At the beginning of 2022, the market ushered in a sharp correction.The "net red stocks" and "star stocks" that were very popular in the past have hit record lows in stock prices.

Peloton, a former star online celebrity stock on Youtube, fell from a peak of $160 to $23, 1The annual decline reached -83.56%.In other words, with an investment of 100 yuan, in one year, the principal is less than 1 yuan.

(The former star stock Peloton plummeted -95.08%)

(The former star stock Peloton plummeted -95.08%)

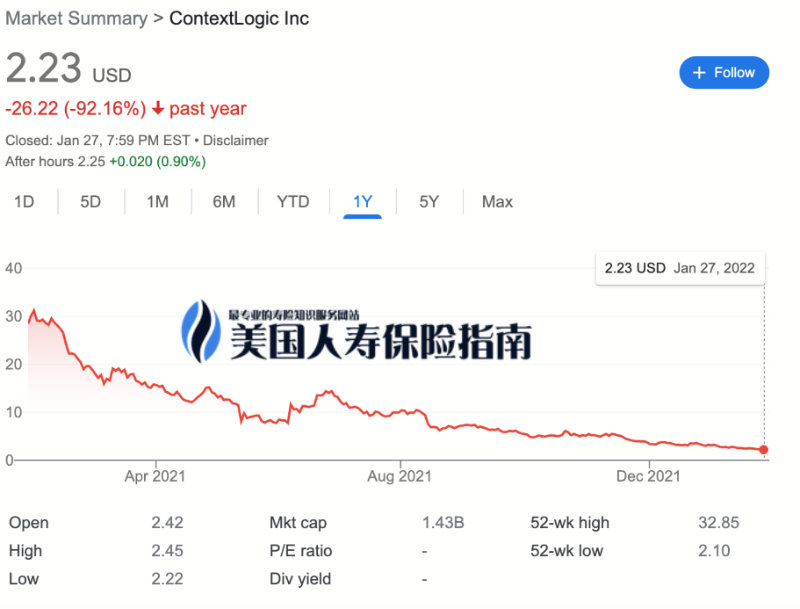

Wish, the same popular star stock last year,A drop of -1% within 92.16 year,At present, it continues to maintain a downward trend, and many ballast partners are also suffering.

(YouTube celebrity stock Wish, plunged -92.16% in one year)

Virtual currencies cannot avoid the impact of the sharp drop in the stock market. Bitcoin and Ethereum have also fallen by more than 20% recently.

In this volatile market environment,How to ensure "no loss of money" in the first place, and "no loss of money" for capital hedging has become our primary choice.

A more widely circulated statement in the financial circle is that, "One profit, two draws, seven losses"——If a family can keep the tie without loss, it has already won the majority of the 70%.

(Buffett's investment principle: don't lose money)

(Buffett's investment principle: don't lose money)

Naturally we will ask questions,Is there a financial product that can effectively protect funds?

Asset insurance underpinning function (Floor)

Asset-based life insurance is a life insurance policy that includes specific features, often referred to as "asset insurance".

Every asset insurance policy will be marked in the contract. Even when the stock market plummets, the insurance company will promise that the cash value income of the policy account will never be less than 0%.

Some financial insurance companies promise an annual return on the cash value of the policy account, with a minimum of 1% or even 2%.

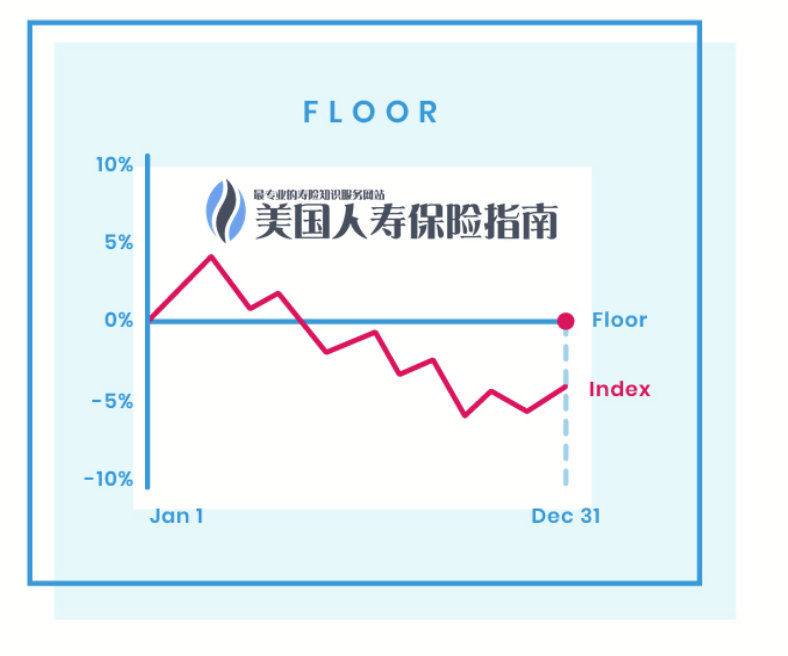

This 0%, 1%. The figure of 2% is the underpinning protection function of asset-based insurance.In the worst case, it can give a "protected floor" rate of return to the policy account.This "protection bottom", we call it Floor.

How does underpinning asset insurance protect our funds?

life insurance for asset protection,Through the "Floor" function, which provides protection of cash value.

I will illustrate with an example.As shown in the chart above, the red line represents the one-year trend of the stock index (Index, such as the S&P 500).Over the course of a year, let's say the stock market is down 5%.

If we invest in stock index financial management ourselves, then after a year,The funds in our investment account will directly shrink by 5%.

But with the protection of the floor function (Floor), the funds in the insurance cash value account,You will get a minimum 0% income guarantee(Some insurance products provide guaranteed return protection of 1% or higher), therefore, the funds in the policy cash value account will not shrink with the overall decline in the securities market.

Our funds are effectively protected in a falling market environment.

(>>>Recommended reading: Annual Billing: Do I Make Money When the Stock Market Falls? |What is the guaranteed minimum return of an index insurance account?)

Article summary

With the large correction in the US stock market, some families' financial accounts are facing the dilemma of huge losses on paper.

"Don't lose money, don't lose money" and "seek progress while maintaining stability" have become the first choice of financial management for many families.

At the same time, a large number of funds have been withdrawn from stock and bond funds, and they are also seeking safer investment channels.

Asset-based life insurance with a floor function has become an important channel for capital hedging.

This article only briefly introduces the underlying protection principle of asset-protected life insurance. Some excellent asset-based life insurance schemes provide additional asset protection functions in addition to "Floor" protection, which can help policyholders to be more comprehensive The management of the risk of loss caused by severe market fluctuations.

Policyholders from different countries or regions canInternational Life Insurance Financial AdvisorWith the assistance of , by understanding the performance indicators of property insurance brands in different countries or regions, and different historical protection benefits, comparing the advantages and disadvantages of different products, and finally finding an insurance plan that can better protect family assets. (End of full text)

(>>>Recommended reading:Buy property insurance?What are the 3 core questions that must be discussed with an insurance advisor?)

(>>>Recommended reading:Family asset allocation strategy: What percentage of family income can I use to buy insurance?)