(Click on the picture to visit the 2020 U.S. General Election Special)

Disclosure of tax returns has been a tradition in the election of successive US presidential candidates.Through the tax return, the public can understand the true financial status of the families of important government officials.

Although U.S. law does not make mandatory requirements, But in the past 30 years,Almost all presidential candidates, as well as vice presidential candidates (except 7), Have disclosed their personal tax returns.

The current U.S. President Trump is the first president not to disclose his tax returns to the public since 1976.1. therefore,American Life Insurance GuideThere is no way to know his life insurance policy holdings.

In 2016, Hillary Clinton, the presidential candidate who competed with Trump for the 45th president of the United States, made a detailed public disclosure of the wealth of the family. Among them,Contains life insurance asset information.

©️The Independent

©️The Independent

FromAmerican Life Insurance GuideFrom the interpretation of this financial report by Net, we can learn that as the former first lady of the United States, the former Secretary of State, and the 45th US presidential candidate,What kind of life insurance does Hillary Clinton hold?Which company's products are these life insurances?And the possible reasons why the Clinton family bought life insurance.

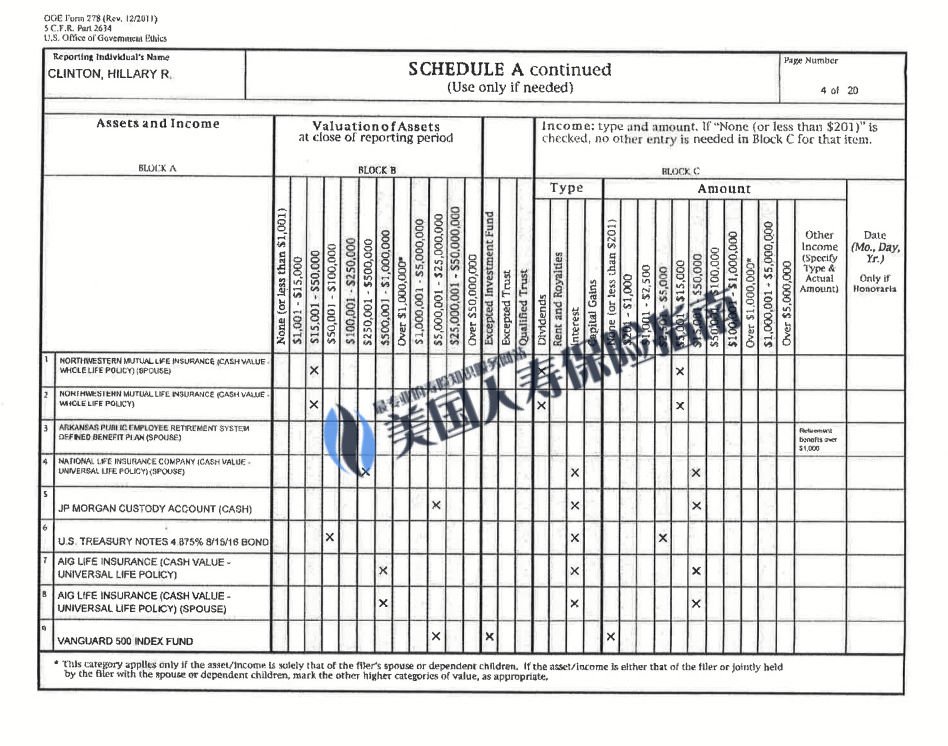

Presidential Candidate’s Life Insurance Policy Assets Sheet

According to the documents, Hillary and her husband Clinton hold a total of 5 life insurance policies.

(Hillary Clinton Schedule A Life Insurance Account and Benefit Section)

(Hillary Clinton Schedule A Life Insurance Account and Benefit Section)

The following is a specific list:

- Northwest Mutual Life Insurance Company, Participating Life Insurance Account (Spouse)

- Cash value of assets – $15,001 – $50,000

- Dividend income: $5,001 – $15,000

- Northwest Mutual Life Insurance Company, Participating Life Insurance Account

- Cash value of assets – $15,001 – $50,000

- Dividend income: $5,001 $15,000

- National Life Insurance Company, Universal Insurance Policy Account (Spouse)

- Cash value of assets – $250,001 – $500,000

- Interest income: $15,001 – $50,000

- AIG American International Group Life Insurance Company, Universal Insurance Policy Account

- Cash value of assets – $500,001 – $1,000,000

- Interest income: $15,001 – $50,000

- AIG American International Group Life Insurance Company, Universal Insurance Policy Account (Spouse)

- Cash value of assets – $500,001 – $1,000,000

- Interest income: $15,001 – $50,000

Analysis of the Insurance Policy of the Presidential Candidate's Family

The 5 life insurance policies of the Hillary family are all with "cash value"Whole life insuranceproduct.

