American Life InsuranceEditor's Note: In the United States, the tuition of children in college is a financial problem faced by many families.Faced with the variety of educational savings products on the market, where should the money for children go to college should be stored?Many parents and financial advisers prefer the 529 education savings plan because of its tax incentives.Moreover, when applying for bursaries and calculating family assets, there is money in the 529 account, which is relatively less important in calculating the proportion of money in bank checks or savings accounts; however, if you save too much, because the 529 education savings plan will serve as a family The inclusion of assets in the calculation will still affect the child's chances of applying for bursaries.Today we will elaborate on the comparison of the following two solutions.

529 Education Savings Plan vs cash value life insurance

Some parents therefore began to explore other savings schemes, using cash valueWhole life insurance, To save for children’s educationPolicy design plan, They entered their field of vision.

First of all, followTerm life insuranceDifferent, the whole life insurance policy is equipped with a tax-deferred savings account that can accumulate cash over time;

Secondly, in terms of withdrawal purposes, this type of life insurance is not like529 Education Savings PlanIn that way, it is only used for education funds, which seems to be more versatile;

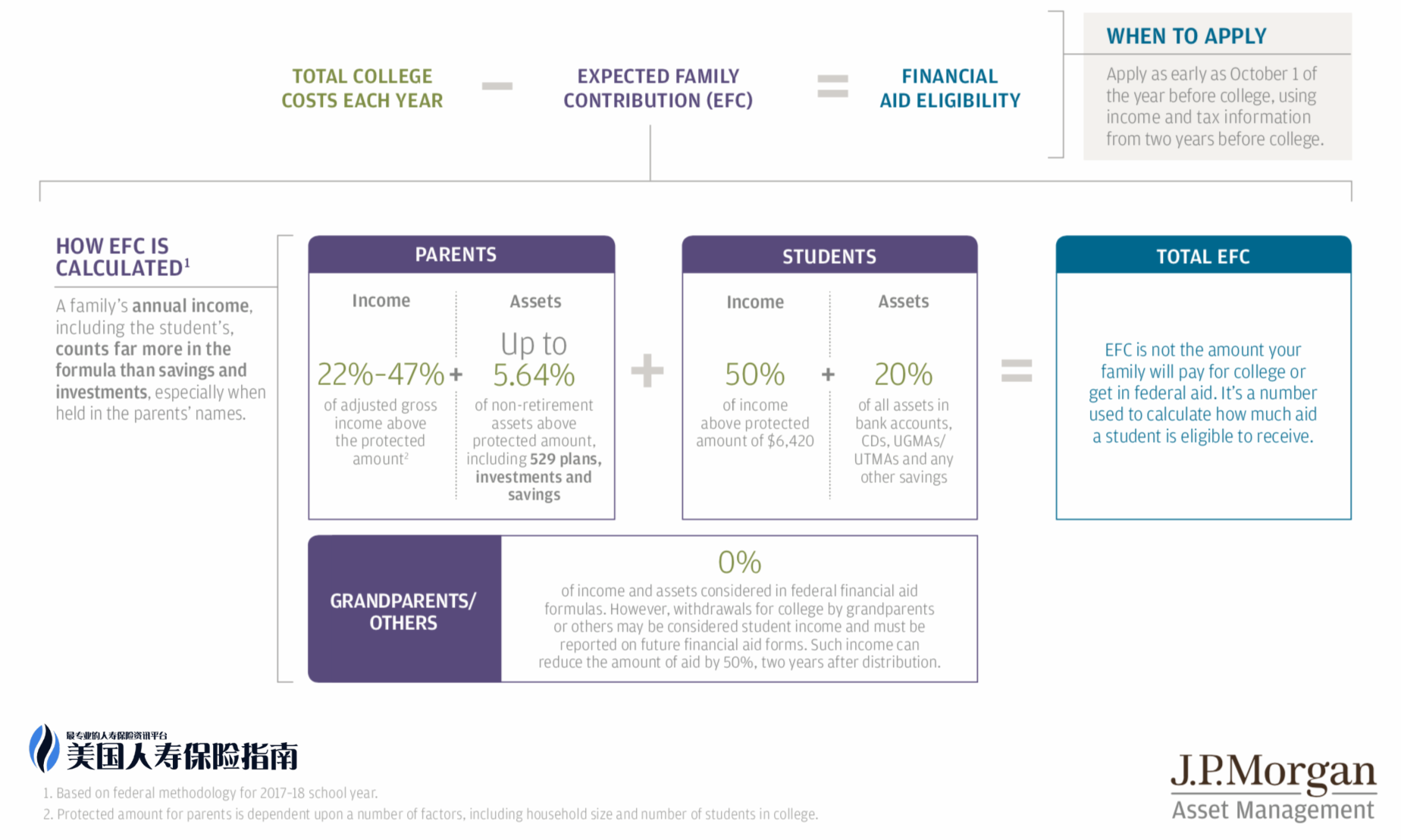

Finally, the money in the policy account we opened with a life insurance company will not be included in the calculation formula for federal grants.In other words, the money in the life insurance cash value account can be excluded from the financial capacity of the student's family, thereby increasing the children's chances of obtaining financial aid.

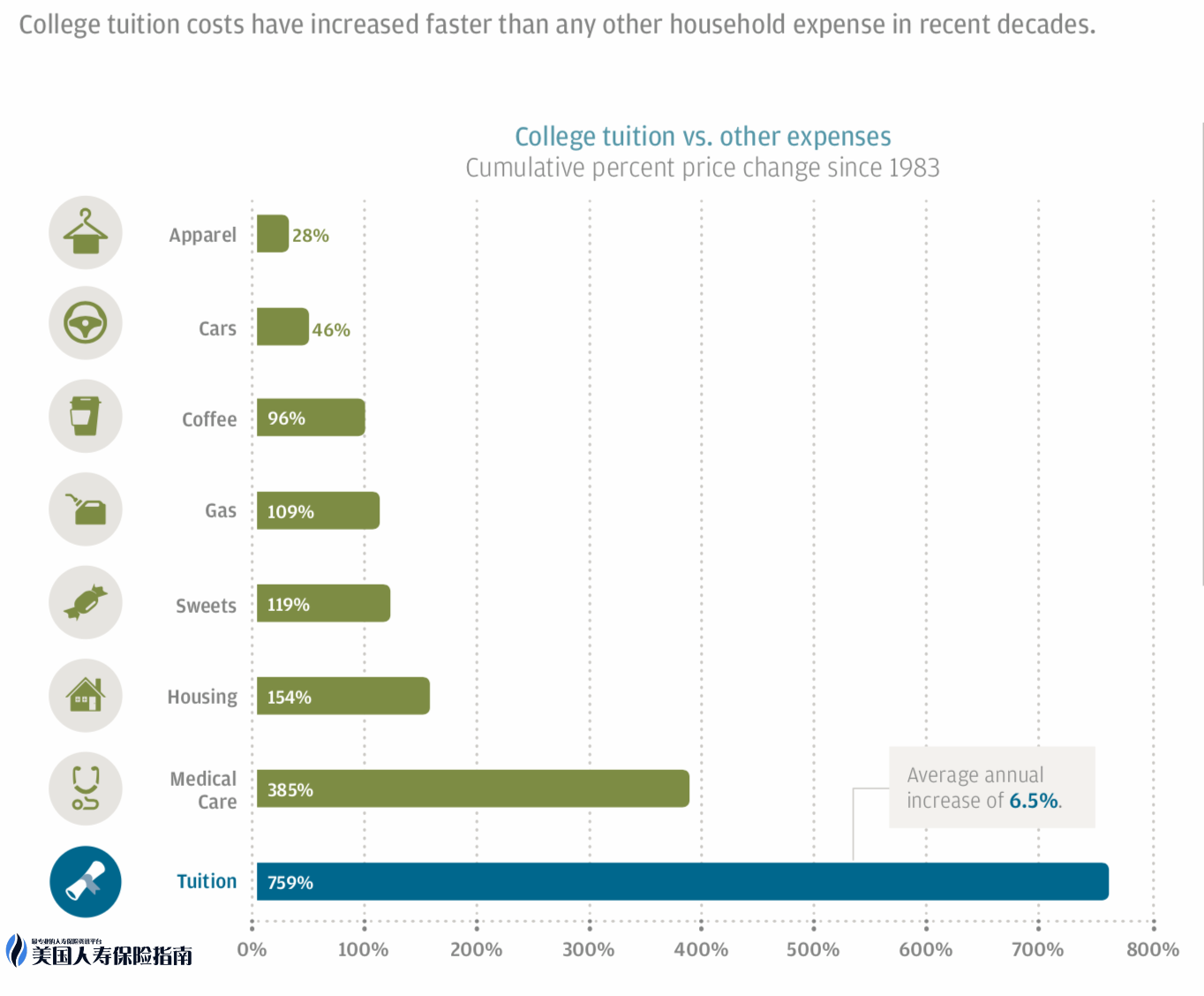

JPMorgan Chase Bank’s historical record of all living expenses and four-year university tuition increases from 1983 to the present shows that university tuition increases by an average of 6.5% per year, and the total increase percentage exceeds any other living expenses.

