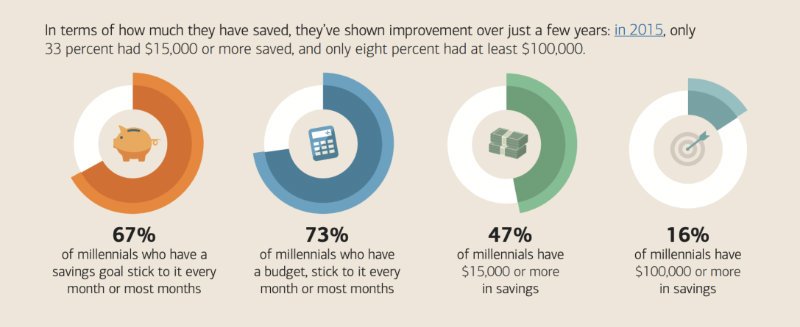

根据美国银行发布的“2018年美国90后理财习惯报告”指出,将近16%的90后——或者更精确地指23岁到37岁的人——至少有了$100,000元的存款。

最爱存钱的美国90后

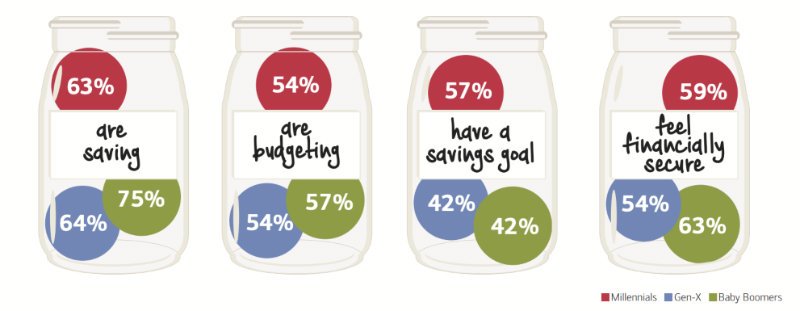

90后,常被成为千禧一代(Millennial),成为超越00后,以及老一辈婴儿潮一代最爱存钱的群体。

根据美国银行的报告指出,美国90后年轻人,有超过一半的群体(63%),都在存钱。54%的年轻人的开销非常有计划,57%的90后年轻人都有明确的存钱目标。

在这个群体中,59%的年轻人都感到在财务上比较安全。

在2015年的银行报告中,有33%的90后存钱超过$15,000,只有仅仅8%的年轻人存款超过$10万。但到了2018年底,16%的90后年轻人存款超过$10万美元,人数翻了一倍。

这个结果完全颠覆了广为流传的“美国人不存钱”的观念。

我们在不同年龄该存多少钱?

存钱才是走向财务安全和自由的最坚实的基础,那我们到底应该存多少钱呢?也要在30岁前存下10万美元才算财务安全吗?

参考25岁到34岁的美国人收入的中位数:$40,352,这16%拥有$10万美元存款的90后群体远远超过了预期。考虑我们到了30岁的时候,我们应该存下和我们年收入一样多的钱比较合理。

那我们在不同年龄阶段应该存下多少钱呢?

虽然这个答案因人而异,但是如果我们想要寻找一个标准,下面这些公式将帮助我们计算出我们大概存多少钱比较合理。

在20岁的阶段: 存下收入数字的25%。这25%也包括401K,403b,以及雇主的Match部分。

专家指出,不要让生活方式的开销占到总收入的75%以上。

到了30岁时: 存下当年年收入这么多的钱。举例,如果30岁每年赚5万美元,那么在30岁的时候,目标应该有5万美元的存款。

这个5万美元的存款,是包括任何退休账户,雇主Match,现金存款,或者投资,股票,公司期权等等所有的总和。

到了35岁的时候: 2倍年收入的存款。

到了40岁的时候: 3倍年收入的存款。

到了45岁的时候: 4倍年收入的存款。

到了50岁的时候: 5倍年收入的存款。

到了55岁的时候: 6倍年收入的存款。

到了60岁的时候: 7倍年收入的存款。

到了65岁的时候: 8倍年收入的存款。

这个存款标准数字,也和富达投资推广的理念相近:30岁时存下年收入那么多钱,在准备退休的67岁,存下10倍年收入(退休前一年)那么多钱。

这些数字听起来有点多,但是如果从20岁就开始存钱,日积月累,按照计划投入到不同的账户里,到了不同年龄后,我们会发现存到10万其实并没有有想象中那么难。

越早开始存钱——不管是为了退休,还是为了买房——我们的财务生活才会越健康。在这一点上,美国90后已经远远走在了前面,我们有什么理由不立刻跟上,开始存钱呢?

( insurGuru©️理财学院 x 美国人寿保险指南网 )