Hong Kong has recently become the focus of the world.In the insurance industry, the circle of friends of insurance practitioners in China, Hong Kong and the U.S. has also been "Hong Kong Insurance lost 4 million overnight, and more than 200 insured persons have raised banners to defend their rights."AXISAXA InsuranceThe title "Blow Thunder Loss 4 Million" has been screened. What is going on here? What is the product of "Blow Thunder Loss 4 Million"? Why is it "Blow Thunder"? Has the same thing happened in the history of the American insurance industry? How does the US market do it?American Life Insurance GuideThe interpretation was carried out for the first time.

What is the insurance product of AXA Hong Kong Thunderstorm?

The "explosive" product isAXA InsuranceA model sold on the Hong Kong marketNon-guaranteed investment-linked insurance products.This product is called 105 investment-linked insurance Evolution.

What is investment-linked insurance?

Investment-linked insurance is an insurance type in the Hong Kong insurance market.Its protection function is very weak, and the product emphasizes assets and neglects protection, The protection part is generalOnly 101% or 105% of the policy value,Therefore, Hong Kong investment-linked insurance is also referred to as 101 and 105.

American Life Insurance GuideI believe that this type of insurance market in Hong KongInvestment-linked insuranceThe product is closer to a wealth management product than an insurance product.The prototype of its product is benchmarked against the rise of the United States in the mid-80sVUL.Investment universal insuranceInsurance types.

Why does this product of AXA explode?

This product called 105 investment-linked insurance Evolution, the operation principle andVUL Insurance ProductsThe operating principle is similar - the policyholder (investor) can choose different funds as the investment target through the policy management agency after purchasing.

The real reason for the "explosive thunder" is that there is a fund in the Evolution product called "Hong Kong Investment Fund SP" (Hong Kong Investment Fund, referred to as HKIF), which has a serious "default", resulting in the investment of the fund's client's account value It plummeted by 95% overnight.It is said that the total loss of more than 200 investors is as high as 4 million Hong Kong dollars.On social media, headlines like "Hong Kong Insurance lost 4 million overnight, and more than 200 policyholders pulled banners to defend their rights."

Have the VUL products in the history of the United States "exploded with thunder"?

History is always strikingly similar.In the history of the United States, this type of heavy investment and negligence of protection, with the name "insurance" and the story of "bloodbath" policyholders, was almost the same as the incident of Hong Kong's AXA insurance policy.

In the early 90s, the U.S. stock market rose sharply. For high returns, consumers focused on mutual funds, stock markets andInvestment universal insurance(VUL) above, the economic situation is very good.

By 1994, the US bond market crisis broke out, and the benchmark interest rate was locked at 12% for 1.5 months of the year.Due to the thenVUL Insurance Product PerformanceLimited, the history of appearance is not long, and the relevant terms and functions are not perfect.Investment Universal Insurance VUL InsuranceInvestors in the product are double bloodbathed by sluggish returns and high management fees, which can be said to be exactly the same as the experience of insured products such as AXA Hong Kong.

The reaction and evolution of the U.S. insurance market

After the bloodbath in the market in the 90s, investors found that no investment in the market was safe, and only then did they realize the importance of insurance as a security product.At the same time, consumers began to shy away from investment products due to the tragic lesson.correspondingVUL Investment InsuranceThe sales of the product plummeted, and it was immediately thrown into the cold palace of history.

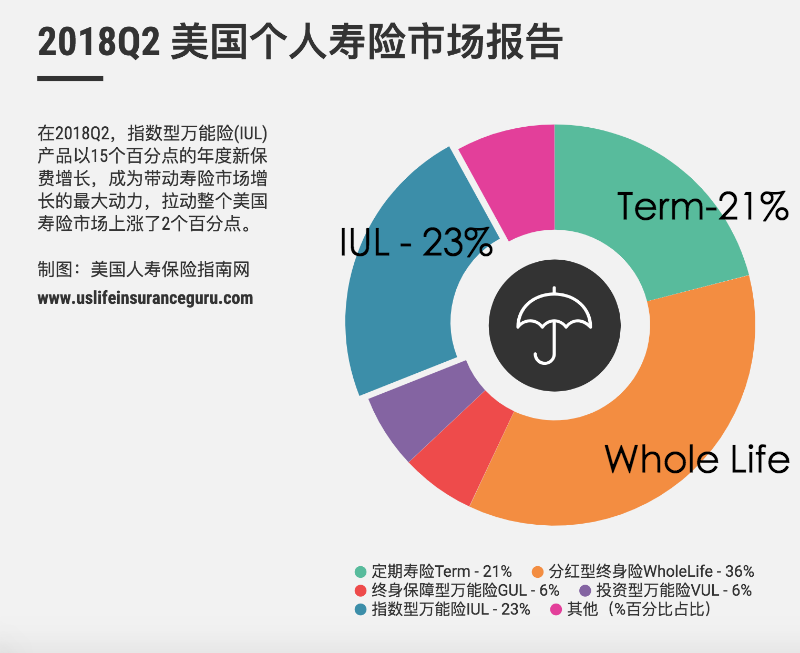

By 2018, fromAmerican Life Insurance GuideShown in the published data chart,VUL Investment InsuranceThe market share is only 6%.

In 1997, the U.S. insurance industry began to introduceIUL insurance(Index Universal Insurance)product.This product guarantees that in the case of a bad market environment, investors will be guaranteed a bottom. In exchange, when the market is good, the interest paid by insurance companies to investors will be capped.With a summary of historical lessons and a leading design concept, it provides a "bottom-proof" functionIndex insuranceInsurance types have gradually become a mainstream product in the US market, and it is also the first insurance product in the US market.

Article summary

从AXA InsuranceThe case of this product in Hong Kong "explosive thunder" can be seen in comparison with the history of the development of the American insurance industry, "There is nothing new under the sun"——The story that happened in the insurance industry in Hong Kong in 2019 also happened in the United States 25 years ago. But whether the lessons have been absorbed and whether the subsequent products have been improved, this is what policyholders care about.

In the "Explosion" incident of AXA, on the one hand, AXA, as the designer of selecting this fund and incorporating it into the investment target of Evolution, must have an inescapable responsibility.But on the other hand, investors who pursue high returns always seem to forget the inherent "protection" function of insurance products.

On the other hand, the American insurance industry and policyholders on the other side of the ocean have absorbed the lessons of history and constantly revised according to the market.Index insuranceInsurance market, but also improved the originalVUL insuranceThe investment sub-account functions and terms ofVUL insurance, exploring a new market direction for the development of insurance markets in other countries and regions.

#Good luck in Hong Kong.