/column/ breakout in 2020New Coronavirus Outbreak, is an unprecedented crisis facing all mankind.The resulting turmoil and suffering have left a heavy imprint on human modern history.

On the other hand, in the second year after the outbreak of the epidemic, the holders of dollar assets, most American households, have become the biggest winners in terms of monetary figures.

As home and stock prices soared last year, Americans’ bank accounts have lost more money, according to Bloomberg Businessweek estimatesAs much as $26 trillion in additional savings has been piled up — 12% of the U.S. gross domestic product.

A lot of money, ultra-low interest rates, or in the second half of last year, pushed up inflation and unemployment in the United States.

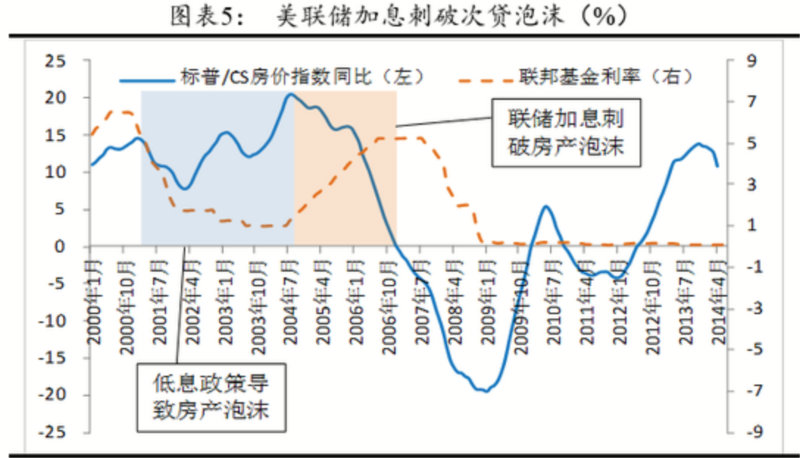

In the face of inflation, a short labor market, and high housing prices, the Federal Reserve changed its attitude in mid-2021 and announced a plan to raise interest rates in 2022.

Historically, every time the Fed enters a cycle of raising interest rates, there is a high probability that it will bring about a recession in asset prices and lead to a sharp depreciation of assets such as house prices and stock prices.

In 2022, both international investors and domestic investors, as holders of US dollar assets,How to protect the currently accumulated US dollar assets, how to protect the existing assets, and achieve the goal of "not losing money, not losing money, and seeking progress while maintaining stability"?

Life insurance for asset protection (abbreviation:property insurance), or will become an important choice for asset allocation in 2022.but with yourLife Insurance Financial AdvisorMeet and discuss before purchasing asset protection life insurance, about"What are you asking? What are you talking about? What are you watching?", the policyholder must understand some basic knowledge.

I have compiled the following 3 common asset insurance function indicators, they should be you and yourLife Insurance Financial AdvisorTopics that must be discussed when planning a project.

1. What is the Annualized Income Protection Rate (Floor Rate)?

dollar-denominated asset insurance that provides policyholder families with aAnnualized Income Protection Rate (Floor Rate).We are used to calling it "Guaranteed rate of return. "

in""Don't lose money", what are the main functions of asset hedging insurance in 2022?In the article, the columnist of finance and insuranceHeather Xiong CFP®️The income protection function of asset insurance is analyzed with pictures and texts——Floor.

Asset insurance brands in different countries and regions provide policyholders with different "guaranteed yield" solutions.From the most common 0% to the gradually emerging 1%, the "guaranteed return rate" of 2% provides a wealth of choices for policyholders seeking asset protection.

Before taking action, policyholders can check with your life insurance financial advisor about the pros and cons of different asset insurance yield strategies.

2. Are there additional insurance bonuses (Bonus)?

Bonus, known as dividend in Chinese, is another unique feature of dollar-denominated asset insurance.

According toThe Life Tank(American Life Insurance Guide©️) evaluation data, asset insurance brands in different countries or regions,They are the assets of the insured, and additionally provide different annual dividend rates from 0.25%, 0.5%, 1.0%, etc..

Policyholders can work with professionalLife Insurance Financial AdvisorDiscuss to understand the additional dividend strategy of different capital insurance brands.Answers to 3 main questions about capital insurance dividends:

- Does this insurance give us additional annual dividends?

- Does the insurance pay dividends from the first year, or after 1 years and 5 years?

- What is the dividend history of the insurance?

Robust annual income protection rate (Floor Rate), and continuous dividend (Bonus) situation, are the two core indicators for evaluating the quality of US dollar asset insurance.

3. Are fixed income rates competitive?

For policyholders who seek certainty and steady growth in assets, "annual fixed rate of return" is another major advantage that property insurance can provide.

According to the basic interest rate of different countries and regions, different asset insurance brands provide different annual fixed income interest rates.

Positioned as "asset management" life insurance groups, they offer annual fixed rates of return that are often much higher than traditional small and mid-sized life insurers.

By January 2022, 1, by community agencyHummingLifeThe data provided shows that a well-known asset insurance brand, the insured assets of high-net-worth customers,Provided a "2% plus 4.3%" portfolio annual fixed rate of return Offer, has become the "sweet pastry" in the current global capital insurance market.

Asset Insurance Column Summary

As a global citizen or a high net worth group, your income is usually higher when you work or hold a job.

Such families often consider,If one day we don't work,For example, if I retire, what will happen to my income and cash flow?Whether our family, children, have enough funds,After any unforeseen circumstances,Enough to live comfortably?

The asset protection insurance that has operated for more than 150 years has helped Western families to achieve a smooth life transition from wealth creation to wealth protection from an institutional perspective.

In this article, the columnist shares the selection with community readers based on actual work cases.Assets Insurance (Asset-Protected Life Insurance)3 core function points of , so that you andLife Insurance Financial AdvisorDiscuss, analyze and compare the advantages and disadvantages of insurance plans.

At last,American Life Insurance Guide©️ pointed out,Any financial asset requires constant data analysis and annual strategic management, and asset insurance is no exception.

American Life Insurance Guide ©️ aims to remind the public of the vital role that insurance professionals play in helping individuals, families and businesses plan the insurance products that best suit their needs.

(>>>Recommended reading:The difference in earnings over 30 years is $186 million. Is my policy correct?)

In the next column,American Life Insurance Guide©️ will continue to reviewAsset Insurance Volatility Control IndexBased on the performance of the whole year in 2021, and compared with the results in 2020, the annual champion of the asset insurance volatility control index in 20201 was selected. (End of full text)

(>>>Recommended reading:How to correctly take the first step in insurance financing?4 questions to discuss with your insurance advisor)

(>>>Recommended reading:Family asset allocation strategy: What percentage of family income can I use to buy insurance?)

*The opinions in this article do not represent investment opinions, and the content is for reference only and does not constitute any investment and application advice.The rates provided in this article are not guaranteed rates.Each insurance rate is determined by the life insurance company and changes periodically.Before you take any action, you need to consult with a financial advisor with the appropriate insurance license and professional certification.