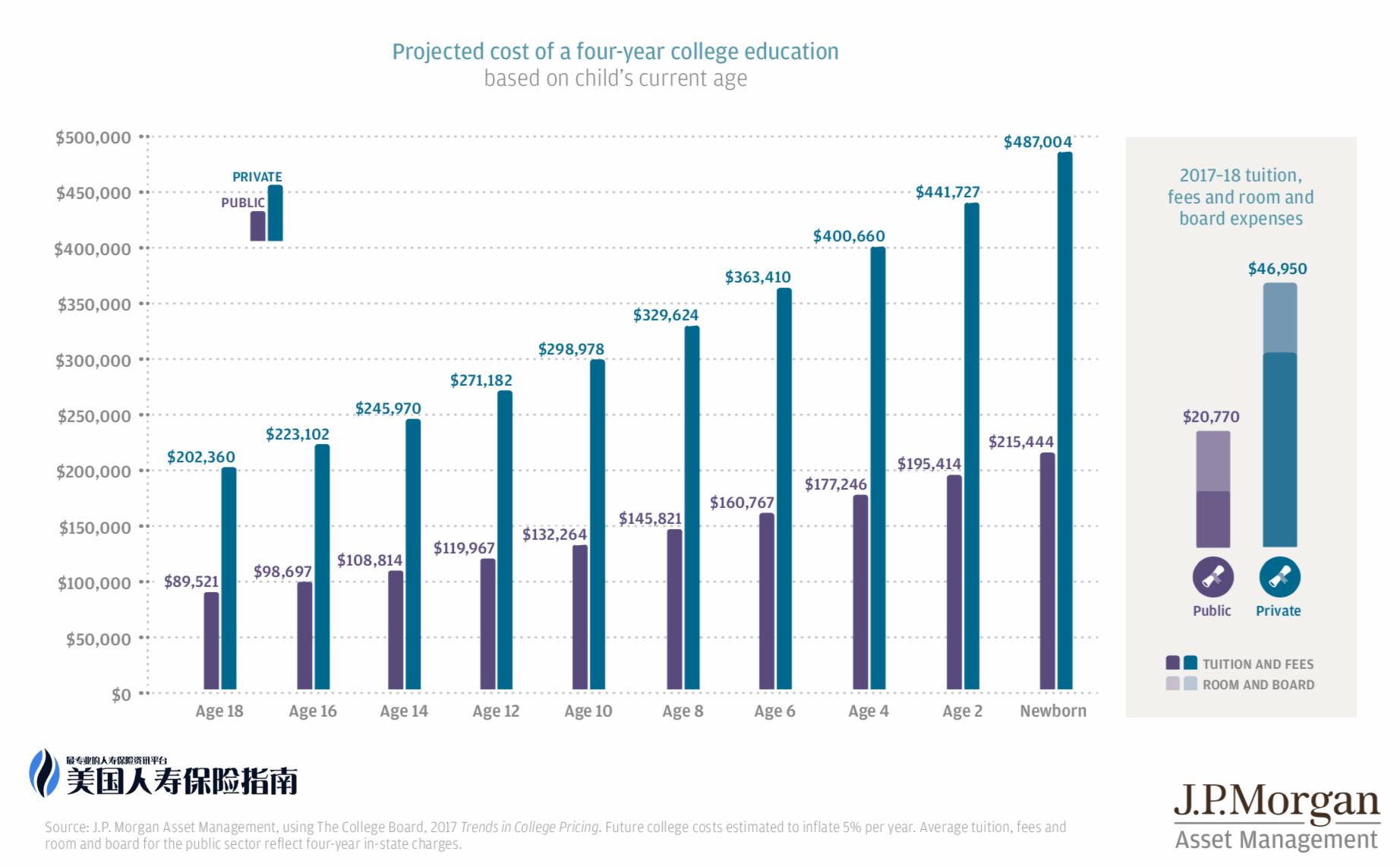

在同一份報告中,摩根大通的數據顯示,2017-18年學年度私立大學的年平均花銷為$46950,公立大學的年平均花銷為$20770。而對於今年才出生的新生兒,18年後私立大學的年平均學費會漲到$121751, 而公立大學也會增加到$53861一年。這將會成為很多家庭最大的家庭支出。

