In TheLifeTank©️'s "Inheritance of Wealth" Academy, we share "0 cost?How to leave cash in your bank savings account with your family and children” way, and further pointed out that the bank savings account in daily life is actually a trust account.

For multinational high-net-worth families and enterprises, in addition to depositing funds in a financial institution such as a bank, there is an additional option with a higher threshold: depositing funds in an insurance company, opening an insurance savings + trust account, namely Insurance Saving Trust.

What is Insurance Saving Trust?

Insurance Saving Trust, abbreviated as IST, is called ""Insurance Savings Trust Account”, referred to as “Insurance Savings Account”.

An insurance savings account is a savings account we open with an insurance company and is managed using the structure of a trust. Therefore, the IST insurance savings account has both the advantages of a trust (such as full control, flexible control, privacy and confidentiality, etc.) Insurance.

How does an IST Insurance Savings Account work?

After setting up an IST Insurance Savings Trust Account, the policyholder (institution) deposits funds into the account.Insurance companies ensure the safety of the principal of funds, manage the funds in a unified manner, and announce annual dividends during the annual financial reporting season.

The policyholder's savings account earns dividends from the insurance company, and there will be no loss every year, so as to achieve the goal of stable asset appreciation.

(>>>Related reading:Depth|What kind of investment and financial management have life insurance companies made?Where do our premiums go?)

Pros and Cons of an IST Insurance Savings Trust Account

From the insurance side

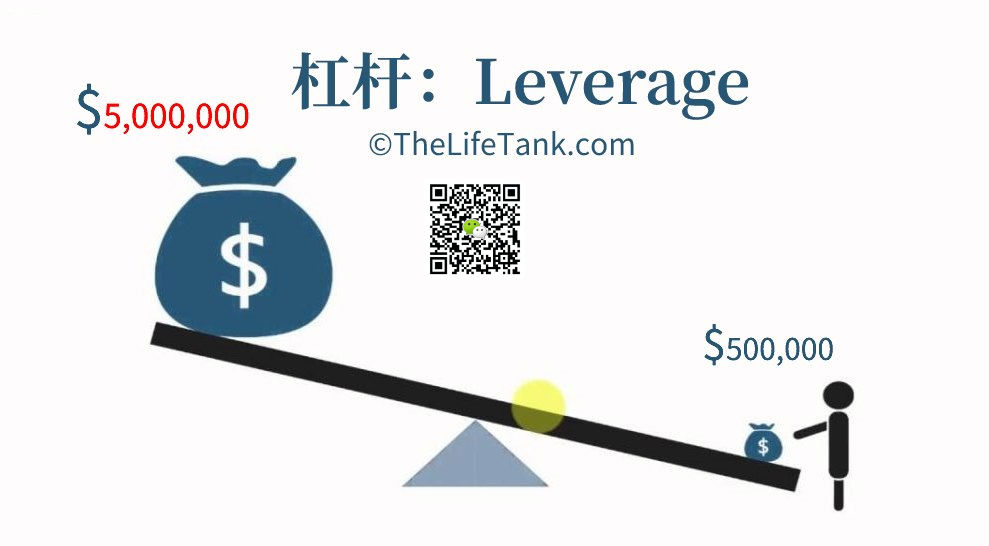

The biggest advantage of the IST Insurance Savings Trust Account is that it does not have the various leverage features included in other life insurance, so the cost is significantly reduced, and the principal amount is guaranteed.

The advantage of the IST Insurance Savings Trust Account is, on the other hand, its disadvantage: it is a savings account and does not offer high claims leverage.When the insured dies, the family members of the children can only receive the account balance.

The advantage of the IST Insurance Savings Trust Account is, on the other hand, its disadvantage: it is a savings account and does not offer high claims leverage.When the insured dies, the family members of the children can only receive the account balance.

(>>>Recommended reading:What is a bumper lever?How to correctly buy insurance leverage?)

From a fiduciary perspective

XNUMX. Safety and stability

Protect wealth from political instability and provide a safe environment to protect personal wealth while ensuring the safety of their capital.

