The U.S. insurance industry is experiencing the same paradox as the U.S. stock market.On the one hand, consumers suddenly discovered the huge role of life insurance and rushed to the market. On the other hand, insurance companies seemed to have other plans and were not eager to insure the policyholders immediately.

Why is there such a conflicting market situation?In this special market and social environment, as an insured, what skills do we have to choose insurance products?

Business experience of life insurance companies

Here we have to mention again how life insurance companies make profits-The life insurance company invests the policyholder’s premiums into the bond and earns the bond proceeds for a long time until the policyholder makes a claim.

When life insurance companies price our policies, they assume (through actuarial calculations) how much investment profits they can get from our premiums in the future.If this rate of return is lower than expected, then the cost of the insurance policy will increase to make up for the expected income of the insurance company.

At present, even though some insurance companies have stated that inU.S. Novel CoronavirusDuring the pandemic, more and more consumers are seeking the protection of life insurance.But on the other hand, LifeInsurance companies are also suspending sales of certain popular products, increasing premiums, and even reducing the scope of insurance policies.

--Lawrence Lebka

The relationship between insurance companies and interest rates

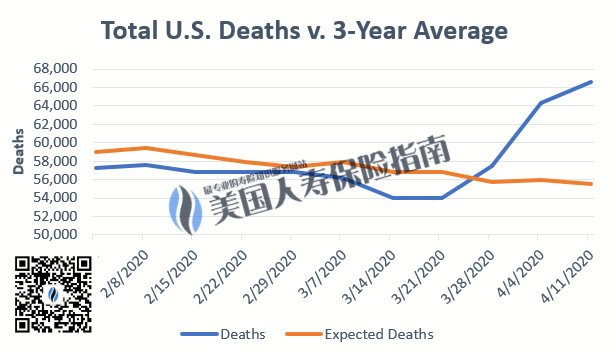

The Wall Street Journal’s market commentary pointedly pointed out that the Fed’s sudden interest rate cut is not a panacea. Under the impact of the new crown pneumonia epidemic on the world economy and society,The life insurance industry, like other industries, is facing an unprecedented situation——Life insurance companies have to worry about the increase in the risk of death claims, but also face the fact that the bond yields they hold continue to fall.

It is very certain that many companies in the insurance industry may be facing bankruptcy and exit.

Credit rating agencyDuring the epidemic, Fitch also warned that due to the increase in mortality and the fall in market interest rates, life insurance companies will be hit hard, and some life insurance and health insurance companies may face bankruptcy.

At the same time, insurance companies expect that future interest rates will not rebound soon, and insurance companies must have new money to enter the fund pool to maintain operations.

And new money keeps coming in, which means that the new insurance policy has entered the risk pool when it becomes effective.The payment of insurance policy claims will greatly affect the financial situation of insurance companies whose real financial situation is not stable. This will become a chain reaction, and will drag reinsurance companies into trouble.

It is under such contradictory circumstances that insurance companies frequently change the underwriting and approval rules.AdoptedLayoffs.Price increase.Discontinued, Lowering the benefits and other methods to stop loss (Related reports). On the other hand, continuing to screen and accept insurance premium injections from policyholders with relatively low risks must never stop.

How can consumers choose?

Consumers’ demand for insurance has not decreased. On the contrary, the United StatesNew crown pneumonia virus outbreakLet people realize the most basic benefits of life insurance.At the same time, the turbulent market and lower and lower savings interest rates have made people begin to seek safer and more transparent financial products.

According to Wink Inc’s life insurance sales survey results for the first quarter of 2020,Index insuranceYear-on-year sales increased by 2%,Savings and Dividend InsuranceThe year-on-year sales volume increased by 3%, while the fixed-type universal insurance sales volume fell sharply by 12%.

Under the current low interest rate situation, for policyholders, choosing the main selling point of "guaranteed" and investing in opaque insurance products for financial planning will cost higher costs.

Take the guaranteed payment universal insurance (Guarantee UL) in the fixed universal insurance as an example. In the past month, various insurance companies have generally adjusted their prices. For people under 50, the current interest rate environment is not a GUL application. Good time for insurance policy.

For index insurance (IUL)In other words, some insurance companies with insufficient financial strength have successively lowered the benefits of their insurance policies in the past two years, especiallyCapped rate of returnThis core indicator.

And for the traditionalSavings and Dividend Insurance(Whole Life), the direct impact on policyholders is that some mainstream insurance companies have already completed price increases in mid-June.In the long run, due to the non-disclosure of its investment targets, it usually relies mainly on bond income to support it. The market predicts that next year's dividends may be significantly reduced. (Finish)