Some policyholders sometimes ask: Is the insurance company reliable?Will it go bankrupt?What if it goes bankrupt?Some people also ask whether the insurance policies and contracts of the insurance company will not be counted.

After the 2008 financial crisis, almost everyone has questions about insurance companies, worrying about their failure or non-performance of contracts.It is normal for consumers to have these questions. Today's article will give a more detailed explanation of these questions.

Professional credit rating of insurance companies

In the United States, some independent institutions assess and score the financial strength and claims settlement capabilities of insurance companies, which can be used as a reference for consumers.The three largest credit rating agencies are Stand & Poor Standard & Poor, Moody’s Moody’s and Fitch Fitch. They are called Big3. The first two are fully American companies. Fitch used to have some British shares, but now it is also fully It is a US-owned company.

In the United States, some independent institutions assess and score the financial strength and claims settlement capabilities of insurance companies, which can be used as a reference for consumers.The three largest credit rating agencies are Stand & Poor Standard & Poor, Moody’s Moody’s and Fitch Fitch. They are called Big3. The first two are fully American companies. Fitch used to have some British shares, but now it is also fully It is a US-owned company.

They evaluate the company’s debt repayment ability and claim settlement ability based on the company’s assets and liabilities, past history, future prospects and other factors, and then score points respectively, represented by the letters A, B, C, and D (Moody’s only to C). A letter represents a level.

(Recommended reading:How are American insurance companies rated and ranked?How to interpret the company rating in detail?How does understanding ratings help me?)

A means that the risk is small, B means that there is a certain risk, and C means that the risk is extremely high, and D is bankrupt.Each level is further subdivided, such as AAA to A- and seven grades, and B is divided into nine grades.If you get the most advanced AAA, it is generally considered that there is no risk or the risk is extremely low.Generally, if the insurance company gets an A-level score, it is more reliable and not easy to fail; if the company’s score is BB or above, it means that there are some risks and you should proceed with caution. B or B- companies are best not to Touch, C or D, you have to hide farther away.

To understand the ratings of major insurance companies, please check the American Life Insurance Guide websiteCompany rankings and brand ratings.In addition to evaluating a company, these three evaluation agencies also evaluate the national debt of various governments. Their power is huge, and each adjustment can affect a country and even the global financial market.

The difference between insurance companies and banks facing financial crises

After the financial crisis, no company dared to boast that it would not fail. Even if it dared to say so, no one believed it. After all, Lehman Brothers, the leader in Wall Street finance with a history of more than 100 years, fell.However, a little analysis will reveal that insurance companies are more reliable than banks and less likely to fail.When depositing money in a bank, people want to withdraw their deposits whenever there is a turmoil, which forms a run.

If a run becomes a trend and exceeds the bank’s emergency reserves, the bank will go bankrupt, because the bank absorbs your deposits, except for a small part of the daily flow to meet the requirements of the Federal Reserve, most of which are used for relatively long-term investments, such as housing. Loans, industrial and commercial loans, etc., these investments have a certain time limit and cannot be withdrawn at any time.Therefore, if a large-scale run occurs, the bank will only fail and the Fed will take over.

But insurance companies are different.The main products of insurance companies arelife insurance,pension,Long-term care insuranceWait, these products can't be run.If you buy 100 million life insurance, the immortality insurance company will not compensate 50; if you cancel the insurance halfway, you will usually lose a lot, and it is not suitable for short-term investment purposes.

Most annuities also have a surrender period ranging from several years (Surrender period), if the contract is cancelled without expiration, there will be a surrender charge (surrender charge).After buying long-term care insurance or disability income insurance, there is no way to refund the policy and get the money back.In this way, there is almost no run on insurance companies, and sporadic claims will not hurt the insurance company. Because the probability of death is stable and declining, insurance companies must retain at least 25% of the cash to meet the needs of claims.The cancellation of insurance or annuity is only the customer, and the insurance company will not be affected.

The most likely cause of bankruptcy of insurance companies is investment failure.During the 2008 financial turmoil,AIGIn the face of a compensation crisis, it is not that its life insurance company is not operating well, but that the investment department is betting on subprime failures-the CDS product operated by AIG provides a credit guarantee contract for Lehman Brothers Home Mortgage Bonds (CDS) with a net loss of 78 billion The US dollar affects the entire AIG.

