Lao Wang is 55 years old this year. He loves to play golf and is in good health.He always joked that he would live to be 100.

Lao Wang has also been considering the transfer of assets brought about by his wealth inheritance.Considering the advanced age in the future, he will not be able to spend more time and energy to deal with the complicated procedures brought about by various "heavy assets", so Lao Wang chooses to use a simpler contract form to inject some of the physical assets in his hands into In the insurance contract,Transferto his wife and daughter, and cooperate with reasonablelever, leaving a fund of about $500 million.

Lao Wang hopes that this part of the assets can be confirmed at the moment of purchase, and he does not want to have tax troubles.Therefore, only guarantee-type insurance products are considered, and any wealth management and investment insurance products are not considered.

1. Conservative choice: GUL (Conservative)

Guaranteed Universal Life, Chinese name, Guaranteed Claims Universal Insurance, referred to as GUL.

"Guaranteed", that is to say, on the day Lao Wang took out the insurance, the amount of compensation that the beneficiary can receive was determined, and there was no need to worry about the issue of breaking the insurance*.

This type of life insurance does not have any "redundant" additional financial management functions, whose sole purpose is to leave a guaranteed benefit to children or beneficiaries at relatively low premiums.It is also the type of life insurance most similar to "insurance" in the traditional sense among the dazzling array of American life insurance products.

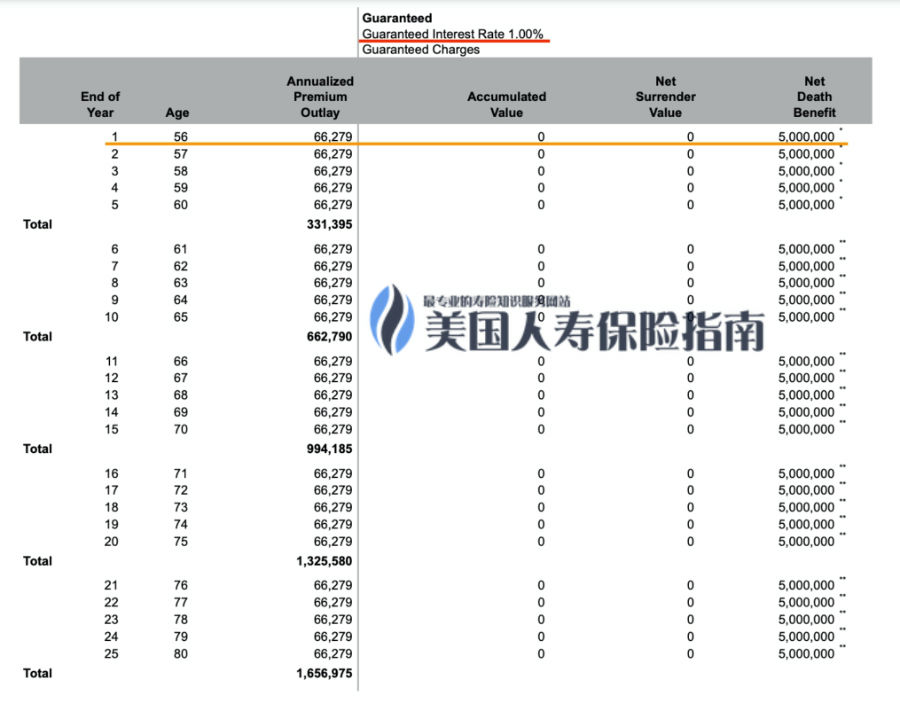

The picture below is a price description chart for ages 55 to 100 (omitted after age 80) based on the actual situation of Lao Wang and based on the interest rate price data provided by community dealers.

©️Drawing based on the 10/31 interest rate price of an insurance product, this chart is not a sales and quotation chart, it is only for public education

As shown in the table above,$66,279 annual fixed premium,Death claim of $500 million.In the first ten years of insurance, the leverage of insurance assets is about 1:10.Before the age of 75,insurance leverage ratioIt is about 1:5.

The risk of death increases with age,insurance leverage ratioGradually reduced, but at the age of 90, there is still more than 2 times the capital leverage.

GUL Insurance: The Cons of Conservative Choices

Lao Wang is 65 years old this year and has just deposited for 10 years.During this year, due to the complex changes in family relations, Lao Wang changed his mind and did not plan to keep the money. He wanted to spend the insurance premiums saved every year by himself and travel around the world to enjoy life after retirement.

At this time, Lao Wang faced a problem. If he stopped paying the premium at this time, the previous more than 60 US dollars would be in vain; if he continued to pay, he would go against his will.

