To readers of American Life Insurance Guide:

I. Annual review

The year of Gengzi in 2020 is destined to be an uneasy year.The Covid-19 epidemic that swept across the United States, the "black life is also a life" protest wave triggered by the death of George Freud, and the controversial 2020 presidential election have brought about earth-shaking changes in American society, and it affects every one of us. People's daily life.

Covid-19

截止2020年12月28日,美国新冠病例总数已突破1,900万,死亡总人数超过33.3万人。

During the epidemic, the American Life Insurance Guide Network published "2020 U.S. New Crown Epidemic Topics", tracking and reporting the measures taken by American Life Insurance Company during the epidemic and related industry trends.

Due to the economic shock brought by the new crown epidemic, the Federal Reserve has continuously lowered its benchmark interest rate, which has had a significant impact on the life insurance industry.The American Life Insurance Guide website followed up and reported on life insurance companies’ sales restrictions, suspension of sales, price increases, reductions in policy benefits, and continuous adjustment of business focus and other industry news that policyholders pay attention to.

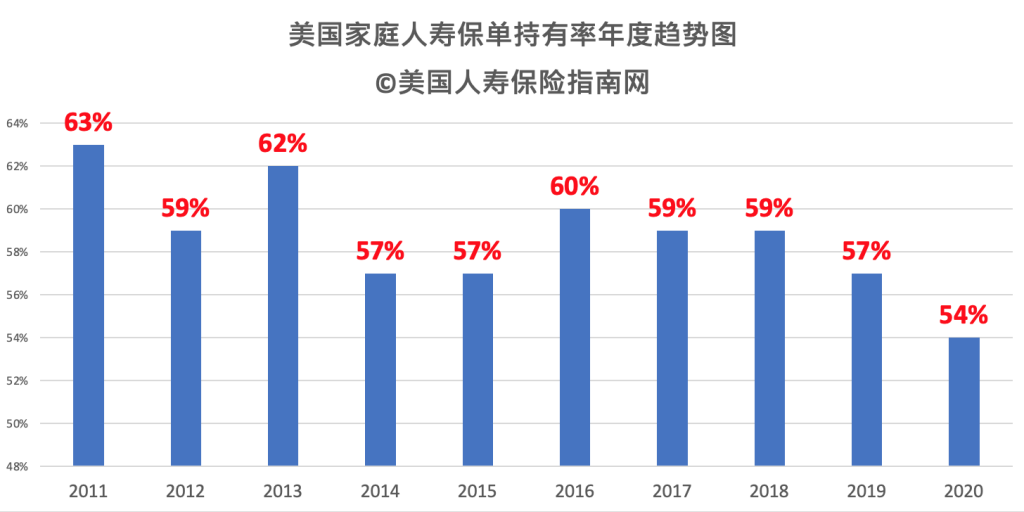

Affected by the comprehensive environment, the retention rate of life insurance policies for individuals and families in the United States has reached the lowest level in 10 years.

For policyholders, 2020 will usher in two major benefits. First, the New York State Monetary Authority has implemented Section 2 since February, which mandates that life insurance and annuity insurance brokers and professionals must be based on the policyholder’s Benefit consideration is the supreme principle of sales; secondly, the introduction of AG 187A regulations nationwide has fundamentally reduced the infringement of "misleading sales" on policyholders.

AG 49A, which benefits policyholders, is officially effective

The AG2020 A regulation, which came into effect on December 12, 14, further regulates the illustration of life insurance policies (Policy proposal) Calculation and display methods, starting from the effective date, the calculations and insurance proposals of all index-type life insurance products on the market, the above forecast display values, will become more conservative.

For policyholders, when making the decision to apply for an insurance policy, a more conservative insurance proposal means a lower risk and a higher chance of achieving it. This is undoubtedly good news.

Biden wins election, insurance demand may expand

On the other hand, as Biden wins the 2020 US election, his tax reform plan is not friendly to high-income families in the United States.

In the "Guide to American Life Insurance"2020 U.S. Presidential Election Topics"It pointed out that in addition to the proposal to increase taxes for high-income families, Biden's campaign platform also includes reducing the inheritance tax exemption limit and revising some existing inheritance asset calculation methods.

If Biden's new tax reform policy is implemented, it will greatly affect Chinese families who want to leave houses, money, and assets for their children, thereby significantly increasing the demand for life insurance in the field of estate planning.

Private equity vs traditional power

According to the 2020 report of American Life Insurance Guide, the growth of private equity capital has challenged the traditional social order and created new hot issues.

In addition to family private insurance companies, listed insurance companies, and jointly-owned life insurance companies, life insurance and annuity insurance companies under private equity investment institutions have begun to quadruple the market, and their brands have frequently appeared in the Chinese community market.

Equity investors with the goal of pursuing high returns, the goal is to get back all their investments and get profits.Following PE's extensive involvement in the medical and health industry, private equity capital has entered the life insurance industry. While bringing market changes, whether the interests of policyholders can be protected for a long time still needs further observation.

But a significant problem is thatDoes this mean that such life insurance companies can only help policyholders who can pay enough premiums and help the insurance company make money?

We will continue to wait and see.

The mission of American Life Insurance Guide©️ is to help Chinese people fully understand American life insurance knowledge and information, share financial planning experience and key points, let users understand their rights, and obtain products that can truly protect themselves and their loved ones.

II. Community Activities

The American Life Insurance Guide website unwaveringly supportsNet Neutrality ActAnd support donationsWikipedia Foundation.

Monthly toDirect reliefWith regular donations, Direct Relief is a non-profit, non-partisan organization dedicated to providing necessary medical resources to people in emergency situations and poverty.

The American Life Insurance Guide team supports and donates to the non-profit organization WeChat User Association of America, and we support the establishment of a non-profit legal aid organization in the American Chinese community.

During the COVID-XNUMX pandemic, members of the American Life Insurance Guide Network team made donations to local community churches. (End of full text)

During the COVID-XNUMX pandemic, members of the American Life Insurance Guide Network team made donations to local community churches. (End of full text)

(>>>Related reading:American Life Insurance Guide 2021 Annual Report )

(>>>Related reading:American Life Insurance Guide 2020 Annual Report )

(>>>Related reading:American Life Insurance Guide 2019 Annual Report )

(>>>Related reading:American Life Insurance Guide 2018 Annual Report )