2024, happy new year.

Over the past year, government data has shown a strong U.S. job market and stable economic data, but according toAllianz Life Insurance North AmericaMarket Watch research* released by the company in early 24 pointed out that more than half of Americans are not optimistic about 2024. Among them, 40% of Americans surveyed feel more stressed and urgently need to relieve financial anxiety and stress.

Amid a combination of factors including inflation, housing costs, economic and market uncertainty, we saw a year that remained active but saw a decline in the amount of money consumers were willing to put into life insurance premiums. On the other hand, the premium funds pouring into the annuity insurance market have experienced significant growth.

Annuity financial management becomes the focus in 2023

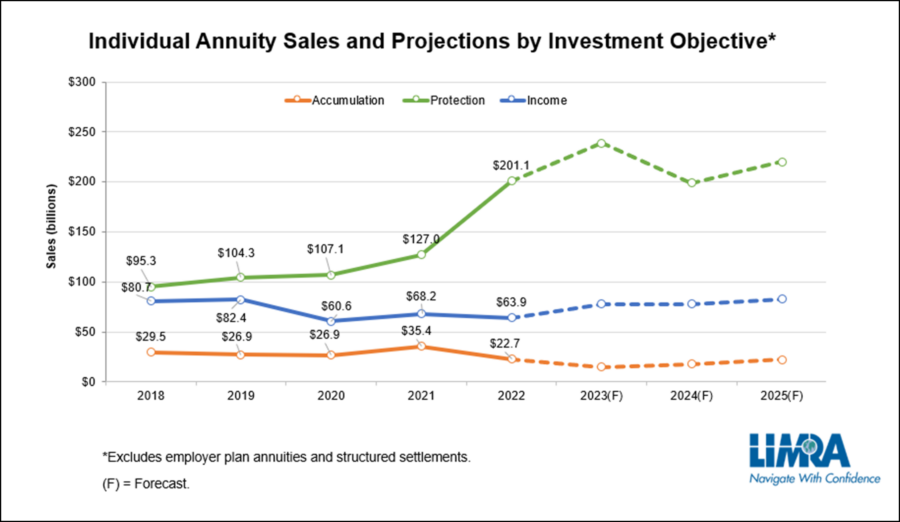

In 2023, the U.S. annuity financial management market achieved significant growth. receiveFixed rate annuity insuranceDriven by the strong growth of the market, annuity insurance sales reached a record high (data).

As interest rates continue to rise, some insurance companies have increased the price of insurance financial products.Cover Yield and Participation Rate, further enhanced the competitiveness of annuity insurance products in the US dollar financial management market and gained recognition from consumers.

In early 2023, Silicon Valley Bank (SVB Financial Group) declared bankruptcy (News report), becoming the second-largest bank bankruptcy in U.S. history after the Washington Bank failure in 2008, which triggered continued concerns among investors and consumers about the safety of their funds.

Driven by risk aversion, "Don't lose money" has become the first choice of financial management groups.

On the other hand, frequent market fluctuations have prompted consumers toAsset protection productsIncreased demand has driven sales of life insurance and annuity insurance, a trend expected to continue in the coming years.

儘管聯儲發出了考慮在2024年進行降息的信號,但人壽保險和年金保險的需求預計在2025年會有所反彈。整體上,年金保險理財的新增保費在2024年預計將達到3110億至3310億美元之間。

*TheLifeTank©️ will start sending real-time multi-year guaranteed interest rate insurance financial product reports to subscribers starting in mid-2023. You can get them for free by subscribing by email.

Review of hot events in 2023

California "Long-Term Care Tax"

At the beginning of 2023, we responded to the California Department of Insurance’s “California Resident Long Term Care Insurance”The proposal was carried outRelated reportsDescription, and reviews the impact of Washington State's long-term care bill on residents and the market.

Currently, in addition to Washington State, which has already implemented it, four states are actively considering legislation to address the high cost of long-term care by levying a "long-term care" tax or similar tax from wage income. The four states are:

- California

- New York state

- pennsylvania

- minnesota

In 2024, we will further pay attention to the development of the situation.

(>>>>Related reports:Alarm bells ringing in California!The storm of long-term care insurance in Washington state has attracted national attention. How can California residents avoid minefields?)

(>>>>Related reports:The Insurance Bureau officially refutes the rumor! California Long-Term Care Public Insurance Plan Deadline and Payroll Tax Shelter Update)

(>>>Recommended reading:TheLifeTank©️ – 2022 Year-End Report )