(Click on the picture to visit the 2020 U.S. General Election Special)

At the end of September 2020, the New York TimesPresidential electionA survey published during the period pointed out that the current U.S. President Trump, between 2016 and 2017,Only paid $750 in federal personal income tax1, Causing an uproar in public opinion.

Donald Trump became the richest president in American history for $25 billion

Donald Trump became the richest president in American history for $25 billion

This could not help but raise a question:How do wealthy American families avoid taxes and accumulate wealth?

The wealthy have the lowest chance of being taxed

TIGAT, the U.S. Department of the Treasury's independent monitoring agency for the Internal Revenue Service, found2, There are 879,415 high-income Americans. Between 2014 and 2016, they did not file their taxes at all, and the Internal Revenue Service did not try to recover them.There were 326,579 cases, which did not enter the recovery system of the IRS from beginning to end, and 42,610 cases ended without problems.

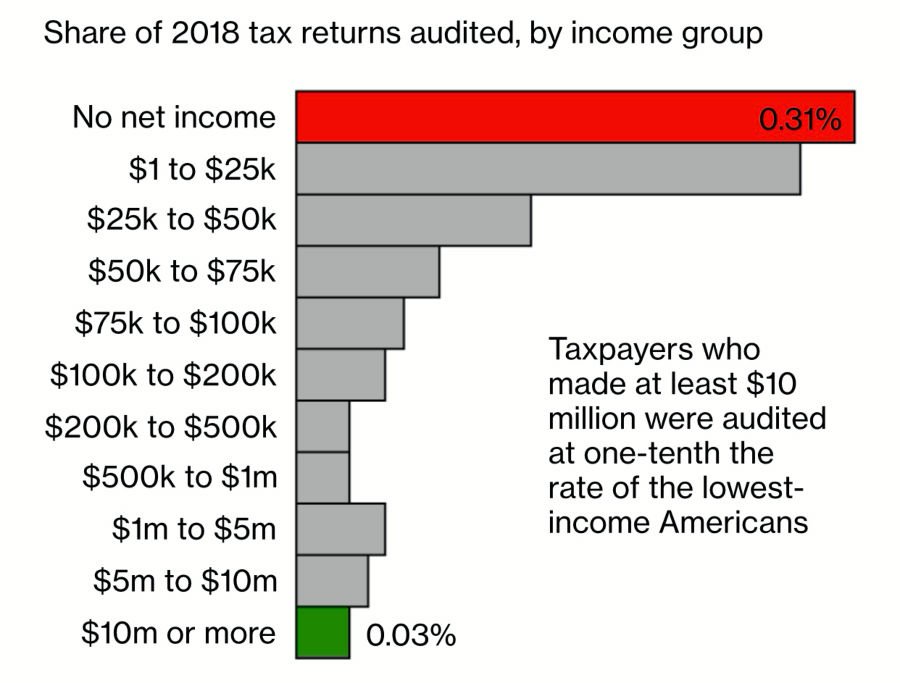

The issue of tax recovery by the IRS for the wealthy is also widely disputed.The chart below shows the probability of tax inspections by the IRS in 2018 for groups of different incomes.Taking 2018 data as an example, comparing the probability of different income groups being inspected by the IRS, the conclusion is that "Classes with incomes of more than ten million have the lowest chance of being checked by the IRS, which is one-tenth of the probability of being checked by the poorest class.. "

(©️Bloomberg, data source: Gabriel Zucman & Emmanuel Saez, University of California, Berkeley, Internal Revenue Service)

How do the wealthy Americans avoid taxes and accumulate wealth?

The current situation in American society is that wealthy families, with the help of professionals,Pay almost no or very little tax.In addition to using the "loss" method for tax deductions, there are three types of tax avoidance tools commonly used by wealthy families:Trusts, private pensions, and life insurance.