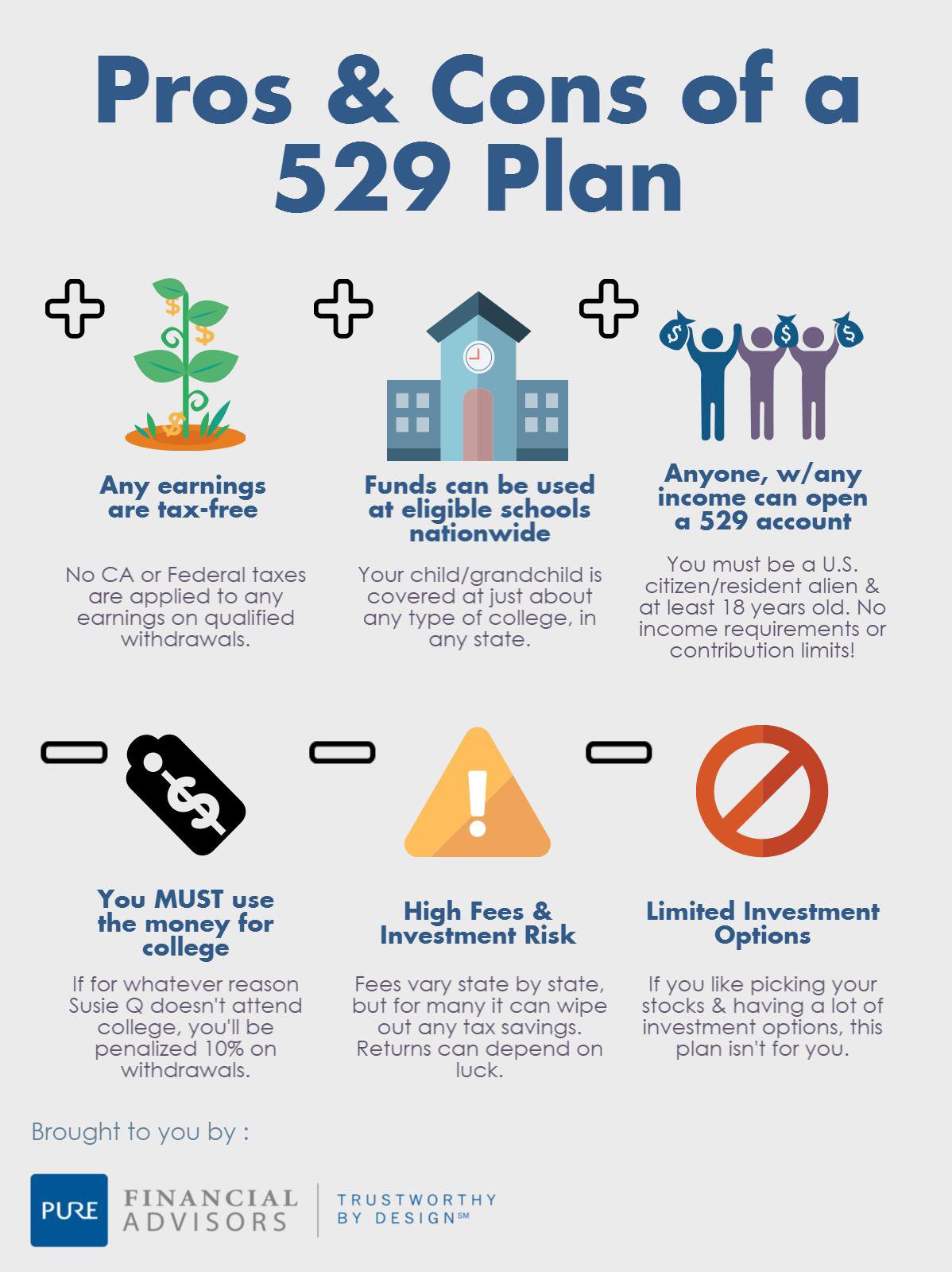

But about the choice529 Education Savings PlanOrWhole life insurance, There has always been controversy.Both have their own strengths and weaknesses in the following four aspects.

