What is an annuity and what is its use?Is the American annuity insurance?Who are buying annuities?And, how does American annuity insurance work?

American Life Insurance Guide > Annuity Academy> What is an annuity?

In the "Annuity Zone" of insurGuru™️ Insurance Academy, we will use the most easy-to-understand language to help consumers understand the following introductory questions about American annuities.

Topic of this issue: Introduction to American annuity, American annuity system, what is the American annuity?

- Is annuity insurance?

- What exactly is an annuity?

- Who are buying annuities?

- How does American annuity insurance work?

Is annuity insurance?

Annuity, the English name is Annuity, it islife insuranceWe often call it "annuity insurance", "annuity insurance".

Since it belongs to insurance, annuity insurance also has the concepts of "holder" and "insured". "Holder" is the person who pays the premium for annuity insurance. Generally, American insurance companies will require that if the holder and the insured of the American annuity insurance are the same person, the English name is "Annuitant".

Let's compare American annuity insurance and American life insurance-In the traditional conceptLife insurance means that after the insured is gone, the insurance company pays compensation; while for annuity insurance, as long as the insured is still alive, the insurance company will continue to pay the benefits. Only when the insured is gone, the annuity insurance will be paid. Stop.

There are also some American annuity insurances that allow the insured to designate a beneficiary. When the insured dies, the money left in the annuity insurance account will be reserved for this beneficiary.

For example, Jeff, the community broker of insurGuru™️ Insurance Academy, bought an annuity insurance for his sister Jessica from Company A and designated his child Olive as the beneficiary. Jeff paid the insurance company, and Jessica became the insured.Based on Jessica's current age and life expectancy, the insurance company worked out how much to pay Jessica.If Jessica had just started to receive the money and died unfortunately, Olive would inherit the remaining amount in the annuity account.

In most cases, the beneficiary and the insured of American annuity insurance cannot be the same person.

What exactly is annuity insurance?

Annuity insurance is a financial product. We deposit premiums and financial insurance companies provide retirement income on a regular basis as agreed.

This insurance payment method is usually based on"year"Pay a certain amount for the unitFriUh, so calledpensionInsurance.

As long as the insured is still alive, by purchasing annuity insurance, we can obtain a guaranteed source of income, avoid the risk of "people are alive, but the money is gone", and achieve the goal of annuity insurance.

therefore,Annuity insurance is also called pension insurance.

Who are buying annuity insurance?

The answer may be unexpected, but in reality, almostEveryone is buying annuity insurance.

According to data records, annuities first appeared in the ancient Roman Empire.The government at that time paid Roman soldiers a lifetime annuity as compensation for their service.

due toAnnuity insurance can be used to provide stable lifetime income, Governments all over the worldUse annuity insurance to solve the problem of national pension.Therefore, our life and annuity insurance are closely integrated, but in different countries and regions, annuity insurance usually appears under different names.

due toAnnuity insurance can be used to provide stable lifetime income, Governments all over the worldUse annuity insurance to solve the problem of national pension.Therefore, our life and annuity insurance are closely integrated, but in different countries and regions, annuity insurance usually appears under different names.

U.S. governmentSocial Security Pension Plan, which is an annuity insurance operated by the government and participated by all residents, providing all residents with a basic source of retirement and lifetime income,Therefore, it is also called social security retirement annuity insurance..The Social Security tax that is forcibly deducted from everyone's tax bill is the US dollar annuity insurance premiums that we pay to the financial institution "US Government".

Japan'sSocial pension systemIt is also based on three types of annuity insurance: national pension insurance, welfare annuity insurance and mutual aid annuity insurance.

In addition to annuity insurance issued by governments of various countries, commercial insurance institutions in various countries also issue annuity insurance products for consumers to purchase.

The famous Powerball Super Lotto, the highest jackpot amount, is actually aAnnuity Insurance.

For American residents, annuity insurance is an important channel to protect retirement income.

For residents of the global high-net-worth world, in addition to the allocation of local currency fixed income sources, choosing to match American annuity insurance products is an excellent way to build a cross-currency fixed lifetime income allocation.

(>>>Related reading:Popular science post|Won the $7.9 million lottery jackpot!Annuity insurance turned out to be the biggest winner)

How does annuity insurance work?

An annuity is made up ofInsurance companyThe long-term investment products issued are used to manage the risk of "people are alive, but money is gone."

