降低保险公司和投保人之间的信息不对称问题,使投保人对保险公司的资本金、资产负债状况、偿付能力、利润、费用、不良资产等情况有充分的了解。

保险公司信用评级是企业在市场经济活动中的“身份证”。第三方良好的资信等级可以提升企业的形象,提高竞争能力,是企业在市场经济活动中的“金名片”,能够增强消费者信心,提高购买。

保险公司信用评级是保证保险公司正常竞争和融资的基础,对一个没有信用等级可参考的企业,外界必然存在相对较高的信息不对称,致使该企业筹资相对困难。而相反,高信用等级的企业较容易取得金融机构的支持,得到投资者的信任,能够扩大融资规模,降低融资成本。

那么,对于美国人寿保险的投保人来说,如何来解读评级机构给出的保险公司综合评价和排名呢?

了解信用评级对我们有什么好处?

当接触到保险公司或者保单产品的说明文档时,我们常常看到,一家保险公司的名字后面,有一个或者几个字母“A”或“B”,如A,A+,AA-等等,这就代表了保险公司的信用评级。读懂这些字母的含义,就能帮助我们初步了解一家保险公司的实力。

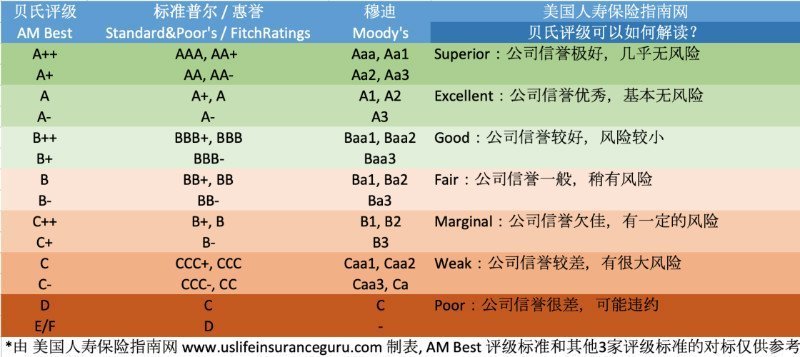

保险公司的评级都是用字母ABCD来表示信用等级的高低,等级越高,意味着企业偿债能力越强,风险越小。每家机构使用的字母和符号略有不同,美国人寿保险指南网推荐以专业衡量金融保险机构财务强度的贝氏评级为主。我们也结合了其他3家的评价系统,绘制了下面的图表,进行了简单对标,帮助投保人理解和解读。

从图表我们可以看出,评级机构还使用了“+”,“-”符号来对一个评级范围进行上下修正。

结语

当我们拥有了这把“尺子”后,就能快速甄别出一家“闻所未闻”的金融保险公司的实力和财务强度。同时,我们可以访问美国人寿保险指南网的保险公司评测页面,对比和了解不同保险公司的评级。

参考附录:

01. “Understanding Best’s Credit Ratings – A.M. Best”, 01.02.2019, A.M. Best, http://www.ambest.com/ratings/ubcr.pdf