Recently, in the popular variety show "Summer of the Band" in Mainland China, Wayna Band and Ren Suxi performed a song "Big Dream" in the band collaboration session. They sang a person's life in more than 8 minutes. The lyrics eloquently talked about growth. Work, children, and the confusion and confusion of aging have touched many Chinese audiences at home and abroad.

(©️iQiyi Youtube Dream Live / For other regions, please click here to play)

The lyrics are intended for a wide audience, but judging from the response to online comments, the sentence "What to do" at the end of each lyric evokes the historical process of "urbanization", when people gradually leave the land and just enter the city. It resonates broadly with the new generation of urban middle class that has taken root.

This is very similar to the situation of some first-generation Chinese immigrants in the United States - in the former, a generation left the land; a group of people left their hometown.

From then on, their respective life experiences were like a person drinking water, knowing whether it is warm or cold.

What to do with lifetime retirement income?

What I want to share today is a topic that everyone must face: "How to build lifetime pension income?'

If everyone starts to think about this topic, then governments of various countries may be examples for us to follow.

How does the government build a pension safety net?

The ancient Roman Empire was the government that invented the "annuity".

The ancient Roman Empire government invented the annuity, a form of lifelong income, and called it "Annua". "Annua" is a Latin word that translates to "annual allowance."Roman citizens (soldiers) at that time received "Annua" paid by the government every year for life as compensation for their service.

The earliest retirement pension system was born.

Because annuity insurance can be used to provide stable lifelong income, governments around the world have begun toAdopt an annuity system to solve the problem of national pension.

U.S. governmentSocial Security Pension Plan, the Chinese government’sbasic pension system,In essence, it is an annuity insurance that is run by the government and compels all residents to participate in it. It provides citizens with a basic source of lifetime income for retirement, thus forming part of the social safety net.

Through taxation, relevant taxes and fees are forcibly paid from everyone's income. This is the annuity premium we pay to the "government" financial institution.

Japan'sSocial pension system, is also based on three types of annuity insurance: National Pension Insurance, Employees’ Pension Insurance and Mutual Aid Pension Insurance.

Commercial annuity insurance, as well as products called enterprise annuities or work annuities, are intended to make up for the shortfall in basic pension income, which is the most important social safety net, and can be purchased from commercial life insurance companies in an independent manner.

(>>>Related reading:Is it really okay to "count on the U.S. government to provide for the elderly?" |Retirement,Why should you give up your fantasy as soon as possible?)

(>>>Related reading:BBC, USA | Complaining about the retirement and pension problems faced by Americans: When ideals fail to meet reality)

What to do?

in"Can you count on the government when you retire?"On this matter, society has already silently reached a general consensus - the government will cover up and work hard on its own.

In the early days, for example, the Employee Retirement Income Security Act was passed in 1974, which clarified social security including pensions.It's not the government's business , the government cannot take over everything, but is a joint responsibility of the government, employers and individuals.

Recently, the SECURE 2.0 Act officially became law in 2022-12, and the "Employee Lifetime Income Act" proposed by the Education and Labor Committee has also entered the agenda. Both of these are providing IRA, 401k, 403b and other types of qualified retirement accounts. Funds have paved the way for the annuity insurance field with "lifetime income" as the core goal; without exception, they have continued the trend of partially offloading the social responsibility of retirement to the market - "Look, the road has always been my way. Once you know it, it’s up to you whether you leave or not.”

However, the market is cruel, and not everyone is a stock god.The retirement savings accumulated through decades of hard work may be cut in half in the face of an economic recession.

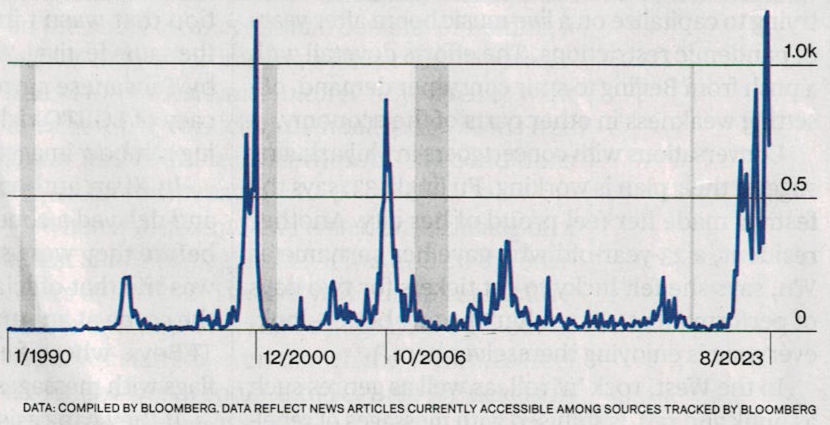

"©️Bloomberg Caption: Number of times the word "Recession" appears in the media and historical recession periods (grey)"

Buffett's close friend, Mr. Munger, said at the 1989 Westco Financial Shareholders Meeting, "...the experience has taught me a profound truth. There are two main factors that determine the outcome: one is the situation, and the other is the person. Situation If you are too strong, no matter how capable you are, it will be of no use... There is a saying, expressed in different ways, but the same truth is said. In the past, there was a veteran in the investment industry who had been through the battlefield, and we respected him very much. Whenever young people When people suggested taking risks, he always said, 'Those who drown in the river are those who know how to swim.'"

therefore,Especially for those over 50 years old and gradually entering retirement age, how to protect their retirement account assets, effectively manage retirement account risks, and resolutely avoid retirement account losses in the stock market should be the primary goal of retirement financial planning at this stage.

The "Super Fixed Deposit" type introduced by TheLifeTank©️Multi-Year Savings Annuity(English abbreviation: MYGA), with higher value-added potentialExponential annuity(English abbreviation: FIA), all provide capital protection for our funds, or a guaranteed annualized minimum return.The annualized returns and interest calculation methods of some asset protection annuity products are beyond my imagination.

Editor's note: You can subscribe to the monthly real-time interest rate of the multi-year savings annuity through the subscription window at the end of the article, or you can subscribe through "Annuity insurance self-service plan design tool” to learn about specific solutions based on individual circumstances.

In such a social system and market environment, what should you do? (Full text ends)

(>>>Related reading:Check the U.S. Social Security Pension Points and Amount Portal )

TheLifeTank©️ Featured Video Column:

(Video Featured) The 57-Year-Old Child (2 minutes and 17 seconds – Chinese subtitles)