The process of buying annuity insurance is similar to opening a deposit account at a bank: we open an annuity insurance account with a financial insurance company, deposit money (premium), and the insurance company conducts professional investment and financial management according to the selected type of account income.When we are ready to receive money for life (this behavior is called "annuitization"), insurance companies begin to provide life-long income cash flow.

The money in the annuity account can be put in one time or several times on a regular basis, but once you start to receive the money, you cannot continue to deposit money in it.At the same time, the payment cycle can be paid monthly, quarterly, or half-yearly. It is not necessarily mandatory to receive it on an annual basis.

Although the annuity products of various commercial insurance companies are different, in general, we usually use annuity insurance in the following three ways:

- Deposit a large sum of money at once, or deposit by installments

- Start taking money immediately, or postpone it for a few months, and then take money in a few years

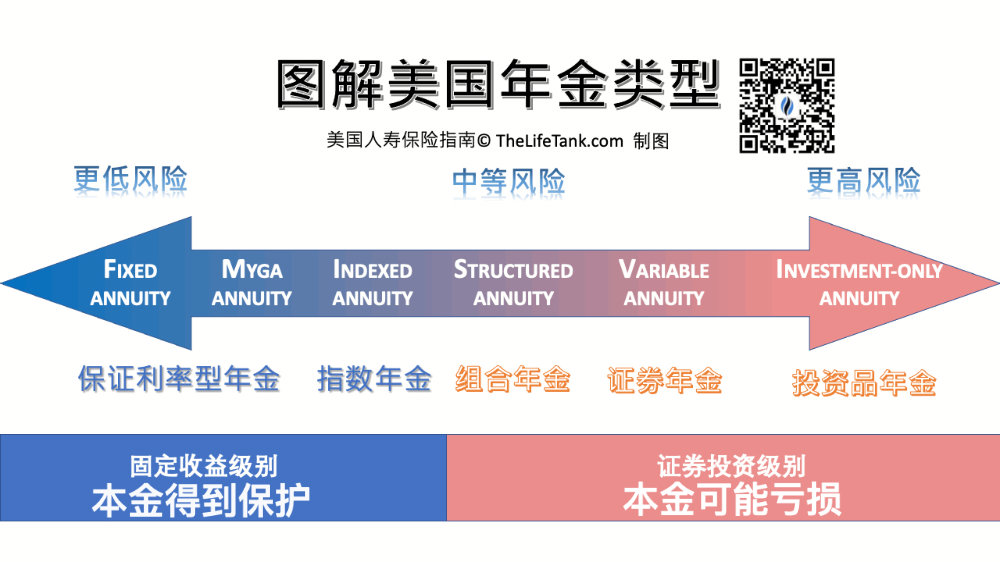

- Choose fixed income, investment floating income, or annuity account type that tracks index income

It is worth noting that in the last article, we saw that annuity insurance has three different investment growth strategies: "fixed income", "investment floating income", and "tracking index income".For ease of understanding, you can mark them as Whole Life (Savings life insurance), VUL (Securities Life Insurance), and the IUL (Exponential life insurance) These three types of life insurance.

For specific advantages and disadvantages of annuity insurance types, insurGuru™️ Insurance Academy is in "Comparison of prices and advantages and disadvantages of American annuity insurance product typesThe analysis and introduction were made in the column.

(>>>Recommended reading:What is index annuity insurance?What are the pros and cons?Is it suitable for me?)

(>>>Recommended reading:What is a fixed income annuity (Fixed Annuity)?What are the advantages and disadvantages?Is it right for me?)

(>>>Recommended reading:Evaluation|Index annuity or fund annuity, which annuity insurance is better?)

(>>>Recommended reading:【Popular Science Post】What is a combined annuity insurance account?What are the advantages and disadvantages compared to indexable annuity insurance?)

Article summary

Through insurGuru™️ Insurance Academy’s introduction and knowledge sharing on American annuities, I believe our readers can already answer the question "What is annuity insurance".

In real life, different levels of annuities are widely used in professional fields such as asset allocation, savings and wealth management, risk management, and retirement income.

Please bear in mind that we have always put forward the concept of "Learn Before You Buy". Before purchasing annuity insurance, understanding the basic knowledge of annuity can help you face financial advisors andInsurance brokercan participate in discussions together and make more favorable judgments and decisions. (Full text ends)

(>>>RecommendedGadget|My annuity insurance plan customization self-service)