XNUMX. Full control

Whether it is investment management or the way assets are allocated to family members, the policyholder is in full control.Convert all heavy assets into light assets and integrate them under the same trust account for easy management, transfer and inheritance.

XNUMX. Asset Confidentiality

Using a specific trust account, a suitable structure can be established to ensure the confidentiality of the identities of all parties.However, in limited circumstances, disclosure to the relevant body may still be required.

IST Insurance Savings Account / Bank Savings Account Comparison

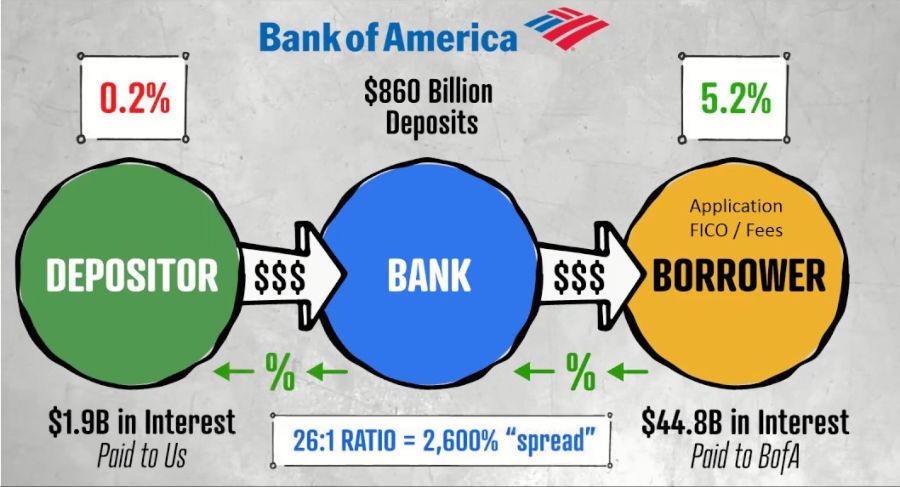

In reality, people's biggest criticism of banks is that when we deposit money into a bank account, the bank only gives lower current interest or fixed deposit interest (as shown in the figure below,"How Banks Make Money ©️Russ Morgan").And banks use our funds to lend in other areas, earning high spreads at high interest - think your business lending rate, or your home loan rate.

©️BankRate 10/07 Bank demand deposit rate Click to view Youtube video description

The bank does not share this income with us.As savers, we are not able to enjoy the huge benefits of our deposit.

Unlike banks,Due to the insurance dividend law, insurance companies must return the vast majority of their annual operating profits (usually 70% to 90%) to IST insurance savings account holders.

In a simple summary and comparison, banks use the public's savings to earn income, and most of the profits have nothing to do with depositors.Insurance companies use the public's savings to earn revenue and return profits to IST policyholders.

Comparison of IST Insurance Savings Trust Account / Savings Participating Insurance

An IST Insurance Trust Savings Account is similar toSavings Participating Insurance.Provides a "guarantee" on the principal, while simplifying the leveraged claims portion of the savings dividend insurance.

After cutting this part of the cost, the IST Insurance Savings Account is fully realized,"Saving + Dividend" in the true sense, is a more extreme choice for "savings + dividends".

Final Evaluation of Insurance Savings Trust Account

The IST Insurance Savings Trust Account is a "Robust defensive type” U.S. dollar asset savings account.Based on historical dividend data over the past nearly 30 years,The annual yield ranges from 0% to 12.4%.

This type of trust + insurance structure savings account,It is suitable for cross-border family or business openings who want 100% complete control of assets, value privacy and flexible asset liquidity, but are not satisfied with bank interest rates.

For those families looking for protection and seeking leverage on claims settlement, the IST insurance savings account may not be suitable; but if it is an "extremely conservative" wealth protection mentality and does not want any loss of principal at all, and at the same time pursues the steady appreciation of funds, then The IST Insurance Savings Trust Account is a product option that deserves serious consideration. (End of full text)

(Related Reading:Evaluation|Comparison of 2 Lifetime Cash Flow Income Plans after Selling a House for Cash )

(Related Reading:Evaluation|No loss is a win?Top 3 Insurance Products and Yield Rankings of USD "Fixed Interest Wealth Management Account")