(RetireGuru©️ Retirement CollegeColumn) For the Chinese who need to reach retirement age, "there is $100 million on the account" which is really cool, rightRetirement lifeFull of confidence.But the increase in the cost of living in the United States cannot be underestimated. To a large extent, how long $100 million can be used after retirement depends entirely on where we live.

According to a Fidelity Investment report, in some parts of the United States, $100 million may only last 10 years.

The column editor of GoBankingRate believes that $100 million is the one we usually setDecent retirementThe demarcation line number is specific to the individual, but the most important thing is to look at the actual situation of the individual.

How long can a $100 million pension last in every state in the United States?

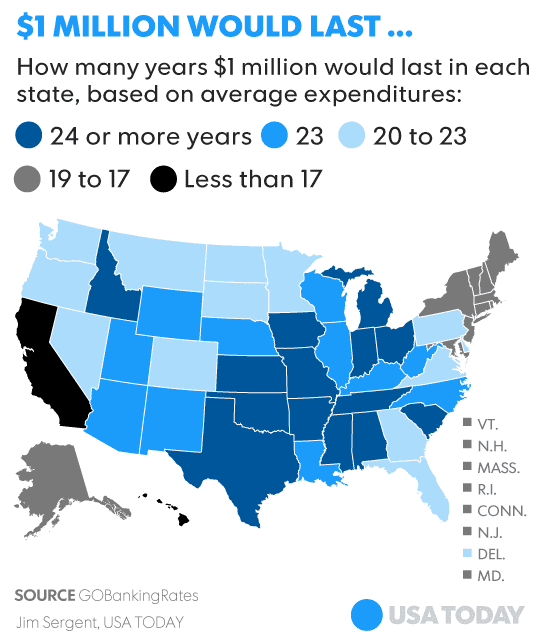

After comparing the average expenditures of general merchandise, housing, water, electricity and gas networks, transportation, and medical and health care for retirees aged 65 and over in the U.S. states, theA graph showing how long a $100 million pension can last in every state in the United States.

$100 million US dollars to strengthen the top 5 list

- Mississippi: 26 years, 4 months

- Arkansas: 25 years, 6 months

- Oklahoma: 25 years, 2 months

- Michigan: 25 years

- Tennessee: 25 years

The above results are not surprising, this is the same as retireGuru©️Retirement CollegePreviously reported "Top rankings for decent retirement expenses in U.S. states"It's basically the same.Central and southern states, such as Mississippi, Arkansas, and Tennessee, are relatively more suitable for retirement. The $100 million retirement savings can guarantee a decent retirement life for nearly 25 years.

But let's look at the other side of spending-Hawaii is a big spender.Residents who retire here have to spend an average of 30% more to equalize the same quality of life in retirement in other places.Due to the high housing prices, the cost of living is not low, the same one million US dollars, the support of a decent retirement life is much shorter.Below is the list of the largest retirement expenses.

$100 million is the least strong ranking Top5

- Hawaii: 11 years, 11 months

- California: 16 years, 5 months

- Alaska: 17 years

- New York State: 17 years

- Massachusetts: 17 years, 4 months

After reading these data, it is easier to understand the importance of preparing for your retirement from the beginning of work.But according to 2018Northwest ReciprocityThe report shows thatOne-third of Americans save less than $1 for retirement.In general, Americans with retirement savings have an average account deposit of $3, which is far from enough for retirement.

Do you already have your ownRetirement plan, If so, has your retirement plan started to work for you correctly?

(End of full text American Life Insurance Guide Edit report)