Illustration, we call it "Policy design plan", "Plan",or"proposal".It is a display and description of the future trend of the policy. The description also includes non-guaranteed factors.In the column "What is the illustration (design plan) of life insurance?What is written on it?What are the controversies and highlights?"In the American Life Insurance Guide©️, a detailed explanation is given.

Policy Design and Policy Design Scheme (Illustration)

The policy design is a very clear and systematic process, and the key points are reflected in the illustration.Professional insurance brokers can simplify this process and help customers achieve their needs.

After the customer expresses the intention and simple demand for insurance,Insurance brokerWill design and send such a "Policy design plan"To the customer.

Through the explanation and mutual communication of the plan, we finally planned out a "Policy design plan(Illustration)", you can enter the next step of the application process.

There are various professional terms, numbers, and data tables in the illustration of the insurance policy. For customers who are new to the insurance policy, they often don't know where to start.

Today, take several insurance policy designs (Illustration) of different American life insurance companies under the author's name as examples to interpret these points together.

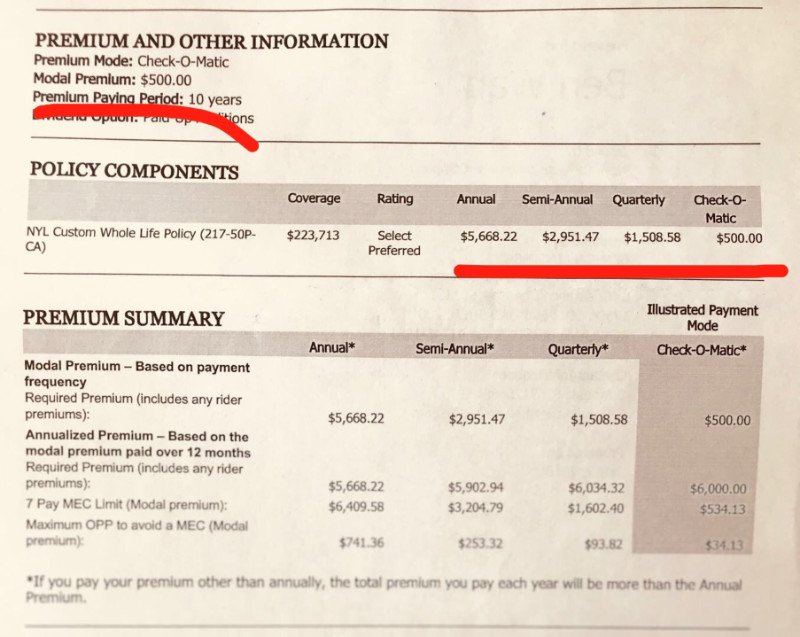

Savings Participating Whole Life Insurance Policy Design Plan

Savings Participating Whole Life Insurance(Whole Life) The characteristic of this type of product is that the premium amount and payment period are fixed.Therefore, in the "Insurance Policy Design Plan", how much money will be paid and how many years will be paid will be very clear.

Figure 1: The design plan of N Company's savings and dividend universal insurance policy: paid in 10 years, $5,668.22 annually, $2951.47 half-yearly, and $1508.58 quarterly

Figure 1: The design plan of N Company's savings and dividend universal insurance policy: paid in 10 years, $5,668.22 annually, $2951.47 half-yearly, and $1508.58 quarterly

From the product characteristics, we can know that because the annual dividend interest of the savings dividend policy product is a fixed value, the cost of insurance can be accurately calculated. The total cost is allocated to each year and month, which is the premium that the customer needs to pay.Once the contract is signed, the payment must be compulsory in accordance with the contract, on time, and the agreed fee.