"To pay or not to pay" became a difficult problem for the old Wang family at this time.

This is the biggest disadvantage of traditional GUL insurance in the field of asset transfer and wealth inheritance: it has no flexibility, no cash value, and is only used for claims.

If the policyholder changes his mind, there is no way to go back.

(>>>Related reading:White Paper on USD Asset Insurance Insurance: GUL Insurance Insurance Guide )

2. Radical option: GVUL (Aggressive)

Lao Wang wants to have a certain amount of compensation, but also thinks that if he changes his mind in the future, he can get back part of the principal.

Lao Wang heard that there is a type of security insurance in the market.It provides a guaranteed death claim, and at the same time there is a cash value, and it may be possible to get part of the money back.Give it a go, if you encounter golden 10 years again, you can still manage money.This type of insurance product, derived from VUL, is collectively referred to as GVUL, and its full name is Guaranteed Variable Universal Life.

The picture below is a price description chart for ages 55 to 100 based on the actual situation of Lao Wang and based on the interest rate price data provided by community dealers (limited space, omitted after age 84).

©️Drawing based on the 10/31 interest rate price of an insurance product, this chart is not a sales and quotation chart, it is only for public education

©️Drawing based on the 10/31 interest rate price of an insurance product, this chart is not a sales and quotation chart, it is only for public education

As shown in the table above,$77,363 annual fixed premium,Death claim of $500 million.

Due to the new cash value feature, andVUL insuranceUnique fund management fees, the comprehensive cost factors brought about, in this evaluation, GVUL insuranceAsset Leverage Ratio, slightly lower than the simpleleveraged productgull.

(>>>Related reading:What is VUL insurance (investment insurance)? What are the advantages and disadvantages of VUL insurance and the applicable population)

GVUL Insurance: The Pros and Cons of the Radical Option

GVUL finally has cash value in addition to a guaranteed death claim. If the 60-year-old Pharaoh changes his mind again, the part in the green box will be every year maybeAmount that can be refunded.

From the green box in the picture above, we can see that if Mr. Wang changes his mind at the age of 60, and the fund investment in the insurance policy does not lose or earn, after deducting the cost, he can get back $25,610 from the insurance company.

Compared with the situation where GUL insurance does not get any money back, GVUL is more flexible, but the risk of investment profit and loss is borne by the policyholder.There is no guarantee of how much money you can get back in the future.

This is the obvious disadvantage of GVUL-type insurance: it is a security-type product and does not show investment losses.Although there is a function of refunding the cash value, the insurance company does not provide a guarantee for the cash value.

2. Robust option: GIUL (Moderate) – ROP

Lao Wang believes that at this stage of life, the goal is no longer to gamble.

After clarifying the definite goal of "keeping a sum of money" again, Lao Wang not only wanted the flexibility of cash value, but also thought that if he changed his mind later, he could still get a guarantee that the premium would be refunded.

Such insurance products,There is a guaranteed death claim feature, along with a cash value feature, and finally a guaranteed premium refund feature.it isIUL insuranceThe derivatives are collectively referred to as GIUL Rop, and the full name is Guaranteed Indexed Universal Life Rop.

