Introduction

When we started to seriously considerIULWhen it comes to life insurance products, it actually faces the problem of choosing an American insurance company.What about the insurance companies that issue IUL policy products in the United States? Which insurance policy performs better?Is there a basic logic that is convenient for us to learn as a reference in the purchase process?

American Life InsuranceThe editor of Guidance.com lists 6 metrics in detail in this article.Before you apply for an insurance policy, you can boldly report toInsurance brokerOrFinancial advisorAsk and discuss these issues, so as to plan the most suitable insurance policy to protect your own interests.

The following is the first issue of this "Insurance Company Ranking" selection column: If you choose the one that suits youIULInsurance company.

6. Is this a mutual aid (Mutual) company or a stock company?

With reference to the California Insurance Code (California Insurance Code), the definition of such a company is as follows:

- Listed companies are owned by public investors, investors provide funds, enjoy profits and bear losses; the goal of listed companies is to obtain benefits for investors.

- Mutual insurance companies are jointly owned by all policy holders to enjoy profits or bear losses; the goal of mutual insurance companies is to provide insurance products to company owners, that is, policy holders, at the lowest cost.

Therefore, it is possible for listed companies to make financial decisions for quarterly earnings reports in order to appease Wall Street and short-term investors.In theory, private companies and mutual aid companies do not have these potential conflicts of interest, and tend to make long-term stable decisions.This usually has a lot to do with the management of different companies.

According to the insurance laws of the United States, some states clearly stipulate that mutual insurance companies must pay more than 10% of their reserves to their customers in the form of dividends.In the first half of last year, Penn Mutual settled with the policyholder at a sky-high price of $1,100,000,000, which was a violation of managementQualified policyholderTo protect the interests of mutual companiesQualified policyholderA case of.

Secondly, listed companies are responsible to public shareholders. Policy holders pay premiums, but not company owners. Company income (including insurance premiums and premium investment income, etc.) needs to be distributed to shareholders.The mutual aid company is to the owner of the company, that is, "Qualified Policy Type "holdersResponsible, because this type of company is not listed,Buying a "qualified" policy type is equivalent to buying shares in a mutual mutual aid company.The revenue from the two types of companies should be used to pay for various company operating costs, such as marketing, research and development, and salary.

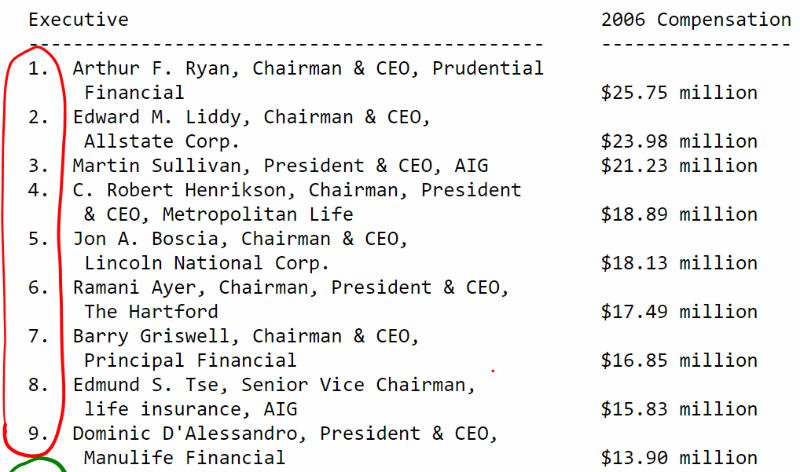

In terms of expenditure, the figure below is from a screenshot of the salary rankings paid by insurance companies to the CEO and chairman of the board of directors. The red circle shows that the top ranked companies are all listed companies of the shareholding system.

From insurance industry magazine: "National Underwriter"

(Editor's note: American Life Insurance Guide Network agrees with the view that "pay and return are proportional" and "work more, get more")

But it’s worth noting that the "qualified policy types" we emphasized,This type of index insurance is not included, that is, index insurance policy holders do not participate in the share dividends of mutual insurance companies, nor are they the owners of mutual insurance companies.

5. What is the credit rating of this company?

Every insured person wants to find a good company that will not fail for a century.The most basic way is to see if the company has a rating from a credit agency.if there is notCredit ratings of mainstream institutions, Or the rating is very poor, that may not be a good choice.

However, in2018 Top IUL Insurance Company Sales RankingHere, almost the top dozen insurance companies are rated "A" or higher.At the same time, we use Comdex scores to measure the rating of an insurance company.This score takes into account the scores of the four major rating agencies.This indicator scores all types of life insurance companies from 1 to 100 points.

InsurGuru©️Insurance Academy, explained in the form of a column "How are American insurance companies ranked and rated?How should the policyholder interpret it?"It can help policyholders to measure.

