Buffett's "gambling appointment" story

In early 2008, Buffett thoughtThe cost of hedge funds is too high, "I'm sorry" gainsOn the Long Bets website, a "XNUMX-year gambling contract" was publicly released.

This bet is about 100 million US dollars as a bet, and a charity organization is designated as the beneficiary.

The content of the bet is that Buffett argued that during the 2008 years from January 1, 1 to December 2017, 12, if the measurement of performance does not include handling fees, costs and expenses, thenStandard & Poor's 500 Index(Hereinafter referred to as'S&P 500' or'S&P500') performance will exceed the performance of hedge funds' fund portfolios.

If Buffett wins the bet, he can get all the bet he won.

Active Fund Investment Vs Passive Index Investment

After Buffett proposed a bet, among the many professional managers of hedge funds, only Ted Seides, the co-founder of Protégé Partners, stood up to respond to the challenge.

He chose 5 "funds of funds", hoping to exceedS&P500 IndexPerformance.

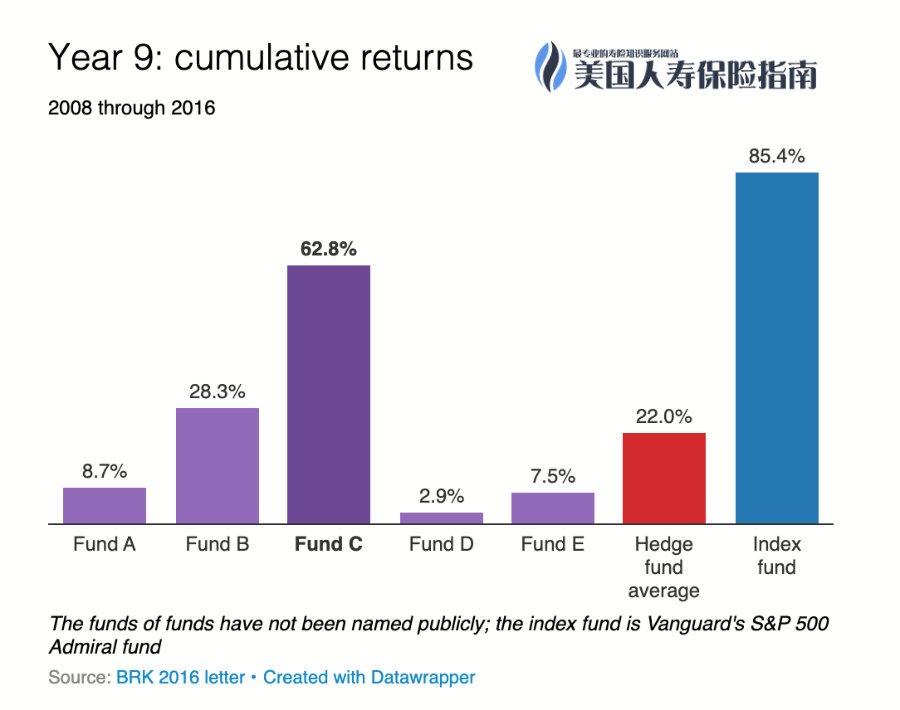

In the 9th year, the S&P500 index fund had a return of 85.4%, while the average return of hedge funds was 22%.

In the 9th year, the S&P500 index fund had a return of 85.4%, while the average return of hedge funds was 22%.

The end of 10 years of gambling

Buffett finally won the bet.The end date of the gambling game is December 2017, 12, but Ted admitted that it failed before that. He wrote: "Judging from all intents and purposes, the game is over. I lost."

Through a 10-year gambling practice, Buffett pointed out his "most successful argument"-including fees, costs and expenses,S&P 500(S&P500) Index funds will perform better than hand-selected hedge fund portfolios in 10 years.

The "10-Year Gambling Game" vividly demonstrates two opposing investment concepts:Passive investment and active investment.

The current state of the investment market in 2019

Bloomberg Business Weekly once described,Over the years, the marina has gradually been filled with fund managers’ yachts, while the yachts of investors and clients have disappeared.