Subsequently, the U.S. government took 850 billion U.S. dollars in aid. This aid reserve reached 850 billion U.S. dollars, and the Federal Reserve took over AIG The company’s 79.9% equity.This is in the history of American finance,For the first time, there was a financial insurance company (state-owned enterprise) directly held by the government.

Unlike banks, insurance companies are supervised at the state level, and the state insurance guarantee association IGA provides reinsurance to policyholders.When the insurance company defaults or becomes insolvent, the SGA policyholders of the state guarantee fund will compensate.

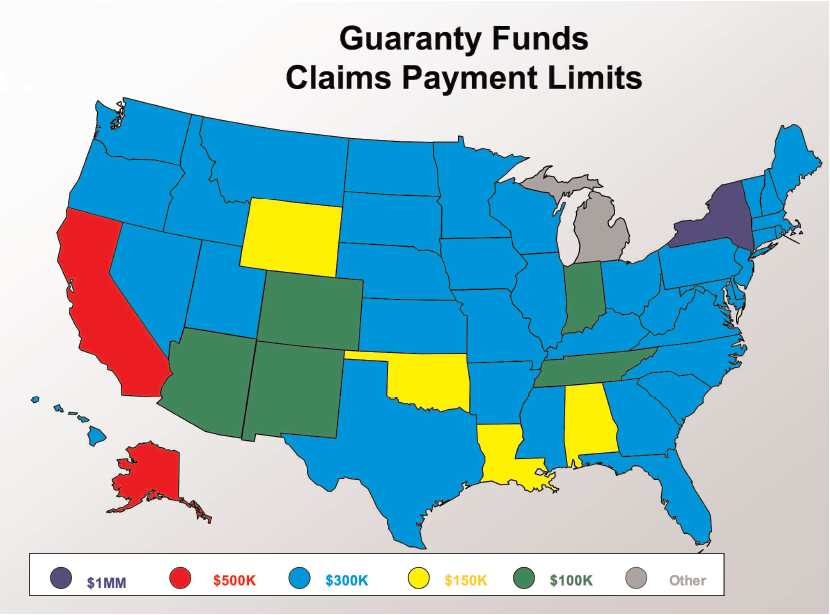

(The insurance bond associations of each state will reinsurance and settle claims on the insurance account of the insured person. The above picture shows the upper limit of claims for each state ©️insurancejournal)

(The insurance bond associations of each state will reinsurance and settle claims on the insurance account of the insured person. The above picture shows the upper limit of claims for each state ©️insurancejournal)

Insurance companies are regulated by the government to participate in reinsurance

Of course, not easy to fail does not mean that it will not fail. In order to reduce and avoid the losses caused by the failure of insurance companies to customers and the impact on society, government regulatory agencies require all insurance companies to participate in re-insurance (re-insurance) Establish a guarantee fund (Guarantee fund) in each state with the premium paid by buying reinsurance.If an insurance company is going to close down, the reinsurance agency will appoint another insurance company to take over, and the guarantee fund will be responsible for the guarantee.

Someone asked why it is not an FDIC guarantee, which involves the regulatory license rights of the banking and insurance industries.Banks are mainly managed by the federal government, so the bank's insurance is called FDIC, its full name is Federal Deposit Insurance Corporation, which mainly provides guarantees for bank deposits. FDIC is not a free lunch. Banks also have to pay premiums to obtain FDIC guarantees. In the past few years, bank failures increased significantly and the FDIC's funds were insufficient, and bank insurance premiums soared.

Unlike banks, insurance companies are mainly regulated by state laws, and there is no national (federal) regulatory agency in form, and its guarantee agency is not called Federal Reinsurance.Instead, each state manages its own guarantee fund.As long as insurance companies sell policies in a certain state, they must buy reinsurance from that state, and use the money to buy reinsurance to establish guarantee funds in each state.

To sum up, in terms of security, insurance companies are undoubtedly more reliable than banks. The risk of insurance companies going bankrupt is very small, and there is reinsurance guarantee, so there is no need to worry too much about them going bankrupt.

(>>>Related reading:Military giant Lockheed's pension options: $49 billion annuity insurance )