4. Has this company unilaterally increased its fees in the past?For example, increase its internal costs and charges to be higher than the cost of demonstrations to customers at the time of sale.

As internal charges and insurance costs will offset some of the cash value growth of IUL, we hope to keep these costs to a minimum.

Unfortunately, the days when insurance companies made a lot of money from premium income have passed.In order to increase revenue, some IUL insurance companies have added internal expenses and insurance costs to their insurance policies.If anything, these costs should go down because people are living longer and longer.

We found that the culprit in this situation is often the actions taken by listed insurance companies in response to the short-term pressure on Wall Street.The IUL insurance company we selected has never done so.

3. In the case of lower interest rates, does the insurance company issuing the IUL policy provide competitive income Cap (upper limit) and Floor (guaranteed income)?

As interest rates fell, almost allIUL insuranceThe company has lowered the finalStandard & Poor's 500 IndexThe upper limit of revenue.

There is no malicious motive to exploit the policyholder.

In fact, such adjustments must be made to meet the operating logic of insurance companies.

Insurance companies mainly invest in bonds, and then use new insurance premiums to purchase new bonds.With the time of purchase, the yield of these bonds is getting less and less.With the passage of time, the budget for IUL insurance companies to purchase hedging options is less. At that time, the S&P500 index has become higher and higher, and the funds are not enough to support the cost of the index rise. In order to maintain this dynamic balance Therefore, a Cap must be calculated to complete the hedging design.

After this article got 100 user scores & evaluation scores of 4 or more,

After this article got 100 user scores & evaluation scores of 4 or more,

We will invite financial experts inLife insurance knowledgeThe college explains IUL’s option hedging mechanism and the formation of Cap

2019.10.14 update: IUL's hedging mechanism and the formation of Cap, the investment principle of keeping up with the upswing and not following down

Therefore, for all IUL insurance companies, lowering the income ceiling is "unspeakable" and has to be done.This is not a critical issue from our perspective of evaluating insurance companies.The real key question is, we have to look at the IUL provided by a company, and whether his Cap will be significantly lower than the industry level.

2. Does the insurance company's IUL policy provide excellent growth strategy options?

Since it is called "index" insurance, the choice of index is the key.

Most of the time, people watch aIUL policyThe performance is good or not, often look at the 1-year S&P 500Income cap.This judgment is correct, but the Top5 IUL insurance companies we selected all provide more exponential growth strategies.These different strategies can be independently selected by policyholders to achieve cash value growth, or to provide a guaranteed return of 0% when the market is down.

(>>>Related reading:Evaluation|What are the 4 most common index strategies in American index insurance and index annuities?)

Some companies provide more IUL growth strategies for customers to choose:

- differentParticipation RateIndex strategy

- Uncapped exponential growth strategy

- Strategies to track different indexes in the international market

- Mixed index options strategy with higher cap

- Multi-year index strategy with higher or no upper limit

A good index strategy can help policyholders obtain completely different benefits under the same market environment.You can check the comparison of actual cases of policyholders through the evaluation column below.

1. Whether the insurance company's IUL policy provides a locked or cap loan interest rate to prevent future interest rate hikes.

This point ranks first becauseThis factor is very important.In addition, I know that many people hear the term "loan" and think they will never use it.however,Loans to insurance policies are not the same as consumer credit loans, Through insurance policy loans, it can be extremely effective inretirementBefore andretirementReceive tax-free cash income during the period.

Imagine that if we now agree on a very competitive credit line and loan interest rate at a reasonable price, in the future, we can withdraw at any time without any reason, which is very beneficial to us.Basically, as long as the balance after borrowing from the policy can still maintain the policy, there is no need to pay the principal or interest.This is the most flexible way in history other than borrowing money from my mother.

Undoubtedly, once you configure the insurance policy, the loan interest rate will be locked or set the upper limit. This is the huge advantage provided by the Top5 IUL insurance company we selected next.The IUL policy loan interest rates of these insurance companies are basically in the range of 5% to 6%.

This interest rate may not seem very low now, but as inflation and time pass, an IUL policy that locks in loan interest rates has become a plan.Retirement planAnd a powerful tool for tax-free income.

Summary

The above are the 2018 major indicators that we selected for the 5 Top 6 IUL insurance companies.These indicators can be used as a measurement tool when you apply for an IUL policy.

We still recommend that when you start choosing an insurance company andbrokerWhen contacting for comparison, please boldly ask yourbroker, To examine his/her professionalism and which company’s product he/she and his family applied for, and why he/she chose this company. This is also a way to understand different insurance companies.

The following is the annual boutique guide published by insurGuru™️, please click to visit:

-Top 2018 IUL insurance companies in 5

-2020 U.S. Insurance Company Ranking: Best Index Insurance Company Best IUL Performance Company Top3