(Introduction: Annuity, also known as annuity insurance, called Annuity in English, in "Learn what annuity insurance is in 3 minutes"In the article, Mr. Annuity in the American Life Insurance Guide©️ Community explains this type of insurance. In today's "Mr. Annuity" column, we will discuss the 8 most common questions and misunderstandings in applying for annuity insurance in the form of questions and answers. Explained.)

Q1: What is the best age to buy an annuity?

Mr. Annuity:There is no so-called optimal age for purchasing annuities, and it actually depends on us in the end.But generally speaking,The best age to purchase annuities is 45-55 years old. This gives you plenty of time to accumulate cash and prepare for your upcoming retirement.

According to Gallup's data,86% of annuity policyholders are before the age of 65Applied to purchase their first annuity insurance policy,The average age of annuity insurance holders is 70 years old.

Q2: Can newborn babies buy annuities?

Mr. Annuity:can.In theory, we can purchase annuities at any time, from the moment of birth until we step into retirement.But most insurance company products limit the maximum purchase age to 80 years old.

Traditionally, the average purchase age of annuity insurance is 50 years old.

(>>>Recommended reading:Insurance strategy|Can I buy insurance for my child alone in the United States?What are the restrictions and requirements?)

(>>>Recommended reading:Insurance strategy|Can I buy insurance for my child alone in the United States?What are the restrictions and requirements?)

Q3: What is the annuity with the highest yield?

Mr. Annuity:At present, the highest 3-year fixed-interest savings annuity on the market has an annualized return of 2.4%, the 5-year fixed-income savings annuity has a yield close to 3%, and the 7-year fixed-income savings annuity has a yield of 3.25%.Variable-income index annuities or structured annuities may have higher yields.The yield of security annuities may be lower or higher.

But "high yield", like a slogan like "deposit and get", may sometimes be just a gimmick for marketing and attracting depositors.In the US annuity market, there have been some 7.0-year fixed-income savings annuities claiming to be as high as 15%, but in actual operation, plus various annuity-related expenses, the actual rate of return is less than 2%.

Therefore, what you need to confirm before buying is the reputation of your annuity insurance and what related expenses are in this annuity insurance product.

(>>>Recommended reading:Knowledge Sticker|How to buy American annuity insurance?How much does it cost to receive 2 per year?)

Q4: Is it possible to lose money when buying annuity insurance?

Mr. Annuity:if boughtSecurity annuity, or structured annuities, may incur losses.If the market declines, the return of this type of annuity insurance may reach negative numbers, resulting in losses.But on the other hand, because the insurance choices bear different levels of risk, when the market is good, the returns will exceed other types of annuity insurance.

For experienced investors, if you choose this type of annuity insurance, you need to understand the prospectus and do a good job of cost risk research before applying.

Q5: What is the safest annuity insurance?

Mr. Annuity:Fixed income savings annuity (Fixed Annuity).This type of annuity is a fixed-term, fixed-rate insurance.This is why it has been compared to "super fixed storage".When depositing this annuity, all terms and instructions have been written clearly and concisely.

>>>Recommended reading:What is a fixed income annuity (Fixed Annuity)?What are the advantages and disadvantages, and which type of people are suitable?

Q6: What kind of annuity insurance has the highest risk?

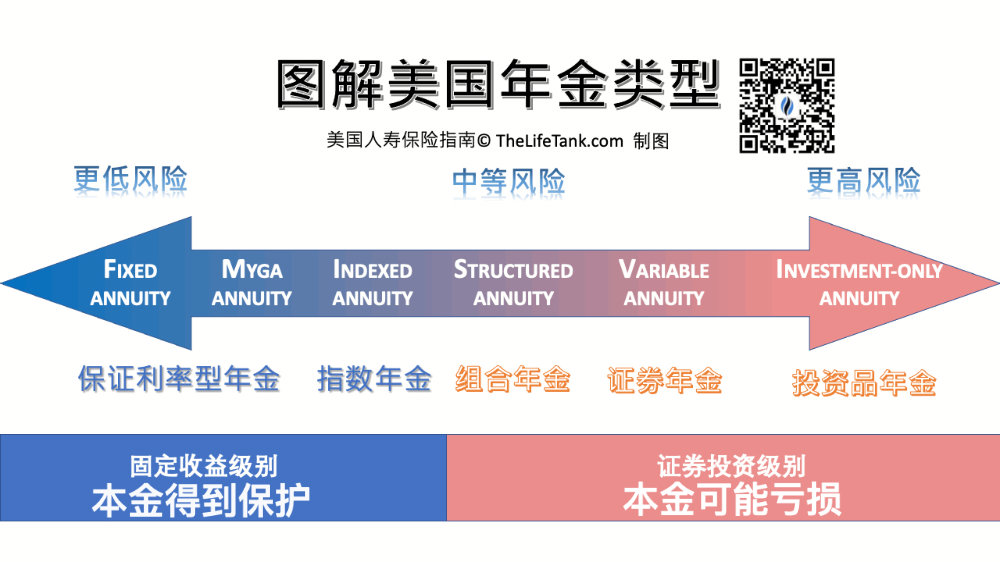

Mr. Annuity:从Risk from high to lowIn the order ofSecurity annuity > ?Portfolio Annuity> Index Annuity> Savings (guaranteed interest rate) annuity ; And fromEarning potentialIn order of possibility,TooSecurity annuity > ?Portfolio Annuity> Index Annuity> Savings (guaranteed interest rate) annuity .

>>>Recommended reading:Comparing the price of American annuity insurance product types and the advantages and disadvantages of American annuities (latest edition)

Q7: I heard that taking money from the annuity account in advance will result in a fine. Is this true?

Mr. Annuity:Annuity insurance accounts are usually the purpose of retirement income planning.It is the same as IRA and other accounts, there is a 59% fine for withdrawal before the age of 10 and a half.Annuity insurance accounts also usually have a surrender penalty period ranging from 3 to 10 years.Before applying, you need to carefully understand the penalty instructions for specific annuity products.

At the same time, when applying for annuity insurance,Often refer to how many years before the age of 60 to choose different types of annuity products.

Finally, the most common question Q8: Is buying an annuity better than buying life insurance?

Mr. Annuity:The two are not comparable.

Annuity is a pension risk management tool.When we are close to the retirement age, such as 50, 55, 60, we save a pension, or our 401K, IRA or other retirement accounts (Qualified Plan) have a pension.

At this time, we are not willing to bear the risk of depreciation of this cash, or the money in the retirement account bears the risk of loss due to the market decline. At this time, we can choose different annuity insurance products according to our risk tolerance, and transfer this money Put it in to manage the risks of this “retirement” and form insurance.

The market generally believes that annuity insurance is not a financial tool that aims to provide "high-yield potential", but a medium- and long-term investment and financial management channel that aims to receive guaranteed lifetime income after retirement and defer the payment of capital gains tax. (Full text ends)

>>>Click to customize my annuity insurance plan self-service quotation service<<

>>>Recommended reading:Popular science stickers|What is annuity insurance?Who is buying annuity insurance?

>>>Recommended reading: What should I do with my pension after resigning and changing jobs? |4 common solutions

>>>Recommended reading:Comparison of American life insurance product types, prices and advantages and disadvantages (2021 version)