American Life Insurance Guide > Life Insurance Academy > What is IUL Insurance (Index Universal Life Insurance)

IUL insurance, The English name is Indexed Universal Life, we often call itIndex insurance, index life insurance,Full name isIndex Universal Life Insurance.This concept first appeared in the 90s of the last century. It emerged after the US bond market crisis in 1994. In 1997, it formally became a product system and was introduced into the life insurance market.

Nowadays, as a flexible financial tool, index insurance is widely used in various fields such as life-long welfare protection, retirement income planning, wealth management and inheritance, estate planning, asset allocation, asset protection, and business planning.

Introduction to IUL Index Universal Life Insurance

IUL insurance, That is, index-type universal life insurance, which isUniversal insuranceAn evolutionary derivative ofIt protects the life of the insured, in addition to providing suchTerm life insuranceIn addition to such basic death compensation protection, there is also a cash value part.The death benefit is not static, and policyholders can adjust it.Its premium payment is also better than term life insurance andParticipating Whole Life InsuranceAll flexible.

Specifically,IUL insuranceLike universal insurance, it provides a savings and investment function, just as you open an investment "account" in the "bank" of an insurance company, but this "account" has a professional term called "Cash value. "

IUL premiumhow to work : After paying the insurance cost, the remaining part of the premium you paid is automatically entered into several alternative "strategy accounts" and converted into the corresponding cash value. You can choose to put this money into the strategy of guaranteed income In the account, such as a guaranteed return of 2.5% per year; you can also choose to target the stock index in the cross-border account, for example, usually choose to linkStandard & Poor's 500 Index(S&P500 index), Nasdaq 100 and so on.When it is put into the stock index strategy account, when the market environment is not good, the insurance company promises to guarantee the bottom. Therefore, the policy holder of the policy account has no risk of loss.

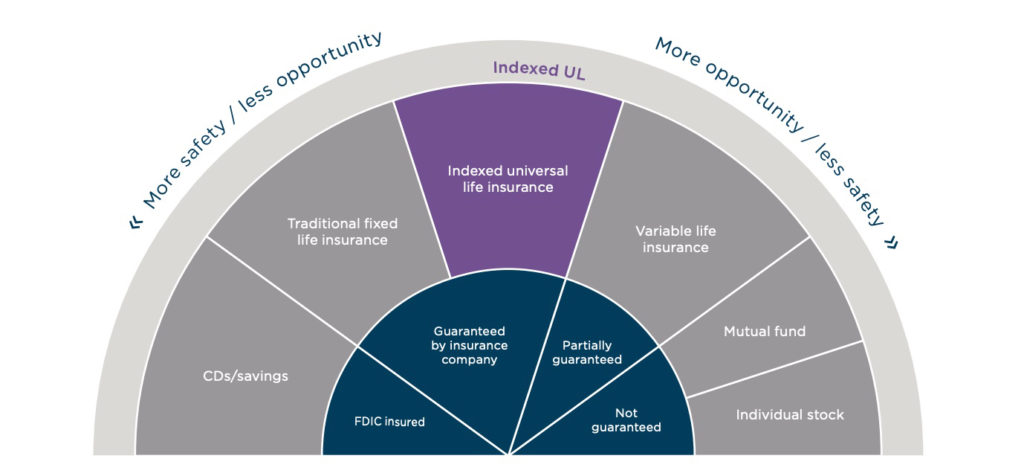

IUL risk:The investment risk of IUL insurance policy is less than that of investment universal insuranceVUL (Variable Life Insurance) insurance, funds, stocks, ETFs and other securities products, Because from beginning to end, your money will not enter the market for stock trading.

IULThe history of exponential universal life insurance

In the early 90s, the U.S. stock market rose sharply. For high returns, consumers focused on mutual funds, stock markets, and investment universal insurance (VUL). The economic situation is very good.

By 1994, the U.S. bond market crisis broke out, and the benchmark interest rate was locked at 12% during the 1.5-month period that year.After investors were bloodbathed, they discovered that no investment in the market was safe, and only then realized the importance of protection.

1997 years,IUL Insurance (Index universal insurance) product launch.This product guarantees that in the case of a bad market environment, investors will be guaranteed a bottom. In exchange, when the market is good, the interest paid by insurance companies to investors will be capped.

(>>>Recommended reading:Technical Posts|Analysis of the operating principle of guaranteed return options behind IUL index insurance)

IUL Investment: IULHow does index universal life insurance work?