The characteristic of this type of cash value insurance policy is that through medium and long-term accumulation, the cash value in the policy account will snowball through the dividends or investment interest of the life insurance company.

Among these five life insurance policies, three of them have relatively larger face value limits.Among them, former President Clinton has insured two, one is a national life insurance policy.The cash value is between $25 and $50, The other one is the insurance policy of AIG American International Group,The cash value of the policy is between $50 and $100 million.

Hillary has insured one of the policies.This kind of insurance policy is issued by AIG American International Group,The cash value of the policy is between $50 and $100 million.

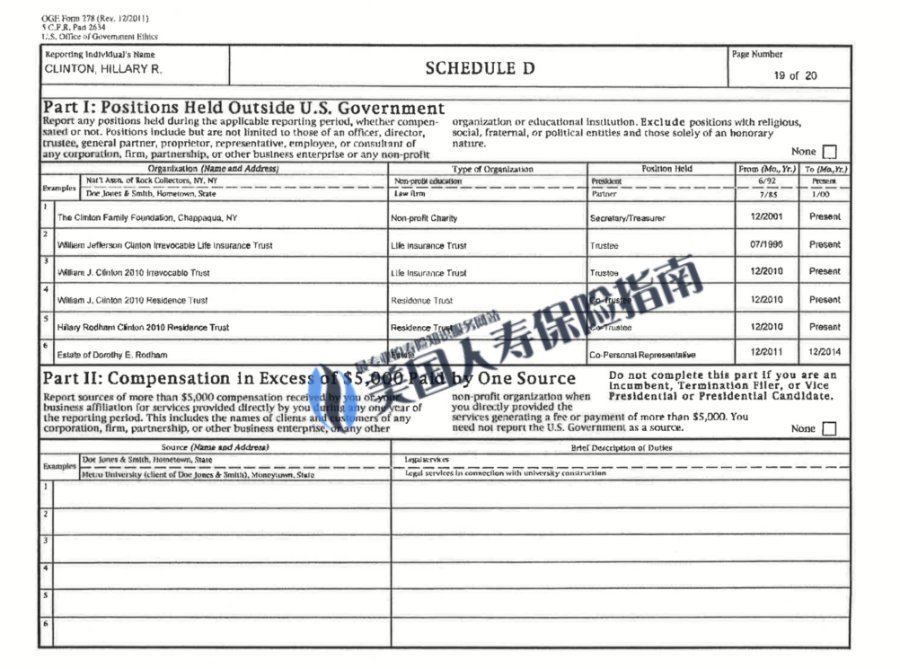

(Hillary Clinton Schedule D Table of Institution or Trust Ownership)

(Hillary Clinton Schedule D Table of Institution or Trust Ownership)

These three insurance policies with large denominations have all been placedLife Insurance Trustin.

althoughAmerican Life Insurance GuideThere is no further product information for these policies, but from the two points of the cash value of the policies and the amount of interest income, we subjectively speculate that the insured scale of the last three policies is at least 3 million yuan.

Article summary

According to calculations in financial documents, when Hillary Clinton participated in the election for President of the United States in 2016, his family might hold up to $5 million in investment.Therefore, the Clinton family usesThe purpose of life insurance, It should be to save a lot of moneyInheritance tax.

©️Eduardo Munoz Alvarez/AFP/Getty Images

©️Eduardo Munoz Alvarez/AFP/Getty Images

Life insurance claims are exempt from income tax for beneficiaries.By putting life insurance in the trust, Hillary Clinton removed the compensation from the family's inheritance tax exemption.

This approach allows daughter Chelsea Clinton to inherit a huge wealth of assets without having to sell assets, but directly use part of the cash from the life insurance policy to pay taxes in excess of the inheritance tax exemption. (End of full text)

>>>Recommended reading: What is the annual income of the family of the President of the United States in 2020?What life insurance did you buy?

appendix

1. "Tax returns of Donald Trump", 10/08/2020, Wikipedia, https://en.wikipedia.org/wiki/Tax_returns_of_Donald_Trump