01Flexibility

According to the regulations of the Internal Revenue Service, the money in the 529 college savings plan can only be used for "qualified educational expenses", including tuition and fees, book fees, and accommodation fees that need to be paid for studying at an accredited American university.

If your child chooses not to go to university, study abroad, go to an unrecognized school, or get a full scholarship, you can either switch529 Education Savings PlanThe beneficiaries must either pay the income tax and use the money for other purposes-they may also need to return the state tax deductions received over the years and pay a 10% fine based on the income.some529 Education Savings PlanMay allow beneficiaries-usually students with lower income tax brackets-to bring the money.But no matter how low the tax is paid,Whole life insurancePolicyholders do not need to pay this tax.

"But the advantage of life insurance is that it doesn't care how you use the cash in the plan." Jim Van Meter, a financial planning consultant at the University of Nevada, said that using the money in the cash value account of the life insurance policy to pay for college expenses and housing down payment is also Yes, whether it is used for business or pension, you can use it flexibly according to your own wishes.

2 Risk

with529 Education Savings PlanBy comparison, if you are young,Whole life insuranceThey tend to be more resistant to market fluctuations and guarantee return on investment.

In the first two years of the policy, the rate of return is usually the lowest, because the insurance company has to get back the cost of the insurance.But after ten years or more, policyholders may get a return rate of 4% to 8%.However, if the insurance plan guarantees a return, it often sets a return limit.If the purchase is an investment universal life insurance (VUL) product, investors can invest their cash savings in a self-selected mutual fund sub-account, and the market will perform well and the return will be high.Of course, if the market drops sharply in the short term, the savings account balance will shrink a lot.

with529 Education Savings PlanThe difference is that some life insurance uses a tiered return design, and the more investment, the higher the rate of return.The University of Texas Planning Commissioner Jim Kuhner suggested buying a whole life insurance plan with lower death claims and a higher corresponding cash value, and then “save up to the maximum deposit allowed by the government.”

03 Grants

Cash valueWhole life insuranceOne big advantage is that the money in the insurance account will not reduce the amount of grants that students can get, because the money in a lifetime life insurance policy with cash value does not need to be included in the federal grant calculation formula.And the money in the 529 college savings account, for every dollar, can reduce the bursary by up to 5.6 cents.

The calculation formula for determining the amount of bursary in the JPMorgan Chase Bank report

Some parents will learn fromWhole life insuranceIn the policyBorrow money(Learn more) Pay tuition fees to your children and enjoy the benefit of tax-free principal. "However, when borrowing money from a life insurance policy, it should be noted that as long as it is not returned, the amount of the death claim will be reduced accordingly. Because the premium deducted from the death claim, in addition to the cost, the balance goes to the cash savings account. The two are declining." Jim Van Meter reminded.As long as you plan ahead and give enough time to increase your cash value, you can take out tax-free cash value at the age of 18 as a supplement to university tuition or even full coverage.

04 Cost

According to Morningstar data,529 Education Savings PlanThe management cost and advisory fee of the company are usually between 0.25% and 1.85%, especially for direct purchase plans that bypass financial advisors, generally not exceeding 1%.It is not uncommon for the various expenses of cash life insurance to add up to 1% or higher.

As long as it is used for the purpose of education expenses, the money withdrawn from the 529 education savings account will not be subject to capital income tax.In addition, life insurance does not enjoy much529 Education Savings PlanAvailable state income tax relief.However, not every state provides529 Education Savings PlanIncome tax relief, even if it is provided, is mostly only for those who purchase the state plan.

In short,And529 Education Savings PlanBecause it is simple and clear, the cost is relatively lower,It is a good choice for some families.If you plan early and want to avoid risks in particular, whole life insurance is a very feasible option for you to save college education funds for your children.

In the actual use of life insurance to complete the plan design process of the children’s education fund planning, we can selectStronger asset management capabilitiesOfLife insurance company,as well asBetter cash value growth potentialLife insurance products, withParent's retirement incomeNeeds to better achieve the goals of family financial planning.

small tools:American University Tuition, Cost of Living Calculator 2020 version

(>>>Recommended reading:Evaluation|What are the advantages of the two-in-one plan of "education insurance" for children and "retirement insurance" for parents? (Picture))

(>>>Recommended reading:Can children and newborn babies buy life insurance in the United States?What kind of insurance should I buy?What are the advantages and disadvantages of buying life insurance for children?)