Be a fortuneIUL premiumWhen it is paid, part of this money will be used to pay the policyholder's annual cost.The funds after deducting this cost will be accumulated in the cash value part of the policy.The total cash value is invested in index markets, such as the US S&P 500, the German 30DAX Index, or the MSCI Emerging Market Index, and is included in income based on the rise or fall of the index.Insurance companyIUL insuranceAllow policyholders to choose different indices by themselves,IUL insuranceIt also usually provides a fixed interest rate strategy with a guaranteed bottom.Therefore, the insured can set whether to put the cash value part in the guaranteed return or invest in the index market, and the insured can also allocate different percentages to different investment strategies.

The rise and fall of index values are compared monthly.If the index grows during this month, the interest earned will be accumulated in the cash value.For example, if the index has increased by 8% from the beginning of August to the end of August, multiply 8% by the cash value invested in the index to get the interest value. This value is multiplied by the participation rate, and the obtained number will be accumulated to the cash value in.Different brand companies have different policies. Some products will calculate the sum of monthly index changes within a year to find the average value of the index.If the final index change is a decline rather than an increase, the guarantee base will be guaranteed in accordance with the index investment guarantee interest rate promised by the policy. The interest rate of this support base is generally 6%-6% in the market.

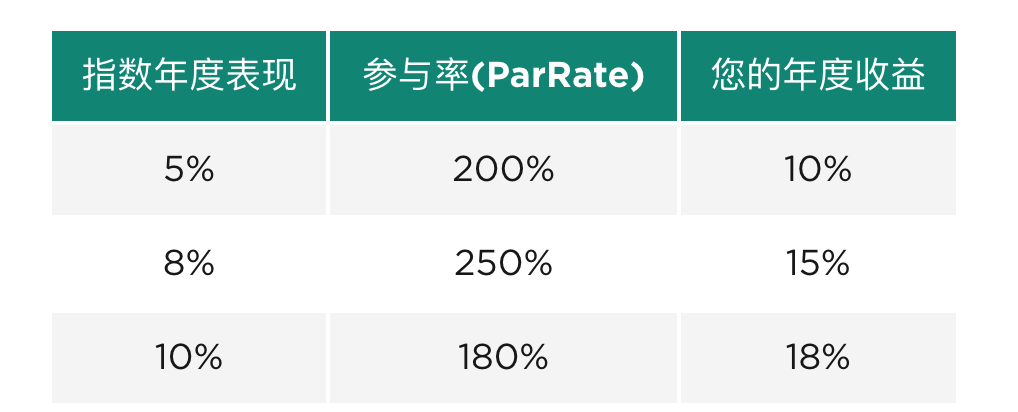

Here is another indicator that needs to be paid attention to:Participation Rate, which isAttendance Rate , determined by the insurance company, generally a value between 25% and 200%.In general, the index benefit earned by the customer is ultimately multiplied by the participation rate as a percentage before accruing to the cash value component.

When the participation rate is less than 100%

If the return is 6%, the participation rate is 50%, and the cash value component of the current investment index is $10,000, then ultimately, the return on the cash value component is $300 (6% x 50% x $10,000 = $300).

When the participation rate is greater than 100%

(Updated 2022/03) Assuming an annual index return of 6% and a participation rate of 150%, then based on the calculations, the expected annual return on cash value is6% x 150% = 9%, that is, the annual rate of return on the policy cash value account is 9%, which is also standard practice for most insurance companies and insurance accounts.But it is worth noting that a few insurance companies have once again capped income in this situation. For specific product catalogues, please consult yourLife Insurance Financial Advisor.

What is the Cap of IUL index insurance?

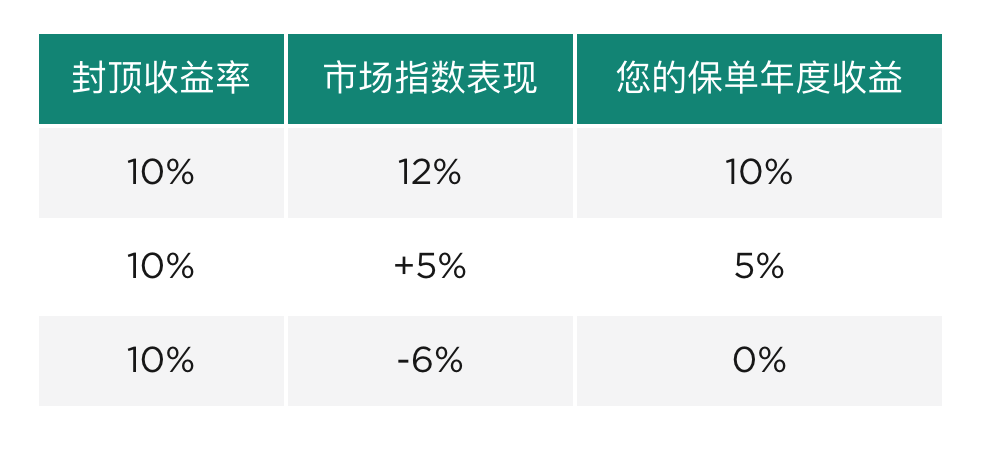

For common market indexes, such as S&P500, NASDAQ-100, index insurance productsThere is an annual capped rate of return cap, called in EnglishPostcode, in exchange for protecting the safety of your principal (as shown in the figure below).