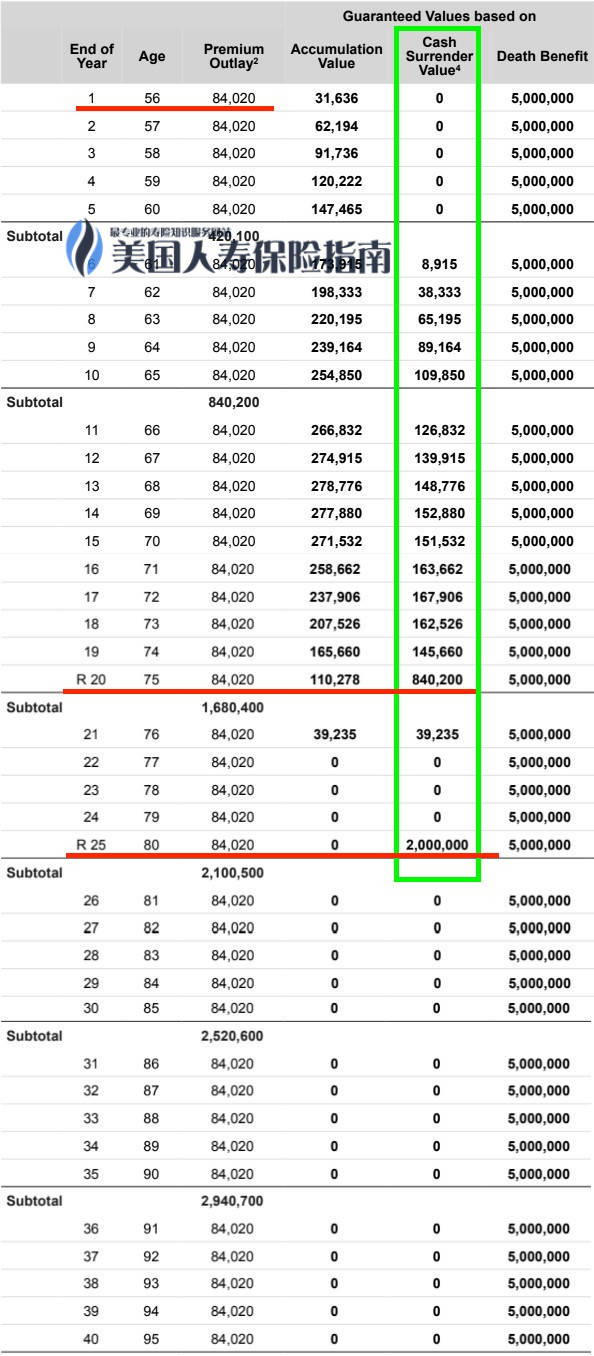

The picture below is an illustration chart of premium prices for ages 55-100 based on the interest rate price data provided by community dealers based on the actual situation of Lao Wang (after the age of 95 is omitted due to space limitations).

©️Drawing based on the 10/31 interest rate price of an insurance product, this chart is not a sales and quotation chart, it is only for public education

As shown in the table above,$84,020 annual fixed premium,Death claim of $500 million.

Due to the new cash value function and the comprehensive cost factors brought about by the premium refund function, in this evaluation, the leverage ratio of GIUL insurance assets is equal to that of GVUL, and slightly lower than that of the purely leveraged product GUL.

GIUL Insurance: Pros and Cons of Robust Choice

GIUL not only has cash value, but also gets the guarantee from the insurance company to return the premium. If the 75-year-old Pharaoh changes his mind again, the part in the green box will be every yearGuaranteed money back.

As can be seen from the green horizontal line in the picture above, if Pharaoh changes his mind at the age of 75, he can get compensation from the insurance company.GuaranteeGet back $84 in premiums.When Lao Wang was 80 years old, the insurance companyGuaranteeRefund of $200 million in premiums.

Compared with GUL insurance products where you can’t get a penny back, GIUL products have the flexibility of cash value; compared with GVUL insurance that allows the policyholder to bear all the risks of cash value, this type of GIUL insurance is provided by the insurance company. Guaranteed" a promise to return the cash value of the premium.

But this brings about a disadvantage of GIUL-type insurance: the functions are becoming more and more abundant, and the premium price is getting more and more expensive.

Article summary

GUL, GVUL, and GIUL are three subdivided types of insurance products in the US dollar insurance market.Different insurance companies issue different insurance products correspondingly.

These insurance products on the market have different advantages and disadvantages, but generally speaking, they conform to a basic common sense, that is, the simpler the functions, the cheaper the premium price; each additional function will naturally increase the cost price accordingly.From the comparison of the annual premiums of these three types of products, we can see that,For each additional function point, the cost also increases from $8,000 to $10,000.

$66,279 -> $77,363 -> $84,020

Under normal market conditions, the price of a product is directly proportional to the richness of its functions.GUL, with the lowest premium prices, brings the fewest options, buthighest leverage; GVUL in the middle has the function of cash value; while GIUL, which has the highest premium price, insurance companies provide the most guarantees.

If you were Lao Wang, which type of insurance product would you choose?

In this test, in order to have an intuitive comparison of these three types of insurance, we use the unified design parameters.The comparative description in this article will help the public learn and understand the interactive relationship between premium prices and functions of different types of insurance products.

Throughout the review process, TheLifeTank©️ editors enlisted life insurance advisors Heather Xiong CFP®️Thanks for your comments and help.

In the real world, policy account design and payment schemes vary from person to person.You can consultProfessional Life Insurance Financial Advisor, select asset transfer insurance products with style preferences, and carry out personalizedPolicy account design. (End of the full text Last Updated @ 11032022 10:00AM PST )

(>>>Recommended reading:What is PDA insurance account design service?How much is the design fee and price?)

(>>>Recommended reading:Is buying insurance the same as buying leverage?What is Insurance Leverage?how to buy?)

(>>>Related reading:What are the 4 legal ways to transfer assets?)