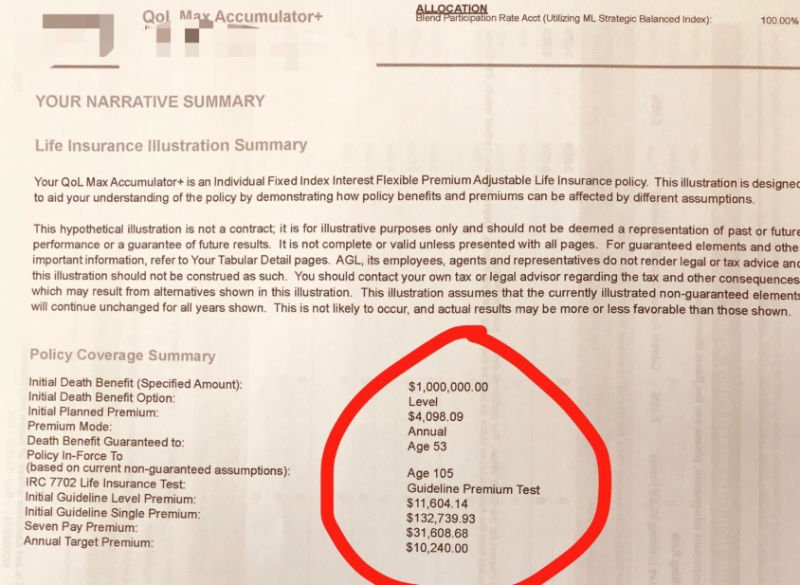

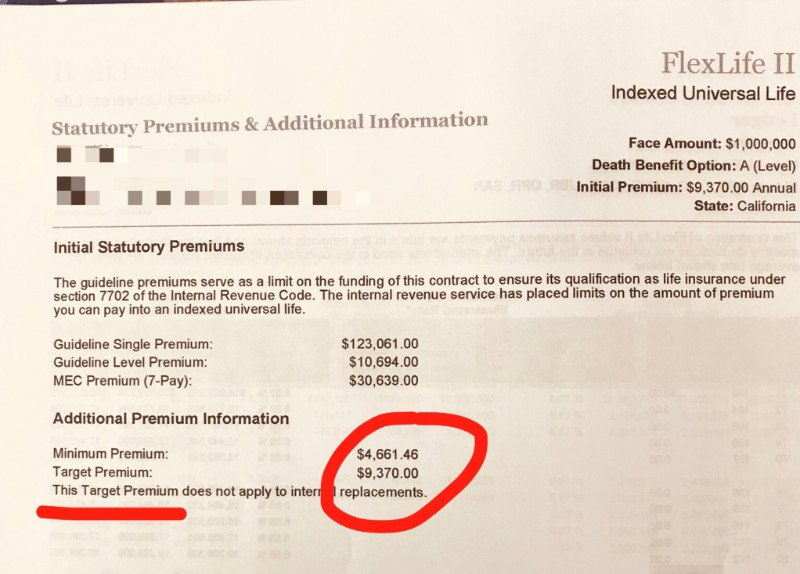

Universal life insurance (Universal Life, GUL, IUL, VUL) policy design plan

Due to the great flexibility of this type of product, how much you pay and how many years you pay depends entirely on the minimum maintenance cost of the policy and the customer's own purpose.Therefore, when designing an insurance policy, it is necessary for the customer and the insurance broker to communicate and confirm.

In the picture below, we will show and explain, byUniversal Life InsuranceDerived from product upgradesIndex Universal Life Insurance(IUL) Policy payment strategy.

Figure 2: Company A’s IUL-20 policy design plan with an annual payment period of $4,098.09 for the base premium and $10,240 for the recommended annual premium

Figure 2: Company A’s IUL-20 policy design plan with an annual payment period of $4,098.09 for the base premium and $10,240 for the recommended annual premium

Figure 3: Company C’s IUL-20 policy design plan with an annual premium payment period. The minimum premium payment is $4,661.46 per year, and the recommended target premium is $9,370 per year.

Figure 3: Company C’s IUL-20 policy design plan with an annual premium payment period. The minimum premium payment is $4,661.46 per year, and the recommended target premium is $9,370 per year.

"Flexibility" comes from the unpredictability of the market

FromFeaturesWe can know that unlike savings and dividend policy products, the annual income of universal insurance products is uncertain, depending on the different market conditions that the policy is linked to.

such as,Universal insurance(Universal Life) The annual yield of products is determined by the insurance company based on the yield of the bond market.Investment universal insurance(Variable Universal Life) The annual rate of return of the product is determined by the return of a certain type of stock, andIndex Universal Insurance(Indexed Universal Life) The yield of products is mostly determined based on the growth of the US S&P 500 index.Therefore, the amount of money that can be increased each year in the policy is an uncertain value.

Therefore, if the cash value of the insurance policy has increased a lot, enough to cover a part of the insurance cost of the year, the customer can pay less premium; if the cash value of the insurance policy has increased slowly, the money in the policy will not be enough to cover the insurance cost of the year. You have to pay more premiums.

Based on the principle of this type of policy product, it has the characteristic of "flexible premium".Therefore, universal insurance policies can be paid annually or monthly. Some companies also allow payment every other year, with flexible payment amounts.

Strategy reference for payment and payment period

Combined with the above introduction, we probably grasped the characteristics of universal insurance products.The following is the author's own insurance policy for reference and sharing.

If you are looking for tax-free retirement and rapid cash value appreciation, then pay the premium as large as possible in the first 10 years of the policy, or pay in one step, and pay the premiums of the policy stipulated by the Internal Revenue Service (IRS) every year The upper limit (MEC, please consult the broker who is planning and designing the insurance policy for the specific amount) is the best option for cash value growth.After 10 years, it is entirely possible that you no longer need to pay.

The cash value function of an insurance policy is a compound interest game after deducting premiums. The more premiums invested in the initial period, the more cash value will be, and the faster the compound interest will grow under the condition of the same cost deduction rate.In a good market environment, after 10 years of compounding the accumulated cash value and the annual income, after the annual cost of the policy has been paid, there is no need to pay additional premiums.

For this purpose, if the insurance policy is designed to pay for 20 years, 30 years, or even 50 years, then this design plan needs to be carefully considered.

Summary

Through this article’s detailed answer and comparison of the basic insurance question "How much do I need to pay and how many years do I have to pay", I hope that readers can have a basic understanding of different types of insurance policy design principles.The American Life Insurance Guide Network hopes that our readers can share these experiences with the help of professional life insuranceInsurance brokerWith the help of the company, choose American life insurance products that are configured to truly protect themselves and their families.

Click to go to insurGuru©️Life Insurance Academy