Modern indicators for index insurance (Update:202309)

In order to improve market competitiveness, many index insurance products also provide noCap yield (Cap)Low volatility indexes or alternative indexes are available for policyholders to choose from, and account returns are calculated through the participation rate (ParRate) indicator. The figure below provides an explanation of the annual return calculation for this type of index insurance.

One-year settlement or multi-year settlement

Insurance companies usually calculate the investment situation every year or every few years, and accumulate the interest income generated into the cash value of the policy, and the cash value can be used to pay the premium and borrow it for use.

Is IUL worth buying? IUL insuranceThe advantages

1. Earnings guaranteed When the market environment is bad, the economy is down, and the stock index falls into negative numbers,Insurance companies promise a guaranteed return of 0%-2%.This is the core function of IUL Insurance -Floor.The working principle of this function, please refer to the column "Policy underpinning protection function (Floor) description. "

2. Higher return potential Most insurance policies focus on call options on stock indexes.In the past 90 years, the average annual return of the S&P 500 was close to 10%, so there is great potential for growth.However, the dividend interest rate provided by the comparative dividend-type whole life insurance is often very small.

3. More flexibility The insured can decide which investment strategy to choose, how much risk he is willing to take, and he can also adjust the amount of insurance according to his individual situation. In terms of ancillary contract, he can also customize his own insurance policy collateral.The payment of premiums is also more flexible.

4. Capital gains tax exemption Policyholders will not pay capital gains tax due to the increase in cash value over time.Therefore, IUL can be used as a retirement plan account with lifetime protection.There is only one exception, that is, they decide to withdraw all the cash value at once and give up the policy.

Is IUL worth buying?IUL insuranceShortcomings

1. Uncertain annual income Because it is linked to the stock index, the annual yield varies with the market.It cannot give a definite annual rate of return like a participating whole life insurance product.

2. The return on investment is capped In the case of a bad market environment, insurance companies provide investors with a guarantee. In exchange, when the market is good, the annual rate of return that insurance companies pay to investors isUpper limit capOr participation rate ParRate, these interest rate indicators are agreed upon by insurance companies.As of September 2023, the number of indexed universal insurance products in the U.S. market will beUpper limit of return CapThe limit is about 8% to 12%; the annualized ParRate is between 80% and 265%.

(>>>Recommended reading: Understand in 3 minutes what is the Cap of the US Index Insurance (capped interest rate))

IUL insuranceApplicable groups

IUL Insurance (Index universal life insurance) is generally considered to be a relatively advanced life insurance financial product. Rider's configuration and policy design are extremely flexible and applicable to many aspects, such as life insurance, retirement income planning, asset protection, insurance trust, wealth inheritance, inheritance Planning and other fields also require regular professional management, so it is difficult to fully explain and understand.IUL products of different insurance companies also have different performance and application areas.It is more suitable forNeed financial protection for life, Intending to do medium and long-term financial planningcustomer of. (End of full text)

【 IUL Insurance Topics 】 :Recommended topics for U.S. index insurance evaluation

appendix:

.[Knowledge Post] What is the insurance lever?Is buying insurance just buying leverage?What is the maximum insurance leverage?

00. 'What is the illustration of the policy account?What is written on it?What are the controversies and highlights?": https://thelifetank.com/what-is-policy-illustration

01. 'Interview|"I thought the decimal point (rate of return) was wrong", the 2021 index insurance policy posted the annual income statement": Https://thelifetank.com/interview-with-iul-policy-holder

02. 'Evaluation|Using IUL Index Insurance for Children's Education Savings and Parents' Retirement Income 2-in-1 Planning (Illustration)": https://thelifetank.com/how-to-plan-education-fund-and-retirement-fund-in-iul-policy

03. 'What are the global asset allocation plans?Comparison of advantages and disadvantages of investing investment account VS IUL life insurance policy account ": https://thelifetank.com/investment-vs-life-insurance-account

04. "[Case]Passive income of $13/year, and evaluation of the plan for U.S. families using index insurance to plan their retirement income": https://thelifetank.com/retirement-planning-show-case

*Disclaimer: *Indexed Universal Life indexed universal life insurance is not an investment product. The specific operation and performance of different products are specified by the policies and additional terms of different life insurance brands. This article does not constitute insurance or investment advice.