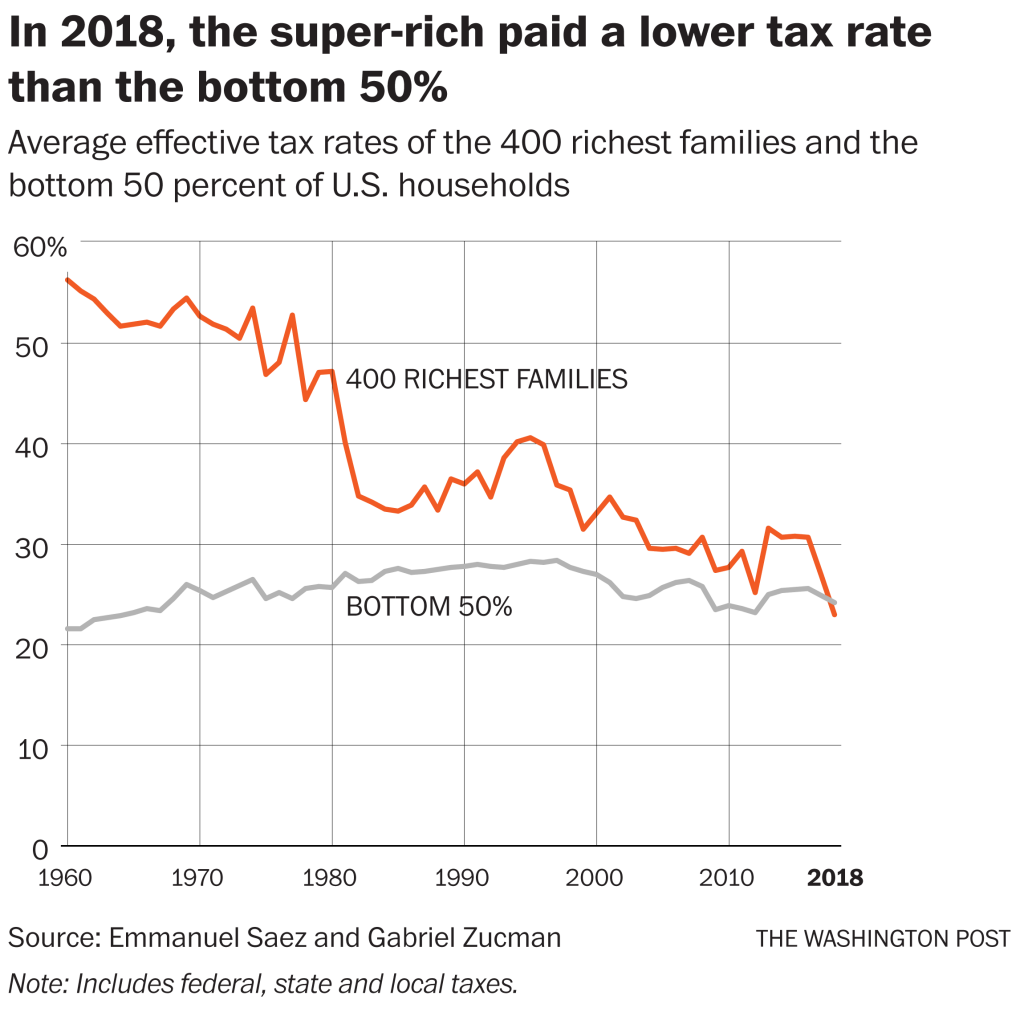

The 400 wealthiest families have an effective tax rate of less than 50% for lower-level U.S. families ©️Washington Post

The 400 wealthiest families have an effective tax rate of less than 50% for lower-level U.S. families ©️Washington Post

And in the largest scale of assetsInheritance of wealthIn the planning of this link, the use of life insurance is a common way for wealthy families to maximize their assets and pass on more money to their children and heirs.

This method of "life insurance" is also the focus of this article.

Tax law "favors" life insurance

Tax law provisions give life insurance premiums and tax advantages3, And allow wealthy families to use life insurance to protect their assets.Life insurance claims are tax-free for beneficiaries.

For wealthy families, the elders do not want their own deaths to impact the financial situation of their children, heirs and the entire family.Therefore, the complete tax-free death claim for beneficiaries is the most basic and core function of any life insurance.

But life insurance has other advantages.

In 2020, if all of your assets are within $1158 million ($2316 million for husband and wife), then they canInheritance of wealthFor children, there is no federal estate tax.But what if all your assets exceed $1158 million?

使用Large life insurance policy,Leave it to the children as the beneficiaries. When the inheritance and transfer of wealth are to be carried out, the heirs can use the life insurance claims to pay for the part of the tax that exceeds the inheritance tax exemption.

Life insurance premiums will not be treated as inheritance, and will be levied on inheritance tax.For example, if we spend $100 million to purchase a life insurance with a face value of $500 million in death compensation, then the equal premium will not be calculated into the inheritance, and it is guaranteed that the children and family members can get a sum of $500 million. funds.

(>>>Recommended reading:Life Insurance Academy #9: Is American life insurance really tax-free? )

The wealthy see life insurance as an "asset"

Different types of life insurance and products have different external and internal values.

Life insurance policies that focus on the potential for cash value accumulation are more than just the payment of claims.When this life insurance is not needed, it can also be settled and sold in a professional organization.These advantages are described in Forbes’ column "Is life insurance an asset?A detailed description is given in the article.

A cash value lifetime life insurance, through the correct design, its interest-bearing income during the cash value accumulation period, or dividend income, will not generate tax problems during the accumulation phase.

Once we have built a strong enough cash value account through the power of the market and time, we can use private banking services just like that.Use the personal loan service of a life insurance company.

Finally, forLife insuranceIn other words, no matter what our health condition becomes as we grow older, the compensation of this policy will ultimately be paid to the family or children of the insured person.

Article summary: Think like a rich man

2020U.S. Covid-XNUMXDuring the period, the total wealth of the 643 billionaires, the richest in the United States, increased by approximately US$8450 billion, from US$2.95 trillion to US$3.8 trillion.In the same period, 20 Americans died in the epidemic, triggering the worst unemployment since the Great Depression.

The comparison between the two shows once again the current situation of economic inequality in American society and the increasing polarization between the rich and the poor before everyone.

As for every family, the inspiration to learn from it may be to think and act like the rich.

"Save, and believe in the power of time, rely on the rules of the system to maximize the compound interest growth of wealth."

On the surface, the yardstick for distinguishing the rich and the poor is the total amount of personal assets.But at the bottom of it, how to treat oneself well, whether you are willing to understand and play the existing system rules and advantages, as well as the use and allocation of assets, or the difference in financial management concepts, is the source of everyone's differentiation between the rich and the poor. . (Finish)

>>>Recommended reading: What is the annual income of the family of the President of the United States in 2020?What life insurance did you buy?

appendix:

1. “Long-concealed records show trump's chronic losses and years of tax avoidance”, 09/27/2020, Russ Buettner, Susanne Craig, and Mike McIntire, https://www.nytimes.com/interactive/2020/09/ 27/us/donald-trump-taxes.html

2. "Trump's Taxes Give Biden Blueprint to Fix System Rigged for Rich", 10/01/2020, Ben Steverman, Bloomberg Businessweek.

3. "Why the Wealthy Should Buy Lots of Life Insurance", 08/15/2020, Barbara Fridberg, Investopedia.com