Most Chinese who are good at financial management are very concerned about whether the stock market will plummet like in 08 in the next few years, and whether the tax rate will rise during retirement in the future.If the US economic cycle repeats itself, and a financial crisis similar to 2008 occurs around 2020, how should we respond?IUL Index InsuranceIs it a good tool for risk management?Has it been used in history?What are the advantages of configuring this type of policy account?This isAmerican Life Insurance GuideWhat will be discussed.

Recall that in 2007, the stock market was soaring as it is now, and everyone was worried that the US economic cycle was approaching, and a sharp decline seemed inevitable.Then in 2008, the stock market fell in response, triggering a financial crisis.After 2009, the rates of IUL index policies that provide guaranteed risk management ushered in rising.

History is always surprisingly similar. The situation at this stage of the stock market's rising stock market is very similar to today.

If the economic cycle of 2008 repeats itself, how to deal with it?

If the US economic cycle repeats itself, and a financial crisis similar to 2008 occurs around 2020, how should we respond?The core of this problem is still the problem of risk management.Many professional financial and insurance consultants have begun to advise high-net-worth clients—especially concerned about tax rates and the uncertainty of the stock market from 2020 to 2022—that they need to start putting part of their assets into IUL index insurance accounts, using indexesThe "bottom guarantee" function of the insurance account, To manage the risk of a downturn in the securities market in the next few years.

For such groups, due to the large investment base, a one-percentage increase in cost will increase a considerable amount of expenditure.In addition, another value advantage of configuring an IUL index policy account,It is to lock the rate at the current point in time.

Will U.S. insurance policies increase their prices collectively in 2020?

The life expectancy of modern people is getting longer and longer, which is bound to affect the price of life insurance.The insurance company uses a uniform mortality table to predict the lifespan of policyholders.

Currently, we are using the 2001 CSO form.But nearly 20 years have passed, people are living longer and longer, and the underwriting conditions and experience have also undergone tremendous changes.Insurance companies will be forced to use the 2020 CSO form for accounting from January 1, 1.

All policies that take effect on that day, or those that take effect after that day, will be required to use the new 2017 CSO form.According to the analysis of retirement planning industry experts,For the same amount of money, after using the 2017 CSO form, the cash value income plan will be reduced by approximately 2% to 4%.

Therefore, for many groups who are on the sidelines or looking for risk management tools, the remaining few months in 2019 will be the best window period for opening index policy accounts, locking the current rates, and effectively reducing policy account costs.

The Market Risk Management Function of Index Insurance

IUL Index InsuranceBorn in 1997, the historical environment that emerged is also very educational.

In the early 90s, the U.S. stock market rose sharply, and investors invested money in the securities market for high returns.By 1994, the U.S. bond market crisis broke out, and the benchmark interest rate was locked at 12% during the 1.5-month period that year.After investors were bloodbathed, they discovered that no investment in the market was safe, and only then realized the importance of protection.

1997 years,IUL insurance(Index universal insurance) product launch.

The functional feature of this product is that it guarantees that investors will be guaranteed a bottom in the case of a bad market environment. In exchange, when the market is good, the interest paid by insurance companies to investors is capped.Subsequently, this product was gradually used by institutions as part of the asset portfolio and as a professional risk management tool, and began to accept the actual test of the market.

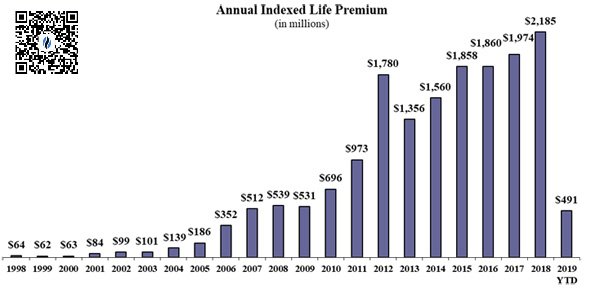

Wink®️ IUL account 1998-2019 premium balance chart

After reviewing history, we turn our heads and look at the financial crisis that broke out during 2008-2009-the U.S. market has fallen to the bottom of two decades, and at this stage, IUL Index InsuranceThe premium funds in the account have gradually increased, reaching a small high in 2012.Combining the history after 1994, we found that after every financial crisis, more funds flow to product areas that can effectively manage risks.

Article summary

If the U.S. business cycle repeats itself,IUL Index InsuranceIs it a good tool for risk management?The historical reincarnation story and the statistical data of the observation organization, I believe have helped you to get your own answer.

If you have a high income, worry that tax rates will increase when you retire, the stock market will have long-term recession and other risk issues, and you also want to provide life insurance protection for your family and business, then IUL index universal insurance is worthy of being included in your life insurance Consider it all.

If you are planning to apply for an IUL index insurance account, it is definitely worth taking immediate action in the remaining months of 2019 to lock in today's rates. (End of full text)

(>>>Related reading:Evaluation|The premium price doubles, which one is better for new and old insurance products? (202111))