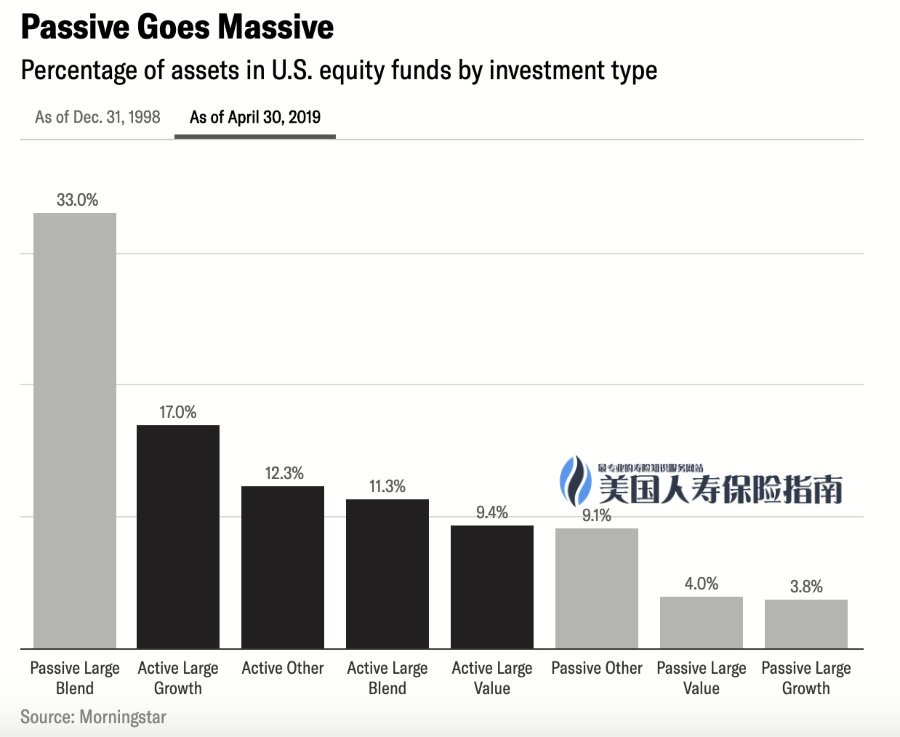

After 12 years of turmoil in the investment industry, 2019 has become a historic year for the industry: starting this year, nowChoosing a passive investment index fundAmount of funds, andThe amount of funds in an active investment strategyIt's the same.

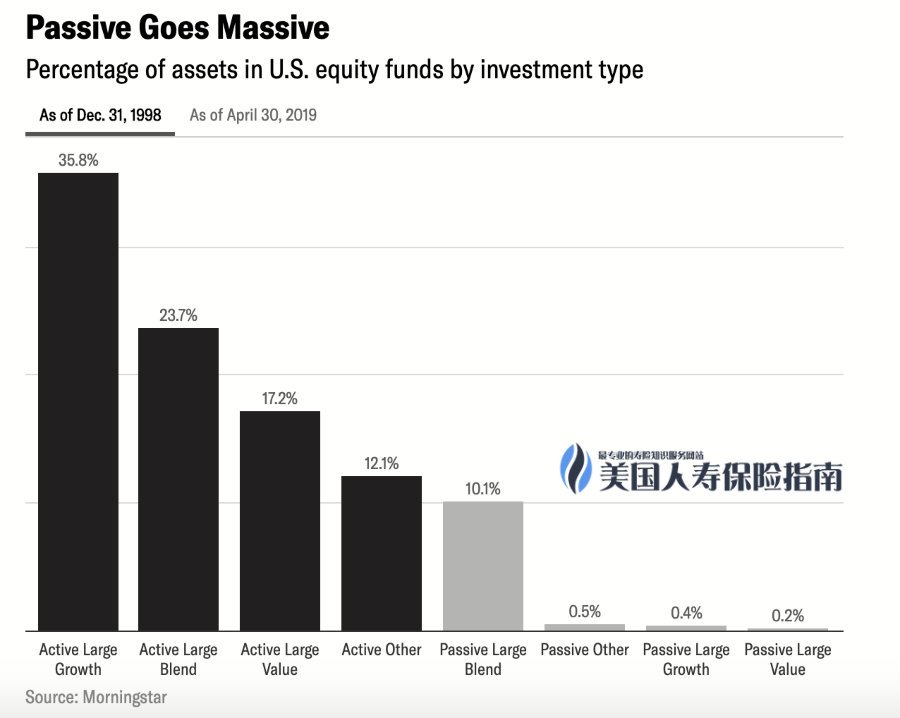

In 1998, active management investment was the mainstream

In 1998, active management investment was the mainstream

In 2019, passively managed investment has become mainstream

In 2019, passively managed investment has become mainstream

Index insurance and its enlightenment to policyholders

For policyholders, the "10-year gambling game" also vividly demonstrates two mutually opposed insurance concepts:Index insurance, or investment-linked insurance.

With the evolution of the market and the education of passive investment concepts, in the field of finance and insurance, passive linkageS&P500 Index, Based on the principle of "cash value accumulation"Index insuranceSince its launch in 1997, it has occupied 20% of the life insurance market in just 24 years1.And more like an "active management type"Investment-linked insurance, It only maintained a 6% market share.

Financial products such as index insurance combine the concept of "passive index" investment and the benefits of American insurance.Funds in the policy account, usually against the benchmarkS&P500 Index, MSCI index, or index against certain institutions, to accumulate funds.When used, it has tax advantages.

In real life, with "wealth accumulation", "Retirement income", "U.S. dollar asset allocation" and other planning as the purpose of insurance policyholders, usually in the way of OverFunding, to practice the "insurance" + "passive index investment" individual financial management concept, improve individual or family risk management plan and asset portfolio. (Finish)

appendix

1. "LIMRA 2018Q2 Market Report: What kind of insurance do Americans buy?", American Life Insurance Guide Network, 2018.08.29